Intraday Market Thoughts Archives

Displaying results for week of May 26, 2019Markets Hit by Trump's Mexican Tariff Threat

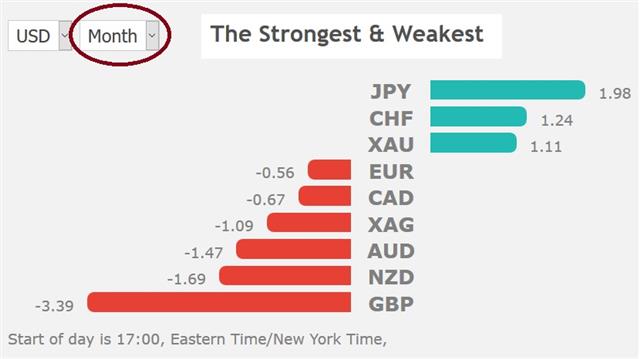

Global indices take a sharp leg down after president Trump shifted attention from China to Mexico. The selloff began around 3 am London time when Trump threatened Mexico with a 5% tariff on all its goods, if it does not halt immigrants from illegally entering the US. The Mexican peso and oil were the bigggest decliners, as was the loonie. The chart below shows how May's ugly market showing has pushed JPY, CHF and gold to the top of the performers at the expense of GBP, AUD and NZD. has been The Premium Insights allowed the DAX long to be stopped out, while the existing Index short deepens in the money. A new FX trade was added before yesterday's NY close.

The Trump team warned that the 5% tariff would rise to 25% by October 1st if illegal immigration were not addresed by the Mexico.

Just as China was threatening to restrict its rare earths exports, Trump shifted to Mexico, broadening the risk-off impact of the trade war, which increasingly appears to become the New Cold War of global economics.

Today's upcoming release on US PCE is a key test for the US dollar as Clarida cracked open the door to a rate cut. More on the PCE below.

On the Bank of Canada

A few word on the the notable contrast in speeches between the top deputies at the BOC and Fed. BoC's Wilkins emphasized upside and downside risks while highlighting that lower bond market rates since the start of the year are stimulating the economy. Fed's Clarida warned that downside risks could call for more accommodative policy and that the global economy has been softer than assumed six months ago.He also emphasized that inflation has been lower than expected. That was a key takeaway from revisions to Q1 GDP as PCE inflation was cut to 1.0% annualized from 1.3%. That drop led to a bid in bonds that pushed yields 5 bps lower across the curve and back to Wednesday's lows.

Those levels could be taken out if Friday's April PCE report paints a similar picture. The PCE deflator is expected up 1.6% y/y on both core and headline but after GDP, those risks are certainly on the downside. The details in the data will be especially important because the FOMC has been pushing a narrative that the weakness is temporary and confined to a few skews. The data is out at 1230 GMT, 13:30 London.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Williams Speaks | |||

| May 31 16:00 | |||

| GDP (m/m) | |||

| 0.4% | -0.1% | May 31 12:30 | |

إشارة حاسمة من منحنى العائد

ما هو المنحنى العائد وإلى ماذا يشير؟ وما هي كيفية قراءته للتداول؟ تابعوا هذا الفيديو المفصّل

Yield Curve Considerations

US and global yield curves are at aspot with dangerous implications, but many may argue that doesn't matter because economic data is solid. We will explain why that's a poor argument. The US dollar is firm across with the exception against the loonie. The revised US Q1 GDP report is due next (see more below). The latest Premium video is more extensive than usual due to the situation with indices. Full video below.

Before a late session recovery on Wednesday, US yields had fallen 5-6 basis points across the curve. The 10-year yield fell as low as 2.20% and the 5-year to 2.00%. That compares to three-month bills at 3.38% and the lower band of Fed funds at 2.25%.

It's a similar story elsewhere including in Canada where the BOC was surprisingly upbeat about the domestic economy after holding overnight rates at 1.75% despite the 10-year at 1.58%.The take from the BOC is typical of those who are arguing against the signals from the yield curve. They say the data is strong.

They're correct but the lesson of the yield curve posits that the data is almost always strong when it inverts. It's a signal that occurs ahead of the turn, so by definition it needs to emerge before the data turns. It's also the reason that central banks almost always resist cutting.

The March 2007 Example

For example, the peak of the US curve inversion prior to the financial crisis was in March 2007 when 3m bills fell as much as 71bps below the 10-year. In that month, non-farm payrolls rose 152K, which was slightly above the 12-month average of 146K. The ISM non-manufacturing index was at a healthy 54.3. The retail sales control group had risen 0.9% and had only posted a single negative print in 18 months. Consumer confidence was near a six-year high. A year later the economy was in shambles.Which yield curves matter? Ashraf will post a detailed chart of the relevant yield curve measures using yield spreads for 10-2 year, 3-5 year and 3-month to 10 year.

As always, the timing is the difficult part. The S&P 500 and yen crosses peaked long after the yield curve inversion so it's a signal that argues for caution, not immediate action.

What would confirm it is a slowdown in data or a further intensification of the trade war. The second look at Q1 GDP is due next and expected to be trimmed to 3.0% from 3.2%. What will be more important are signals about Q2 GDP; JPMorgan cut its estimate to just 0.6% earlier this week.

Another data point to watch is the April US advance goods trade balance report for signs of trouble from the trade war. The consensus is a rise in the deficit to $72.5B from $71.4B.

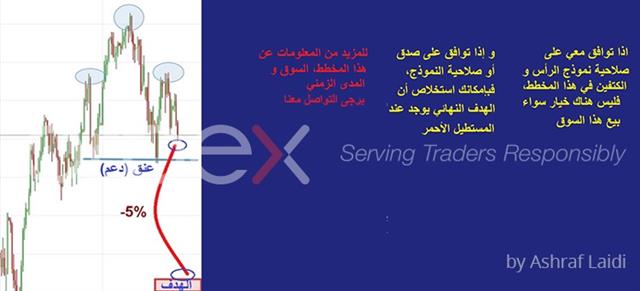

إغتنام فرصة المخطط المجهول

أن كنت توافق معي على صلاحية نموذج الرأس والكتفين في هذا المخطط، فليس هناك خيار سواء بيع هذا السوق، وإن كنت توافق على صدق أو صلاحية النموذج، فبإمكانك استخلاص أن الهدف النهائي يوجد عند المستطيل الأحمر. لمعرفة باقي التفاصيل

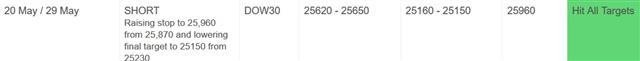

Testing Support on Trade War Fire, BoC Next

China has entered into a war of words that makes a quick resolution to the trade war less likely. This includes a report that Beijing may restrict the exports of its rare earths as a retaliation to the US. (more on this below). The Bank of Canada decision is up next. The short DOW30 Premium trade hit its final 25150 target, realizing 470 pts of gains. A new trade was issued at the start of the London session and is already 60 pts in the green.

A report in the South China Morning Post emphasized that the US side “kept adding new demands in the late stages of the negotiations”, including a demand requiring that China completely open its internet and change its laws to allow unilateral US sanctions.

We have no idea if that's true or if the leaked US version is true. What's important here is that China has entered into the war of words and propaganda. Before this, China had kept a lid on leaks and the domestic press. This aim of this move is at least party to harden domestic opposition to the US and that points to a willingness (or at least a bluff) that it's prepared for a long battle.

Rare Eaths Threat

Although China has retaliated with tariffs on $60bn of its imports from the US on every day merchandise such as eletronics and foodstuffs, newspapers reports are signalling a possible move towards limiting the sale of rare earths. This would be a serious blow to the US, which relies on China for about 80% of its rare-earth imports. China makes up more than 2/3 of the world's rare earths production. Rare earths is crucial in making smatphones and laptops faster and lighter and Apple is widely dependent on rare earths.US equity markets started the day in a positive mood after the long weekend but the bond market saw through it. Yields fell 4-5 bps across the curve and the 10-year is now just above the lower Fed funds band at 2.22%. The further inversion of the yield curve is a bright-red flag. Keep an eye on 2777, which is the 200-DMA of S&P500

Looking ahead, central bankers have to navigate these challenges. The BOC is up next and will undoubtedly hold rates, despite months of very strong domestic data and a resolution on metals tariffs. Expect Poloz to hike growth forecasts but continue to insist on patience to do low inflation and trade worries.

The Centre can't Hold

Taking a break from the US-China trade war, the nationalist streak in EU elections may have faded but dissatisfaction with the status quo continued, and that could have long and short-term implications for markets. Both equity indices trades in the Premium Insights remain open and the lone cryptocurrency trade remains open and up 49% in the green. CFTC positioning showed a late shift into GBP shorts.

It's a slow slow start to the week with the UK and US on holiday Monday so it's a chance to digest the EU election results. This is traditionally a forgotten vote in markets but it took on special meaning with euroskepticism, nationalism and anger running high as growth in the region continues to disappoint. Turnout surged to hit 50% for the first time in at least 20 years.

The short-term story is that the grand coalition of the centre-left and centre-right has lost the combined majority for the first time in the past 40 years. A surprise is that it wasn't because of a swing to nationalists but because of surprise strength in green and left-wing parties.

In the short-term, this will leave EU parliament less effective and more fragmented. That's a small negative for the limited growth levers that the EU can pull. Yet, the market will quickly move on.

The long-term is the more interesting development as these results crystalize the trend in the developed world away from the mainstream. What looked like a right-wing shift in parts of the world a few years ago is increasingly looking like voters dabbling with different ideas.

The message is especially stark in the UK where another vote shows support bleeding away from Conservatives and Labour. Nigel Farage won a seat for the Brexit party and his comments afterwards were salient: “There's a huge message here. Massive message here. The Labour and Conservative parties could learn a huge lesson tonight but I don't suppose they actually will,” he said.

He wants the lesson to be about Brexit but it's really about wanting change. Voters might not yet be sure of what they want but they're looking for something or someone to believe in. For more details on Ashraf's take on GBPUSD, please see Friday's piece here.

Another trend is the rise of green parties. If mainstream parties can't deliver progress then some voters are increasingly turning to people who will take dramatic action on the environment. This is a trend that market participants must watch extremely closely. Many environmentals leaders are practical but others are dogmatic and prepared to take dramatic action at any cost, especially if costs are borne by neighbouring states rather than at home. Today Trump is using national security as a justification for tariffs but we can easily envision someone citing the environment for a similar tactic.

It may be no coincidence that Bitcoin is back at a one-year high at $8940. The same dissatisfaction with the status quo is a part of the financial system as well. At the same time , tech, pot and fake meat companies are reaching lofty valuations.

The lesson is that everywhere people are looking for something to believe in. Ultimately, the fundamentals are what determines winners and losers but at the moment the currencies, companies and people who are selling big dreams are winning. There's no sense fighting it.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -101K vs -95K prior GBP -26K vs -3K prior JPY -55K vs -62K prior CHF -37K vs -40K prior CAD -42K vs -48K prior AUD -66K vs -66K prior NZD -11K vs -11K prior

The sudden jump in GBP sales is a red flag. Specs have been wrong-footed repeatedly and piling into shorts in the pound at this point feels like chasing a horse that left the barn a few weeks ago. May was a thorn in the side of the pound for months but the political risks are suddenly two-sided with many names entering the race for PM and the chance of a Boris win and/or no-deal Brexit meaningfully lower than the bookies and newspapers suggest.

Another interesting one is the Australian dollar. Scott Morrison's surprise win led to some short covering this week but it will take a resolution – or at least an improvement – in US-China talks to lead to a short squeeze.

ندوة مساء اليوم مع أوربكس

مع توجه المستثمرين إلى الملاذات الآمنة واضطرابات الأسواق التي شهدناها بسبب التقلبات السياسية المصاحبة لتوترات الحرب التجارية، دعونا نكتشف الخصائص الفريدة لكل من الفرنك والين في هذه الندوة الالكترونية المجانية مع خبير الأسواق العالمية أشرف العايدي في ندوة مساء اليوم