Intraday Market Thoughts Archives

Displaying results for week of Oct 27, 2019Biggest USD Drop in 21 Months, NFP Next

The US dollar continued its post-Fed slide on Thursday as economic data weighed. On the day the yen was the top performer while the US dollar lagged, registering its biggest monthly decline in 21 months . Non-farm payrolls are due up next (more below). Renewed doubts with the continuity of the US-China talks are weighing on markets, triggering high profile failures of the 200 and 100-DMAs in the USDJPY and US 10 yr yields before considerable daily slides. Each of the 4 existing premium trades is currently in the green.

إدارة الصفقات الخمسة (فيديو للمشتركين)

Dueling forces worked to pull USD/JPY notably weaker on Thursday. The Fed pause and accompanying message highlights that it will take a 'material' shift in the outlook to cut rates again. Ostensibly that's positive for the dollar but it's negative for risk trades.

The problem was highlighted in a couple reports on Thursday. The PCE report showed spending at +0.2% compared to +0.3% expected and inflation numbers also slightly softer. The Chicago PMI also fell to 43.2 from 47.1. That was probably a result of the now-ended GM strike but the numbers both highlighted that if the economy modestly weakens, there is no safety net.

At the same time, the long-term message from the Fed was that hikes are off the table unless there is a significant rise in inflation for a sustained period. That sent Treasury yields decidedly lower and highlights that US yield differentials won't be improving any time soon.

The next move will hinge on Friday's jobs report. Non-farm payrolls are forecast to rise a modest 85K, down from 136K in September. After the Chicago PMI, there are growing worries that the auto strike could lead to a dismal number. If so, expect it to be a short-lived dip because those jobs have returned.

A look at the October monthly moves:

The pound led the way with a 5% rally against the dollar and 5.7% against the yen (which was the laggard). It was the worst monthly decline for the USD in over 20 months. In the stock market, most of the world put up gains in the 2-4% range including a 2% rally in the S&P 500. The FTSE 100 was slightly lower but that's a side effect of currency appreciation. Gold was up modestly and entirely due to the rally on Wed-Thurs.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI | |||

| 43.2 | 48.4 | 47.1 | Oct 31 13:45 |

| Final Manufacturing PMI [F] | |||

| 51.5 | 51.5 | Nov 01 13:45 | |

| ISM Manufacturing PMI | |||

| 49.0 | 47.8 | Nov 01 14:00 | |

| PMI | |||

| 51.7 | 51.0 | 51.4 | Nov 01 1:45 |

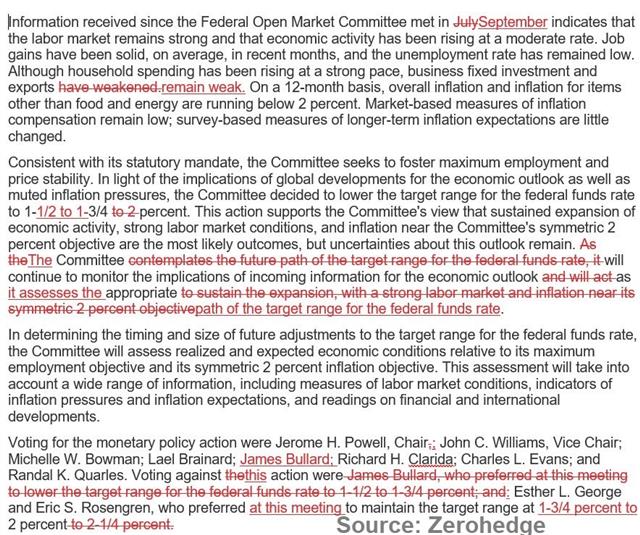

The Powell Put is Alive

The simple message from the Federal Reserve:They're not eager to cut, but they will act if something goes wrong; yet if everything goes right, they're still not going to hike. The dollar jumped on the first part, then sank on the second. The Canadian dollar tumbled further as the BOC took a surprisingly dovish turn. A new Premium trade was issued after Powell's press conference, supported by 2 charts & 6 key notes.

The dollar was whipsawed by the FOMC meeting. The early move was higher as the statement and early comments from the chairman indicated it would take a 'material' negative shift in the outlook to spark another rate cut. He highlighted trade and global growth as particular risks.

That means a December cut is much less likely than the 31% priced into Fed funds futures in the run-up to the meeting. As of now, Fed funds futures are pricing no chance of a December rate cut, and 1 rate cut by next June.

Nevertheless, the dollar turned around and sank on cautionary inflation comments. This pivot towards inflation has been quietly circulating for months and appears to be the lasting legacy of this rate cutting cycle. Powell said they “would need to see a really significant move up in inflation that's persistent before we would even consider raising rates"

That's an extremely dovish statement and will have lasting consequences for the Fed chair until at least Feb 2022. Even longer if it's adopted as Fed doctrine. Given that criteria, it's unlikely that Powell hikes again in his term.

So the message is: rates will remain at current levels, or lower indefinitely. That was already the baseline in markets, but if you paint an optimistic scenario of a US-China trade deal and a pickup in global growth, then it's a stance that's potentially very stimulative and dollar-negative, especially against emerging market currencies.

The Bank of Canada took a different view. Like Powell, BOC Governor Poloz highlighted resilience in the economy but said that resilience will be tested in the months ahead. The market was pricing in virtually no chance of a cut Wednesday but Poloz said they weighed an insurance cut. It means the BOC is paying far less attention to sizzling domestic employment data, 2% domestic inflation and a pickup in housing; and far more attention to global growth. If there is some kind of setback, the BOC may be quick to pull the trigger. That dovish shift weighed on the Canadian dollar across the board.

A Powell Cut then what?

A third consecutive cut from the Federal Reserve is imminent this evening, but the market reaction will hinge on signals about what's coming next, especially Powell's press conference (more below). Due to the temporary time difference, the Fed decision is at 18:00 London, 19:00 central European time. All currencies are up against the US dollar, led by CHF and GBP, with the JPY the weakest. US advanced Q3 GDP grew 1.9%, beating the exp 1.6%, but still below Q2's 2.0%. US October ADP report on private sector jobs showed a 125K rise vs the exp 110K with the slowdown concentrated in manufacturing. USD ignored both reports. The Sept figure was revised down to 93K from 135K. The Pre-Fed English Premium Video is found below.

Fed day is finally here and along with month-end it will surely unleash some pent-up volatility. The market is pricing a 94% chance of a cut and it would be the biggest monetary policy surprise in a decade if the FOMC were to defy that.

The intrigue lies beyond Wednesday. The market is currently pricing in a 27% chance of a cut in December. That was above the 40% midway through the month and near 50% at times in September but has trended lower as the US and China made headway on trade. At this point, a Phase One deal and an extended ceasefire are solidly priced into markets and that's probably what the Fed will assume going forward.

At the same time, the Fed is loathe to remove optionality and will preserve the option of easing further if trade or the economy deteriorates. The goal of post-meeting communication will likely be to keep December cut expectations around where they are now. In theory that should mean minor tweaks in communication.

The main risk Wednesday is a communication error. The most-recent Fed minutes indicated a growing push to communicate to markets this isn't a rate-cutting cycle. If Powell strikes the wrong tone in that signaling and dials back expectations too hard, that could spook equities. A similar message may also arise in the number of dissents or overly-optimistic economic commentary.

Can Equity Indices Rally Further?

Yes, sure. Powell could over-emphasize low inflation and economic risks; talking further about manufacturing and downside economic risks abroad. The market could take that as a signal about more cuts, which would weaken the dollar and breathe fresh life into gold. The best case scenario for stocks and worst one for JPY would be for Powell to send the message that further easing is precautionary, rathen than reactive to a serious erosion in growth.Ultimately, Powell has gained some experience in his role and should have a relatively easy time of managing expectations.

With regards to today's Q3 GDP release, it's far too early to get an accurate read on Q3 and these numbers are routinely revised more than a full percentage point in either direction over the year ahead. The market is also jittery about a soft October jobs report because of the GM strike. The strike was not reflected in the ADP.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC Statement | |||

| Oct 30 18:00 | |||

| FOMC Press Conference | |||

| Oct 30 18:30 | |||

| Advance GDP (q/q) [P] | |||

| 1.9% | 1.6% | 2.0% | Oct 30 12:30 |

| Eurozone Spanish Flash GDP (q/q) | |||

| 0.4% | 0.4% | Oct 31 8:00 | |

| ADP Employment Change | |||

| 125K | 125K | 93K | Oct 30 12:15 |

US Stocks Highs, UK December Elections

The S&P 500 hit a record on Monday as commentary from executives so far points to a modest economy but not a recession. The pound regains the 1.2890s after UK Labour leader Corbyn announced his party's backing for a December election (more below). One of the final inputs for the Fed is release of the October consumer confidence report from The Conference Board, which slipped from 126.3 to 125.9. Pending home sales edged up 1.5% from 1.4%, while house price data was mixed. The mystery charts below will be discussed in the Premium Video later this today.

Towards UK December Elections

Labour Leader Corbyn finally agreed to holding a general election in December on certainty that there will not be a no-deal Brexit. Now we move into several votes amending elections laws. The rationale explaining GBP's moves nearing elections has been discussed in last week's piece here.Stocks are in the spotlight after Monday's record high in the S&P 500, breaking the double top at 3029. The jump came on the anniversary of Black Monday exactly 90 years ago – an event that led to an 89% drop in the Dow.

There are historical parallels with the trade war and rising protectionism but some lessons have certainly been learned. Trump has halted his offensive against China and a Phase One deal is now likely fully priced in. Given the proximity to the 2020 election, the likelihood is that we get an extended pause. Central banks have also learned lessons with a wave of global easing accompanying the trade war.

Yet there are similarities as well. The global trend of voters shifting to the fringes is well-underway. In a state election in Germany on the weekend, Merkel's CDU finished in third place behind far-left and far-right parties. Huge protests have erupted in Chile, Lebanon and Hong Kong. Westminster is so dysfunctional that an election is held up on a three-day discrepancy in voting dates.

The break in stocks signals some resilience in the economy. Commentary from CEOs outside of the hard-hit automotive industry talk about slowdowns, poor investment and sluggish orders but few are bracing for a recession.

Looking ahead, Wednesday's looming FOMC decision will probably keep a cap on volatility in the day ahead. The market is pricing in a 92% chance of a cut but the odds of another move in Dec have fallen to 22%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| HPI (y/y) | |||

| 2.0% | 2.1% | 2.0% | Oct 29 13:00 |

| CB Consumer Confidence | |||

| 128.2 | 125.1 | Oct 29 14:00 | |

توازن المؤشرات مع العملات قبل اجتماع الفيدرالي

يوضح لكم خبير الأسواق العالمية أشرف العايدي في هذا الفيديو الحصري عن كيفية اقتراب المؤشرات الأمريكية نحو قمم جديدة قبل كل اجتماع للفيدرالي الأمريكي بأيام قليلة، فما هي التحركات المنتظرة للمؤشرات الأمريكية إثر هذا الاجتماع القادم؟ تابعوا التفاصيل

Brexit Extension and China Watch

The S&P500 has hit new all time high of 3041, while the DOW30 is 200 pts away from its own record. All indications suggest the EU will extend the Brexit deadline to January 31 and that will put the focus back on Westminster on later today. GBP is the day's best perfomer as cable hits 1.2877. Signals from a high level political meeting in China this week could have long-term implications. This week's major events include: Johnson's efforts to call for an election, FOMC meeting, BoJ meeting, China political meeting & US jobs report.

France has been grandstanding about blocking the Brexit extension but Macron now appears to have relented. A draft declaration cited by reporters extends the deadline to Jan 31 but includes a provision allowing the UK to leave Nov 30 or Dec 31 if both sides ratify the deal.The EU meeting will take place shortly before a planned vote in UK parliament to force a December election. That effort appears as though it will fall short of the necessary two-thirds majority.

If it all unfolds as expected, we will find out if Johnson will redouble efforts to get a deal in November or continue to push for an election. A deal push would be more-positive for the pound.

On the weekend, data showed the extent of the slowdown in the Chinese economy. Industrial profits were down 5.3% y/y in September, an acceleration from -2.0% in August.

Reports on Friday indicated that the text of the US-China deal is largely done but that some US officials are pushing for tougher language in IP. This week, risks may be on Beijing's side with the annual four—day meeting of the Central Committee underway today. This is largely a political meeting and a draft communique focused on casting the Chinese political system as meritocratic and fostering ideological innovation. That sounds like it's more of a defensive posture and it's a closed door meeting but any shifts on trade or the economy afterwards could have far-reaching effects.

The weekend surge in cryptocurrencies has been attribute to Beijing's backing of more govt investments in Blockchain technology.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -51K vs -75K prior GBP -52K vs -73K prior JPY -18K vs +7K prior CHF -11K vs -13K prior CAD +33K vs +13K prior AUD -48K vs -48K prior NZD -40K vs -40K prior

Pound shorts had been stubbornly hanging in over the past two weeks but cracks are beginning to show. Still, there is plenty of space for a squeeze. The other standout is the contrast between the Canadian dollar and the antipodeans. It's tough for them to diverge for any significant period of time.

ندوة أشرف العايدي مع أوربكس مساء الثلاثاء

تابعوا الندوة الالكترونية " يومٌ قبيل لقاء الاحتياطي الفيدرالي" مع أشرف العايدي مساء الغد، في تمام الساعة العاشرة مساءً بتوقيت مكة المكرمة. للتسجيل من السعودية و للتسجيل من باقي دول العالم