Intraday Market Thoughts Archives

Displaying results for week of Feb 21, 20215 Things on Gold & Yields before more Powell

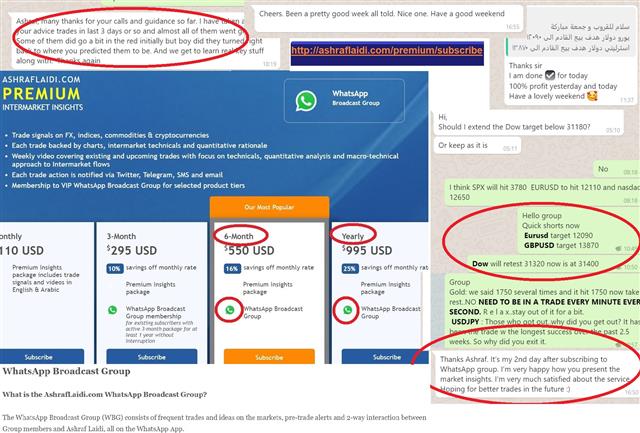

Friday's plunge in yields was just as notable as the preceding gains. As Fed chair Powell gears to speak next Thursday about the economy, here are the things im watching: 1) favourite of mine involving an overlay of HUI gold miners, suggesting major developments in XAUUSD (i will share these with the WBG next week); 2) The same applies to the Gold/SPX ratio, showing similar technical positives to the patterns of 2001, until support gave up these past two weeks. 3) Friday's candles in 2 and 10 year yields suggest neutral-negative moves early in the week, but it is the midweek-Thursday that Im concerned about. 4) USDJPY knived through its 200-DMA and its 55-WMA, calling for 107.20 as a short-term target. Our WhatsApp Broadcast Group entered this pair back in 104.60s. 5) Those who trade indices have seen the balant manner in which the jump in yields and oil boosted the DOW30, before their sharp Friday pullback dragged down the index, while supporting NASDAQ. We were active throughout the week with our WhatsApp Broadcast Group (WBG), sharing trades/analysis on DOW30, Nasdaq, XAUUSD, USDJPY, EURUSD and GBPUSD. Tune in for more next week. This is far from over.

مقابلتي المفصلة مع جو الهوا

تفضلوا بمقابلتي المفصلة على سي ان بي سي العربية مع جوالهوا عن المؤشرات و المعادن و العوائد وونواع التضخم و طبعا ... العملات الرقمية شاهد المقابلة هنا

Yield Shield Peeled

Initially the FX market shrugged off higher yields, early on Tuesday AUD/USD hit 80-cents for the first time in three years. After a strong US durable goods orders report, the Canadian dollar also hit a three year high. But as the jump in yields grew increasingly disorderly, both reversed in a big way. Cable was also sucked back to 1.40.

Importantly, this was a global jump in yields and while the outlook is strong for this year in the US, global central bankers will not appreciate the speed of this move. The Fed will be facing pressure internally and externally to clamp down on rates.

The first step will be verbal intervention. The Fed's Williams speaks Monday, Brainard on Tuesday and Powell next Thursday so there will be plenty of opportunity.

Yet, if Friday's PCE report shows unwelcome inflation, they may be forced into action sooner. The consensus estimates on both core and headline are +1.4%.Yields Hit Nasdaq, Bitcoin Pre-Powell

Bitcoin hit an air-pocket on Monday in a quick fall to $46,610 from $53,000 before bouncing all the way back to $55,000. Monday's Bitcoin drop took only minutes and highlighted the fragility of the world's biggest crypto. At the same time, it highlighted the resilience of the bull market with dip buyers wasting no time at all. Ultimately, that's the signal from here with retail still at the point where they'd rather double up than cash out.

DXY stabilised at the curcial 90 support, while XAUUSD failed at the 1815/16 predicted in Ashraf's video above, whole US crude oil counts the minutes before it returns to 57--Premium subscribers can see the rationale above.

Meanwhile, commodity markets continue to strengthen and that's providing a lasting tailwind for commodity currencies.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +140K vs +140K prior GBP +22K vs +21K prior JPY +37K vs +35K prior CHF +14K vs +11K prior CAD +8K vs +10K prior AUD -3K vs -1K prior NZD +12K vs +12K prior

The speculative market continues to be locked in place. Even the latest rally in GBP is being met with skepticism while nothing seems to be able to jar euro positioning.

One spot that is notable is the oil speculative position, which is right in the middle of the 5-year range at just over 500K contracts. Could specs be what drives the next leg of the move?