Intraday Market Thoughts Archives

Displaying results for week of Sep 01, 2019China RRR Cut Sustain Rallies, NFP & Powell Next

Risk-on sentiment continues to triumph, lifting stocks and bond yields, while punishing metals and the yen. Today's announcement from China cutting banks reserve requirement ratio for the 7th time since 2018 and Thursday's revelations from China that top-level US-China trade meetings will resume in October are helping to fuel risk appetite ahead of US and Canada jobs and Fed Chair Powell speech. There are three Premium trades currently in progress.

(فيديو للمشتركين) مرجعية ٢٠٠٧، ٢٠١١، ٢٠١٥ و ٢٠١٩

The People's Bank of China announced today it would cut the reserve requirement ratio (RRR) by 50 bps, with an additional 100 bps cut for qualified city commercial banks. The magnitude of the rate cut was larger than most analysts had expected and the 900 bn yuan released is the largest stimulus in the current easing cycle.

The S&P 500 broke out of its box to the best levels in a month at 2985 (DOW30 to 26830) after the US and China agreed to face-to-face talks in early October.

A few things stood out from this rally. One was that Treasury yields climbed alongside stocks. Many times last month it was stocks moving higher alone. Cyclical stocks are also accelerating their gains, even European automakers--the biggest victim of the trade war. Yen crosses made similar breaks with AUD/JPY and USD/JPY both rising to a one-month high. Commodity markets reversed recent moves as gold sank more than $30 to $1518 and oil touched a one-month high.

On the fundamental side there were some notable differences as well. A Chinese MOFCOM spokesman highlighted that both sides would strive for 'substantial progress' at the talks, which is not a term that has been used before. State mouthpiece Hu Xijin also noted a higher possibility of a breakthough.

The lengthy timeline is also a notable development. I leaves a catalyst for bulls in place but also gives central banks a reason to be less aggressive until there is a resolution.

In terms of economic data, the US showed some improvement as ADP employment rose to a four-month high of +195K compared to 148K expected while the ISM non-manufacturing index was at 56.4 compared to 54.0 consensus.

Fundamentals will remain in focus on Friday with US and Canadian jobs reports both due. Non-farm payrolls are forecast at +160K. Note however that the report has missed the consensus 77% of the time in September over the past 22 years. While APD was strong, the employment component of the ISM services survey was weak. Powell's speech is at 12:30 Eastern, 17:30 London.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed Chair Powell Speaks | |||

| Sep 06 16:30 | |||

| ADP Employment Change | |||

| 195K | 148K | 142K | Sep 05 12:15 |

| Eurozone Final Employment Change (q/q) [F] | |||

| 0.2% | 0.2% | 0.2% | Sep 06 9:00 |

GBP up 300 pips on Johnson Triple Blow

USD extends broad selloff, US manufacturing deepens woes alongside Europe's but it's Boris Johnson's Triple defeat in Parliament that's dominating FX -- sending GBPUSD up by 300 pips from Tuesday's lows. The UK Prime Minister Johnson denied in a pair of votes that blocked a no-deal Brexit and an early election. US ADP on private sector jobds and services ISM are due on Thursday. Below is the week's Premium video detailing the importance of 3 years in grasping key patterns in equity indices.

(1) Boris Johnson's was damaged yesterday as the Conservatives officially lost majority in power following the defection of a Tory MP to LibDems. Today: (2) Johnson was denied by a motion blocking a no-deal passed by rebels MPS, followed by (3) his call for an election next month being rejected by MPs.

Over the past two days, Cable shot up to 1.2255 from Tuesday's 1.1958 low. The combination of eording chance of a no-deal Brexit with broadening USD weakness have conspired into fuelling cable. An election is inevitable, a no-confidence on Boris Johnson isn't ruled out and two-way risk is very much present.

On Tuesday, US ISM manufacturing index underscored that global manufacturing has moved from slowdown to recession. The US index fell to 49.1 compared to the 51.2 estimate. It has been a dramatic slide from a cycle high of 61 last August and coincides with a decline in nearly every developed country. The index faces more trouble ahead with the measure of new orders falling to the lowest since 2012.

The ECB continues to simmer in the background with Villeroy adding to the growing list of voices against more QE. A report suggested the ECB is preparing a package of a rate cut, longer guidance and tiering. The central bank is now in its quiet period.

The Bank of Canada held rates at 1.75% but the statement wasn't as dovish as expected and the loonie jumped. The main guidance of the statement continues to say that the current level of accommodation is appropriate while warning about 'global developments' taking a toll on the domestic economy. Schembri will offer further clarity in the day ahead but the commentary suggests the BOC is less likely to cut in October than the 62% priced into the market.

Thursday features a heavy focus on US data with ADP, factory orders and the services ISM all to come.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change | |||

| 148K | 156K | Sep 05 12:15 | |

Johnson Raises Stakes, Pound Holds the Lows

The UK may be headed for an October 14 election. The pound fell on the news to start the week while the yen led the way on trade-related uncertainty. ISM manufacturing is due up next. There are currently 3 Premium trades open (FX, commodity and index), all of which are currently in the green. Feel free to use the EUR GBP USD calculator below found in the lower right hand side of our homepage to try out the various scenarios for EURUSD, EURGBP and GBPUSD.

Boris Johnson raised the stakes of a parliamentary vote on Tuesday aimed to block a no-deal Brexit. If he's defeated he will bring forward a motion on another vote Wednesday to trigger an election.

The pound jeered the fresh uncertainty with cable testing new lows for the year at 1.1959 before regaining 1.2030s. The outcome of both votes is entirely unclear. If Johnson fails in the first vote, it would take a two-thirds majority to trigger an election. If that fails, it puts the UK into an even deep quagmire.

Ashraf tells me he's keeping an eye on GBP's 8-year cycle as well as key developments in EURGBP.

Johnson already sounds like someone who is playing the blame game and preparing for an election. He's blaming 'remain' MPs for an impossible negotiating position. Ultimately, an election may create a clear path forward for the UK but in the short-term, it adds to an already-uncertain situation.

Elsewhere, the state of play is also murky. Rumors that Trump might delay tariffs help risk assets late last week but he didn't and that put markets in a sour mood. The continuing fall in the yuan, Hong Kong protests and capital controls in Argentina also added to unease.

Brexit headlines threaten to dominate trading Tuesday but it's also the first trading day of the new month for North American traders. Data includes the ISM manufacturing report and construction spending. Hawkish dissenter Boston Fed hawk Rosengren will also speak at 2100 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Rosengren Speaks | |||

| Sep 03 21:00 | |||

| FOMC's Williams Speaks | |||

| Sep 04 13:25 | |||

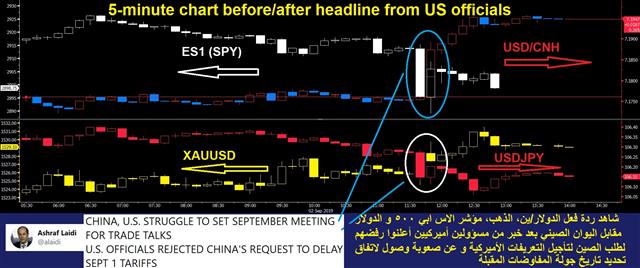

Charts Reaction to Latest US China Rumblings

Even during quiet holiday hours of US Labor Day, US officials managed to move equity futures when claiming they rejected China's requests for delaying US tariffs and that it was difficult to agree on the next round of negotiations. Markets reaction was negative, and here's how it panned out in the 5-min chart below.

ندوة أشرف العايدي مع أكس تي بي غدا الثلاثاء

ملتقى التداول الإلكتروني مع إكس تي بي يوم الثلاثاء 3 سبتمبر الساعة 9 صباحاً بتوقيت مكّة المكرّمة بوجود 10+محاضرين و منهم أشرف العايدي الذي سيبدأ محاضرته الساعة 3 عصرا بتوقيت مكة المكرمة و للمشاركة في البث المباشر إضغط هنا