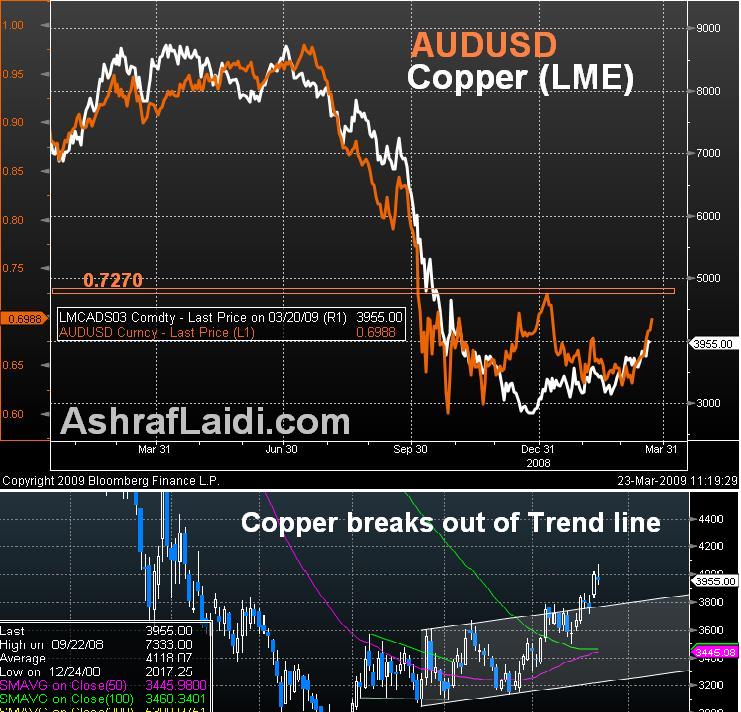

Copper's $4,000 Break

Copper's 44% rally from Decembers 4-year lows is worthy of notice due to i) the break of the January rising channel (ii) its high correlation with the Aussie and iii) the possible implications for a looming industrial order recovery. Having broken above the $4,000 mark on Friday, the new support stands above the top of the previous channel at $3,800s. Fundamentals are stacked in favour of further Aussie gains, eyeing 70.70 cents, especially as markets begin scalding down chances of a 25-bp rate cut from the RBA at the April meeting.

More Hot-Charts

-

Mystery Charts

Feb 5, 2026 20:48 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

2hr Gold Chart

Feb 3, 2026 13:09 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold Net Longs

Feb 2, 2026 17:16 | by Ashraf LaidiI really dislike after-the-fact analysis, but looking at this chart of Gold speculative net longs at the Comex, it shows speculators began lightening their longs on Jan 23.