Intraday Market Thoughts Archives

Displaying results for week of Jun 16, 2019فنيات الدولار بعد قرارات الفيدرالي الأمريكي

تابع شاشة أشرف العايدي بينما يحلل صفقاته الرابحة والخاسرة لهذا الأسبوع ويطلعكم على أهم أخبار الأسواق المالية حيث أعلن البنك المركزي الأمريكي لأول مرة تحت قيادة “جيروم باول” عن بداية السياسة النقدية اللينة، والتي واجهت احتجاجاً من “بولارد” والذي صوّت لصالح تخفيض نسبة الفائدة، مما خلق اختلافاً لأول مرة منذ تولي “باول” رئاسة البنك المركزي . شاهد الفيديو لمزيد من التفاصيل

5 Markets Upended by the Fed

Here are the markets that have been markedly impacted by the Federal Reserve decision, which we think derserve close scrutiny from chartists and traders in the weeks ahead. Meanwhile, Bitcoin hit 9922 and Ripple 0.45 as the erosion of carry from the Fed and Persian Gulf tensions help the cryptospace.

1) Gold

Gold pushed further into its 5-year highs to make its biggest daily % gain in 8 months and the biggest weekly gain in over 3 years (when gold was gaining ahead of pre-US presidential election dynamics). It tested 1350 last Friday and again Tuesday before backing off. It finally closed above $1350 after the Fed and that kicked off a $27 surge to a five-year high at $1411. This zone has been a major level of resistance going all the way back to 2014. The last time global central banks embarked on an easing cycle, gold hit $1921. Add to it the escalation tensions in the Persian Gulf and you bolster the case for higher lows and a follow-up to 1480. The Cup-&-Handle followed and shared by Ashraf over the last 6 months was last shown here.2) USD/CHF

Increasingly correlated with USDX, USDCHF is the biggest mover of the past two days (Thursday was the biggest % daily slide since Jan 2018), falling to 0.9800 from 1.000. It's carved out a rough head-and-shoulders top and broken the trendline that started in February 2018. USD/CHF can do well with Fed rate cuts but it can do even better if it's coupled with risk aversion because of a trade war or recession. Ashraf sent me a chart of a stabilizing and rising CHFJPY, suggesting that market risks may be shifting from the US-China fear matrix to that of a broader slowdown in global growth.3) USD/JPY

USD/JPY has fallen by over a full yen (yen has risen) despite the run-up in global indices, highlighting the USD-side of dynamics. Ashraf's reationale to short USDJPY ahead of the Fed decision, whereby a dovish Fed would hurt USD and the pair, while a hawkish surprise would damage markets and booost JPY, thereby also dragging USDJPY. The BoJ won't welcome the Fed dovish turn but there is now little support separating a return to the March 2018 and flash crash lows, both of which are near 104.50.4) US 2-year yield

Not every market is screaming the same message. US 2-year yields plunged 7% on Wednesday to as low as 1.69%, posting its biggest % daily drop since September 2016, before turning around to finish higher on the day at 1.78%. Technically there isn't much of a reason to expect a further significant bounce but it's a spot to watch as the 2-year yield is the highest positively correlated US govt fixed income with USD. The bond market was first to sniff out the Fed's dovish turn and any signals now are doubly important.5) CAD against everything

The Bank of Canada is suddenly in a bind. Central banks almost everywhere else are poised to ease but the data in Canada has simply been too strong to follow along. Bouncing oil on the Persian Gulf tensions and absent BoC has dirven USD/CAD down the June lows and is threatening the Feb low of 1.3113. The BOC is loathe to see the loonie strengthen rapidly, but their options to contain the decline are limited because there are no speeches scheduled ahead of the July 10 decision. The CAD trade in the Premium Insights remains short USDCAD at 1.3360/90.| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Brainard Speaks | |||

| Jun 21 16:00 | |||

Gold at 5 yr High on Powell's 1st Dovish Turn, BoE Next

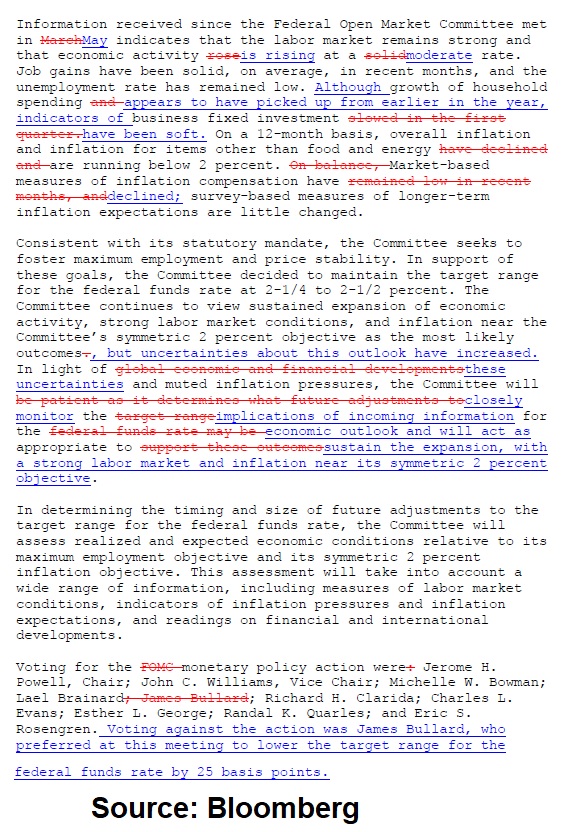

The Fed finally lived up to the market's dovish expectations as Powell made the case for cut in July. It was the first aggresively dovish turn and the first dovish dissent in the era of the Powell Fed. Gold broke above 1350 to hit a 5-year high of 1394 and silver broke 15.00 to reach 15.40. The pound was the top performer while the US dollar lagged. The BoE decision is up next. The Premium Insights gold long reached its final target of 1380 (from 1280 entry). Each of the 3 other existing USD Premium trades are at least 100 pips in the green. Below is the latest FOMC statement with a strikethrough comparison with the April stmt.

The market went from 'fairly certain' of a rate cut in July to 'entirely certain' after the Fed removed patient from the statement and lowered the dot plot. The dots now show nearly half of the Fed anticipating two cuts this year. Powell pinned the shifts in language on rising uncertainty from trade and global growth along with weakening inflation. The market reacted by fully pricing in a July cut with a small chance of a 50 bps cut. A second cut in September is 86% priced into the Fed funds futures market as well.

It was a historic Fed outcome as not only it signalled the first clear dovish shift in the Powell Fed era, but also had the first dovish dissent, with St Louis Fed's James Bullard voting for a rate cut.

The bond market was surprised by the outright turn and 2-year yields fell 13 basis points to a fresh cycle low at 1.73%. Ten-year yields were down 3 basis points in a slight signal that the Fed is catching up to the curve.

Given the falls in yields, the dollar decline was initially muted with roughly 50 pip dips across the board. The modest decline at the start reflected the continuing larger role of equity flows as the S&P 500 gained again. It also reflects the Fed's assessment that global factors are the catalysts for cutting; a sign that other central banks won't be far behind.

Cable has engineered a solid turnaround after finding support at 1.2500 on Tuesday to reach 1.2720. Rory Stewart was eliminated from the Conservative leadership race and now it's down to four candidates, one of whom will take on Boris Johnson in a runoff. That man will be decide in the final two votes of MPs on Thursday. All the remaining candidates are polling behind Johnson within the party and there will be some pressure to concede. Any signs of a united front from Conservatives will give them a better chance of getting something through parliament. If Hunt, Gove or Javid chooses to fight, it will signal more gridlock on the Brexit front.

As we move to the BoE decision next, governor Carney may choose to dial back his prior rhetoric that rate hikes could come faster than markets expect in the case of a smooth Brexit. If he decided to stick with a positive tone, the rally in GBP will continue. The Premium Insights remain long GBPUSD from 1.25920

From Patient Trump to Patient Fed

Markets in quiet mode ahead of the Fed decision/press conference following a volatile Tuesday in the news. GBP traders await the 3rd ballot for PM contenders about 1 hour before the Fed announcement. US President Trump reached out with a phone call to Chinese President Xi on Tuesday and both sides agreed to meet at the G20 and restart trade talks. The announcement spurred already rallying indices after Draghi's easing hint. UK May CPI slipped to 2.0% from 2.1%. Both DOW30 and FTSE100 trades were stopped out. A new trade ahead of the FOMC decision will be released this afternoon.

فيديو المشتركين كيفية التمركز قبل الفدرالي

Trump revealed the change in tone via a tweet saying they will have extended talks at the G20. Staff level talks will also restart ahead of the meeting. At the same time, the reaction in Chinese media to the talks was tepid. They highlighted that it was the US that reached out and said the chances of a deal were slim. That's a hint that China hasn't wavered in its red lines.

USD/JPY immediately jumped 45 pips on the headline and the news added to an already-big day for stock markets. Gains earlier had been spurred by Mario Draghi, who said the ECB would act “in the absence of improvement” in economic data. That's a reversal from his stance two weeks ago when he pledged action only “in case of adverse contingencies”. USDJPY continues to face resistance at 108.80.

The combined news led to a jump in global equities, including 1% in the S&P 500 and 2% in most European bourses. The challenge now is that markets are pricing in both lower rates and a detente in the trade war. In reality, the Fed will be pained to cut rates if a China-US deal is on track. An insurance-style cut would still be possible but not the 3-4 cuts over the next year that are priced into the market.

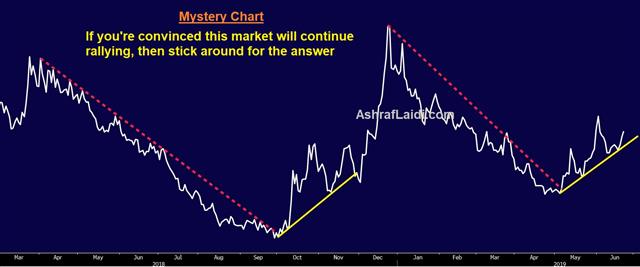

Will Fed patience pay?

After having shifted to a neutral stance at the start of the year, the Fed is expected to make a gradual shift towards a dovish stance -- But how far they go will determine how markets react. The majorty of US data sets over the last 6 weeks have come in below expectations, and the US CITI Economic suprise index has trailed all other major indice (see chart here).For the Fed, 'patience' is key. Recent statements have indicated the FOMC would be 'patient' in determining what moves come next. If that's removed, it's a strong signal that a rate cut is coming in July. Nonetheless, it may be paired with conditionality and the lack of an explicit signal may leave markets disappointed. The conditionality could relate to the trade war, inflation data or the economic more broadly. With the market already pricing in a nearly 90% chance of a cut, anything less than virtual promise could give the US dollar a lift against the yen, while hurting risk appetite more broadly.

Officials may also use a fresh set of projections along with Powell's press conference to tweak the message. The central tendency of the Fed funds projection is 2.4-2.9% at the end of 2020 and 2.4-2.6%. Both of those will undoubtedly be revised down, but will need to at least match the lower end of the 2.25%-2.50% range to keep the market happy.

We must also watch the inflation forecasts and Powell's conference and the extent to which he refers to slowing inflation as transitory. Overall, the market has priced in an aggressive path from the Fed that would be akin to capitulation of the Fed's long-standing hawkishness and optimism. It may be too early for that and the knee-jerk risks are towards disappointment. At the same time, Powell will attempt to keep a cut on the table and highlight that it will be in play if risks materialize. That may be enough to halt any reactionary moves quickly. A new trade for Premium Insights clients is due hours before the Fed decision.

Pound rallies on Stewart ahead of 3rd Ballot

Elsewhere, the pound rebounded from five-month lows as staunch Brexiter Dominic Raab was eliminated from the PM and the Party leadership and PM race. GBP-friendly candidate Rory Stewart continued to be the fastest gainer (but not the one with the highest standing) and is rumoured to be forming a joint-ticket with Michael Gove.Another vote takes place today around 6pm London time, with Stewart and Javid most-vulnerable to be nixed next. Earlier today, GBP edged up even as UK CPI slipped to 2.0% from 2.1%. Another disappointment would give Carney a reason to soften his warnings that the BOE is expecting to hike more than the market.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC Press Conference | |||

| Jun 19 18:30 | |||

| CPI (y/y) | |||

| 2.0% | 2.0% | 2.1% | Jun 19 8:30 |

ترامب يشعل نار العملات قبل الفيدرالي

من المفترض أن يكون يوم الأربعاء يوماً حافلاً في الأسبوع، لكن أنتج اليوم الثلاثاء نصيبه من المفاجآت والتعليقات المؤثرة في السوق. إليك ما يحتاج كل متداول معرفته لهذا اليوم وبقية الأسبوع في التحليل الكامل

Fed, ECB, Polls, Ballots & Debates

USD remains mixed even after the US Empire manufacturing index (NY ISM) fell to 3-year lows (see more below). The chance of a significant breakthrough between the US and China at the G20 meeting is fading. CFTC positioning data showed that USD longs continue to falter but remain dominant on a net-basis. Gold net have broken out key resistance. All eyes on this week's central bank meetings from the US and UK as well as the annual weekl-long ECB conference at Sintra in Portugal -- where speeches from Draghi & comp will serve as the equivalent of a Thursday press conference (More below) . Gold and bond yields appear to be making up their minds, rising and falling respectively ahead of the Fed but USDX remains mixed. GBP traders await three more ballots for the PM race due Tuesday, Wednesday and Thursday. Anti-no deal Brexit Rory Stewart is the fastest gainer in the odds.

The chance of a genuine breakthrough at the G20 has fallen to almost nil. There have been no reports of serious preparatory talks or meaningful discussion on the main trade issues. That could be happening through back-channels but it's tough to believe it would be kept quiet.

US Commerce Sec Wilbur Ross said a deal with China can be achieved, but it won't come at the G20. One positive sign was that VP Pence delayed a speech that was harshly critical of China and was slated to be delivered on the anniversary of the Tiananmen Square massacre. There are signs, however, that it's being rescheduled for after the G20.

Trump had said it was imperative that Xi attend the meeting or that fresh tariffs would be levied, however he changed his tone last week and said it wasn't imperative that Xi attend.

At the moment, the market is optimistic about Fed easing and progress on a deal. Wednesday's FOMC will be a major market-mover. Expect indices to get some cold feet ahead of the Fed early in the week but the main theme will be consolidation.

The Empire Fed on Monday fell by the most on record, all the way to -8.6 from +11.0. That was also the lowest reading since October 2016.

Sintra Week

The importance of the ECB's annual Sintra conference is its inidcation for the markets. Recall how the euro rallied after the July 6th conference when Draghi sounded less dovish than expected. Should he and his colleagues offer a similar disposition to policy, we could see EURUSD push higher. The question is: Will any bounce in the euro serve as an offset to a possible Wednesday euro sell-off that could be the result of a not-so dovish Fed?CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -87K vs -88K prior GBP -45K vs -48K prior JPY -45K vs -44K prior CHF -25K vs -36K prior CAD -33K vs -42K prior AUD -63K vs -63K prior NZD -16K vs -20K prior

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone ECB President Draghi Speaks | |||

| Jun 17 17:00 | |||

| Eurozone ECB President Draghi Speaks | |||

| Jun 18 8:00 | |||