Intraday Market Thoughts Archives

Displaying results for week of Mar 08, 2020Join me TODAY for Traderfest2020

Please join me for an invaluable trading webinar on Saturday, March 14, 2020 at 10:00 Eastern, 14:00 London/GMT, where I'll be part of Traderfest2020 with some of the world's best market analysts. Find out our best trade ideas for these volatile markets. Anything on your mind? Key technicals in FX and metals, the Corona pandemic threat, latest shifts in safe-havens, effectiveness of Fed tools, Brexit, US election dynamics and other risks & opportunities facing capital markets.

Learn battle-tested trading strategies. Get free MT4/MT5 trading tools.

This is a MUST SEE trading education event of the year. and it's totally FREE.

Don't worry if you can't attend. Register here and you will get a video recording of the whole event.

See you tomorrow

Ashraf

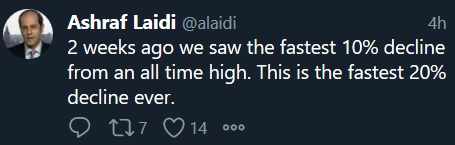

Systemic Risks are here

And it finally happened; major US indices fell 10% in a single day, the biggest percentage drop since the October 1987 crash. Coronavirus is illustrating how quickly a real-world crisis can morph into a financial one. The Fed's emergency liquidity-creation move, return to QE and the enormous losses in markets suggest mounting stresses. The US dollar was the top performer on the day while the pound lagged. The GBP and Bitcoin trades were stopped out. A new Premium video has been posted below, highlighting the core of our high-confidence trades.

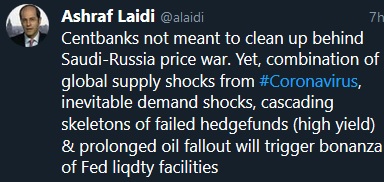

A major theme in the post-financial crisis era in the markets has been the mass expansion of liquidity. The risk is that liquidity has turned into leverage and the breathtaking speed of the declines in financial markets have pushed parts of the system to the brink.

The emergency move from the Fed today was ominous. Five minutes before a 30-year bond auction the Fed announced a $1.5 trillion term-lending program. To put that into perspective, after two years of QE in 2011, the total size of the Fed's balance sheet was $2.1 trillion. Moreover, the Fed announced that in just 35 minutes it would be auctioning $500B of that with a same-day settlement.

That final detail is key. A same-day settlement suggests someone needed money asap. Financial institutions need to balance the books at end-of-day and needed to unload liquid assets to avoid dumping illiquid ones.

The Fed itself said this was due to short-term Treasury market liquidity issues and that also appears to be true. Spreads were widening and the cross-currency swaps market wasn't operating correctly. Given the rout in European banks, that suggests problems could be there.

Of course, this is all speculation. The larger point is that we are all currently focused on the direct impacts of the virus and trying to quantify and mange those but there are a series of second-order effects that could completely break a market that's already on its knees. The combined opacity of that and the extreme unknows surrounding the virus justify the extraordinary levels of risk aversion we're seeing and the continued flows into the safest havens.

Pandemic Declared, BoE Cut, Trump, ECB Next

The UK unveiled a double-barreled fiscal and monetary policy response Wednesday but it didn't help sterling or the FTSE 100. The yen was the top performer while the pound lagged. US indices joined the DAX in reaching the definition of a bear market by extending losses to 20% from their record highs. Trump is set to speak about coronavirus early in Asian trade. The gold Premium short opened at 1669, targetting 1639 was closed for a smaller than anticipated gain, leaving the long in progress. Minutes before the Wednesday close, profit, a new Premium trade was issued, supported by 3 charts 7 key notes.

The Bank of England delivered an unscheduled 50 basis point rate cut and eased the counter-cyclical buffer by 1 percentage point. The moves were generally expected but most expected them to wait until the scheduled March 26 meeting.

The timing makes sense in hindsight as they wanted to match the timing of the government budget and send a powerful signal. New chancellor Sunak delivered a set of measures that won near-universal praise. It included a GBP30 billion response to the virus including gov't paid sick leave for private businesses with less than 250 workers, gov't guarantees on loans to small businesses and abolishing business taxes for a year. They coupled that with a five-year plan to spending GBP175B on infrastructure.

That's the kind of budget that pound bulls were hoping for after the election before talk of more-austere measures took over. This time, the pound fell but that was likely due to the rate cut and general flows.

The broader market went back into a deep risk-averse mode after Trump failed to deliver his promised coronavirus stimulus. The S&P 500 fell 4.9% after briefly falling more than 6% on the day and 20% from the high.

Trump and US officials will get a second chance in the day ahead. The President will speak at 9 pm ET (0100 GMT) on the response to the virus and House Democrats say they will release a stimulus package Wednesday.

The UK package is a good blueprint for what governments need to do right now – especially measures like sick leave that can slow the spread. More importantly, the market may now respond positively to mass event shutdowns because the short-term pain is likely to outweigh the long-term risks of a severe pandemic.

All this to barely mention the ECB which will reveal its set of measures at 1245 GMT. Look for a package of rate cuts and watch for more euro selling. There are early signs that the reverse of funding flows may be drying up, or overwhelmed by safe haven flows into USD, CHF and JPY.

سنتناول المواضيع التالية بعد ساعة من الان في الندوة الإلكترونية

ما يعني أكبر هبوط في العوائد الاميكرية للاقتصاد و الأسواق؟ تصاعدت إحتمالات الفائدة السالبة في أميركا إلى ١٧%؟ في أي مرحلة من الدورة الاقتصادية تخفيضات الفدرالي تفشل في رفع المؤشرات؟ إرتفع اليورو ب ٧٠٠ نقطة بعد توقعاتي في آخر يناير ما هي و متى المحطة القادمة؟

Italy Extends Nation-Wide Virus Lockdown

The world's ninth-largest country is poised to slow to a standstill after another jump in cases led to a mass lockdown and a red flag in the bond market. The yen was the top performer Monday while the Canadian dollar lagged. US stocks suffered their worst day since 2008 and oil its worst day since 1991. A new Premium trade has been posted & sent, supported by 2 charts & notes.

If Italy is a preview of what's to come for the rest of the developed world then the situation is dire. The country restricted movement throughout the country, closed all schools until April 3 and banned public gatherings. Travel is still allowed for work.

The government is preparing to raise its deficit target to 2.8% of GDP from 2.2% but that's a fantasy. GDP will be in freefall in March and until the virus is contained and tax revenues will plunge. While bond yields globally were cratering on Monday, Italian yields rose 35 basis points. The ultimate level of 1.42% is still ultra-low but it's a warning that the market won't tolerate rising Italian debt. Greek bonds also slumped.

So what's next? The most-likely scenario is an endless stream of negative coronavirus headlines for at least a month. Any subsquent central bank cut will be met with news like today's from Italy announcing 1800 new cases and nearly 100 new deaths. In all likelihood, the numbers will be much higher.

The second-order economic effects are just beginning and those include lower estimates, lower guidance, banking problems and debt downgrades. Mix in the potential for political and social unrest and it's not tough to see why market participants are already dumping risk assets.

As for oil, there is no way to draw a line under crude with production exceeding demand and storage levels high. We've warned about this for a month. The loonie slumped Monday but what's surprising is how long it has held up. A series of domestic missteps put Canada on the doorstep of recession before coronavirus and the knock-on effects from crude and a global recession will be dramatic. Even at 1.3700, the loonie is asleep to the risks.

Oil Implodes, Crisis Looms

The collapse of OPEC+ on Friday prompted Saudi Arabia to launch a price war and crude prices fell more than 20%. The yen soared in early trading gas oil-related currencies sank. USDJPY fell 2.7% on the day, the worst daily drop since Aug 2016. CFTC positioning data emphasized the squeeze on euro shorts. The yield on the US 10-year treausry is down 49% (no typo) so far this month, the worst monthly drop ever. For a perspetive, the worst monthly decline on yields was 25% in Nov 2008. Yields on the UK 2 and 5 yr bonds have entered negative territory. Tuesday's Premium short in the Dow Premium hit the final target for 1590 pts. 2 new trades will be issued later this evening, adding to the existing two open trades.

Oil fell 10% on Friday and upwards to 20% on Monday in a proper crash. OPEC+ was unable to come to a consensus on cutting production Friday and all parties walked away. OPEC officials tried to put a positive spin on it but behind the scenes Saudi Arabia was launching a price war. On the weekend they contacted customers to offer them $8-$10 discounts and reports say they're prepared to start pumping an additional 2 million barrels per day in April. At the open, WTI crude fell $11 to a low of $30.00; Brent fell $11 to $31.02 before a $4 bounce.

As we've highlighted repeatedly in the past month, there is nowhere for the extra oil to go. Coronavirus has already destroyed at least 3 million barrels per day in demand and global storage levels are already high.

Oil companies are going to have a disaster of a day on Monday and virtually all producers are on a slow march to bankruptcy in the low $30s. US shale was already struggling and is particularly vulnerable now with more than $200B in bank debt due through 2023 and perhaps as much in bank debt.

So while oil will grab the headlines on Monday, the spots to watch for stress are in the high-yield market and related industries. In the FX market, oil exporters are in trouble. USD/CAD rose to 1.36 in early trade and NOK hit the lowest against the US dollar since at least 1985.

At the same time, coronavirus continues to escalate. Italy locked down the Lombardi region and its 16 million people while Saudi Arabia also announced a limited quarantine. Case and death numbers are rising everywhere outside of China with no end in sight. The only safe havens at the moment are gold, JPY, CHF and bonds.

The market is on the verge of panic.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -87K vs -114K prior GBP +35K vs +30K prior JPY -42K vs -56K prior CHF +3K vs +1K prior CAD +11K vs +15K prior AUD -52K vs -44K prior NZD -17K vs -15K prior

At this point, there is mass de-risking ongoing and that will push many speculators to the sideline. That means an unwind in many of these trades, which is what we're already seeing in the euro.