Intraday Market Thoughts Archives

Displaying results for week of Jun 14, 2020Sterling Sinks, Quadruple Witch Ahead

Ashraf touted selling GBP ahead of the Bank of England decision and that proved profitable with the UK currency sinking to its lowest levels since June 1. Cable breaks below the May trendline support, while EURGBP takes out the triangle resistance, nearing the final target from the Premium trade.

The drop highlighted the importance of technicals in the market. There was nothing surprising or particularly negative for the pound from the BOE. On both the decision headlines and newswire comments from Bailey, the bulls tried to stage a reversal but were quickly swamped in both instances.

Bids at 1.2400 and 55-dam at 1.2413 finally halted a decline and those will be key levels to watch in the day ahead. A break could open up a further quick fall to 1.2280.

The other side of the equation is the US dollar and it was broadly stronger on Thursday with commodity currencies and EM soft. That didn't spill over to equities but massive volumes of expiring options Friday could be holding stocks in place. Be cognizant that the latest equity rout was preceded by risk aversion in stocks and Treasury yields.

Quadruple Witching & gold

The quarterly expiration of index, options and futures expiration is due today, which is always a volatile session for US equity markets. US indices are all pointing higher, but it's crucial how we close the week. And take a look at XAUUSD, testing its trend line resistance. A break towards 1745 is in the cards.For Canada, the retail sales report is for April so it will be less insightful but Statistics Canada in selected releases has offered some insight into the month ahead, so that could be telling.

Aside from that, we continue to watch climbing state virus numbers. There wasn't a sharp acceleration in most metrics but California, Arizona, Florida all had record one-day increases in cases.Uneasy Truce

The base case for the BoE decision is for £100 bn in extra QE, with the GBP reaction likely to be shaped by the extent of the 9-person consensus at the MPC. Also look for hints on the likelihood of zero interest rates. The complexity will surface in the event of a smaller than expected consensus (such as 7-2 or 8-1) in which case GBP would try to rebound before the commentary/language takes over regarding the probability for for further rate cuts.

Ranges are narrowing and doji stars are appearing on more charts as market participants weigh the balance between easy money and the virus. Data was generally negative with US housing starts missing estimates and COVID-19 cases in US hotspots remaining elevated.

That was enough to sap some early optimism and send USD/JPY to a three-day low but the overall picture was of modest market moves and consolidation. Powell spoke in his second day of testimony and repeated his points about keeping policy easy but it was Atlanta Fed President Bostic who highlighted the crux of the problem. There is not a lot of historical precedent to predict a post-virus economy, he said.

The unease in markets has narrowed ranges but that won't last for long. Looking ahead, the weekly initial jobless claims report is due on Thursday and expected to show another 1290K claims. The market is also watching continuing claims, which were at 20.93m last week and is expected to slip to 19.85m.Tug-of-War is here to Stay

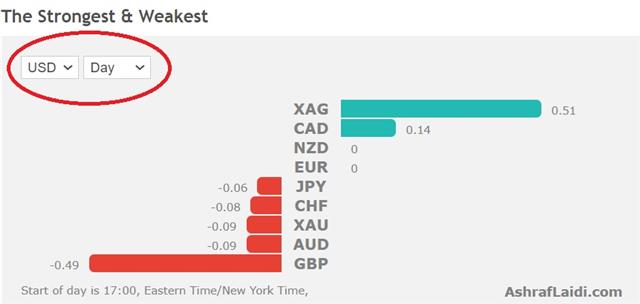

Price action is keeping the balance between heeding the resurfacing cases of Corona virus, while asserting the positives of re-opening economies, muted dissent on the US-China trade front and Fed's willingness to cap bond yields. CAD was the top performer while the Australian dollar lagged. Below are the release times for different US states. USD stabilises against EUR, GBP & CAD, while XAG, AUD & NZD gain as tech indices outperform DOW & SPX. The weekly Premium video raises questions over EUR complacency and most optimal zone for DOW and DAX daytrades.

For weeks the market shrugged off virus news and focused on the reopening but that has changed. A series of headlines on Tuesday sparked an immediate market reaction. Beijing has gone back into somewhat of a lockdown and closed schools.

Those headlines hit the same time as a jump in Florida cases, something we warned about yesterday. That was later followed by higher cases in Texas and an especially large jump in Arizona. Each of those headlines led to a negative kneejerk in risk trades.

Dip buyers fought on the other side of the trade but they were discouraged when Powell said the corporate bond buying program is more of a fall-back and will be used flexibly. The implication is that the FOMC won't be using the full $750B allotment unless market conditions deteriorate.

That the market was able to withstand all the negative news was a testament to the reopening narrative. It was boosted by a 17.7% record jump in May retail sales compared to +8.4% expected.

The question now is how much of that is boosted by government stimulus and one-off pent-up demand. It will be some time before that question is answered but on the industrial side the numbers are less-promising. Industrial production rose 1.4% in May after a record 12.5% decline in April. That was short of the 3.0% rise forecast.

Also consider that German Finance Minister Scholz said not to expect any major lockdown in the event of a second Covid-19 wave.

All the back-and-forth is a sign of uncertainty and it will take some shift in data or a continued acceleration in the virus to break the impasse.

For reference, the state virus data is out at approximately the following times: Texas 1820 GMT (hospitalizations 1500 GMT), Arizona 1620 GMT, Florida 1430 GMT.

Pavlovian Powell Play

Fed Chair Powell stuck to a largely expected rhetoric during his Congressional testimony after Monday's unexpected Fed play into corporate bonds. Powell's testimony lead with indications that the US may be bottoming out, while rates will remain near zero growth until growth returns on track. He did his best to qwell speculation of negative rates, while admitting they were looking at yield curve control.

مستويات المضاربة العرضية (فيديو المشتركين)

Monday's unexpected announcement from the central bank revealed more about market sentiment than about anything new. Risk trades rebounded after a poor start to the week. Now heavy slate economic data kicks off.

The Fed has rolled out an unprecedented number of programs since the start of March and keeping tabs on all of them is no easy job. On Monday, the Federal Reserve announced it was buying corporate bonds directly. Risk assets jumped and the US dollar sank. Previously the Fed had only been buying corporate bond ETFs.

A closer inspection shows that the Fed was mostly doing what was already announced. When corporate bond buys were announced in March, the plan was always to buy ETFs first (that started May 12), then buy corporates directly once some kinks were worked out.

Effectively the Fed was simply doing what they had already promised to do.

Certainly we could take issue the rational. Initially the Fed said “Purchases will be focused on reducing the broad-based deterioration of liquidity seen in March 2020 to levels that correspond more closely to prevailing economic conditions.” Corporate spreads are already in-line with that objective, so arguably the buying is no longer needed, or could be tapered.

Of course, that wouldn't be in-line with Powell's pledge last week to "act forcefully, proactively and aggressively."

So while this wasn't anything new or surprising, the timing was odd. It could have been announced on the weekend or before the market open.

Given that this wasn't anything new or material and that the Fed didn't signal anything unexpected, the main takeaway is market behaviour. The automatic risk-on reaction to “Fed” and “bond buying” remains the order of the day. There's no deeper strategy. That underscores the emotion in the market and how the narrative can flip between the virus and easy-money.

Risk trades were initially bumped higher Monday when Florida rose 2.3%, below the 2.4% average over the past week. However note that cases reported Monday have been consistently low (similar to the UK). So while cases at 1758 were certainly lower than the 2581 record on Saturday, they were much higher than 996 a week ago on Monday.

Hotspot Hopscotch

The re-opening narrative is running into a hard truth: That many people won't participate in the economy until it's safe. Those who are overzealous might face a second wave.

The US remains the main focus and a number of primarily southern states where case rates are rising. Florida reported record numbers on Saturday and Texas hospitalizations continue to rise. Headlines from those hotspots began to move the market late last week but it's certainly a global story.

The overall number of new cases on Saturday hit a record of 142,672 with Latin America the epicenter at the moment. However Saudi new cases hit a record Sunday and deaths in Iran hit a two-month high. Tokyo reported the most cases in 5 weeks with half traced back to nightclubs. Even China is slipping backwards with Beijing forced to lockdown part of the city because of local transmission.

In a sense, none of this is particularly surprising so what happens next will be a test of how much short-term bad news the long-term bulls can withstand. Early-week indications are soft but certainly not insurmountable.

Kolanovic's latest note

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +96K vs +81K prior GBP -24K vs -36K prior JPY +17K vs +33K prior CHF +2K vs +9K prior CAD -23K vs -33K prior AUD -37K vs -41K prior NZD -11K vs -13K prior

The specs largely disbelieve the reopening story but the enormous long-euro position can't be ignored.