Hot-Charts

EURAUD Looking Up

by

Apr 27, 2009 10:33

| 11 Comments

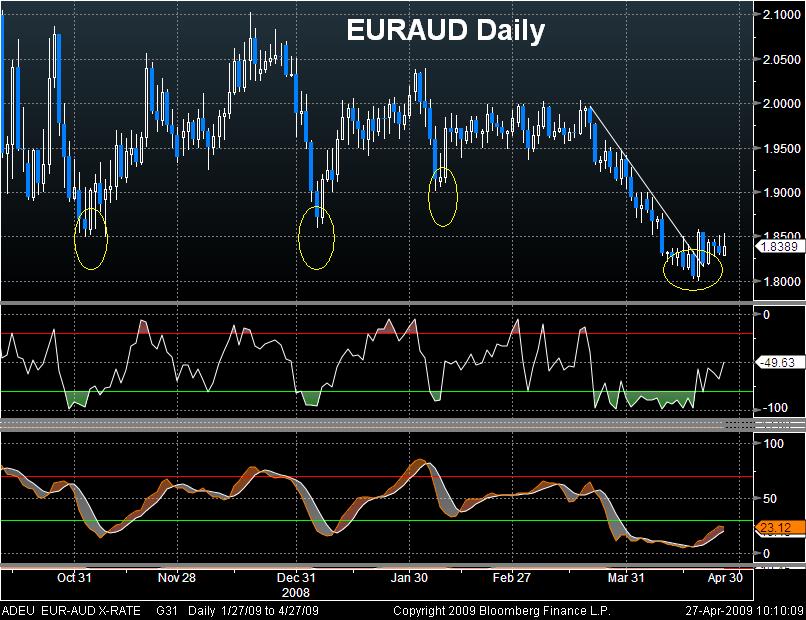

While both the Aussie and euro have shown to come under pressure against USD and JPY during risk aversion, it is the Aussie that underperforms relative to the euro during these times of falling risk appetite. Daily technicals show continued stabilization in the oscillators, while the weekly chart shows a more clearly bullish formation. Note that FX markets have grown more risk averse than their equity counterparts (as seen in the short-lived gains in risk currencies such as GBP, EUR and CAD). As equities start to exhibit further pullbacks, expect EURAUD to extend gains towards 1.8440 and 1.8550. Support seen standing a. 1.8185, backed by 1.80.

More Hot-Charts

-

Nasdaq Drawdowns

Oct 10, 2025 20:26 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات . Will send a detailed note on latest technical parameters to our WhatsApp Bdcst Group .. -

MARA Octobers

Oct 1, 2025 18:11 | by Ashraf Laidi. -

HUT Octobers

Oct 1, 2025 18:10 | by Ashraf Laidi.

GEORG, i dont closely follow ZAR, but AUDZAR has been in mainly consolidation zone since September (6.30 and 7.0). ZAR was badly damaged in past year due to unrest and its eroding production of gold. But just like the Aussie, ZAR has rallied significantly against USD since March, which was the beginning of the RISE in risk appetite.

AMIR, thats the million $$ question. i cannot imagine the FED sitting there, releasing the same statement as last month (no additional purchases) and allowing bond yields to rise further. I see 70% chance Fed announing purchases of more treasuries.. but the QUESTION is will that be ENOUGH to drag down the dollar and help gold? not so sure at the moment.

Ashraf

You have outlined boths scenarios weather the Fed decides to expand its QE in any form (buy back LT treasuries or ask treasury to issue 50yr bonds) or if it doesnt and the impact on markets. Which scenario are you more biased to? And how would you trade the markets accordingly and how would you hedge your position? Thank you.

iwant know is there chance to eur/jpy fall to 115.

as long target

thanks

EUR, GBP, AUD, NZD, CAD and NOK are called risk currencies because they usually rally diring RISING risk appetite and fall during falling risk appetite. There is a whole chapter in my book (chapter 5 called Risk Appetite in the Markets) illustrating the remationship between risk currencies, VIX, equities and credit spreads. rising risk appetite prompts funds to go from lower yieldig currencies (USD and JPY) and into risk currencies. Although GBP is low yileding currency, it still behaves as a high yielder due to concentration of financials in UK equities.

Ashraf

You made mention of risk currencies in the Hot chart above (GBP, EUR & CAD), can you briefly explain this, why they are so called and how they affect the market. Thanks so much and regards to the Queen.

Ashraf

Refering to previous hot chart on EURCHF with a target of 1.53, which did not materialise, do you see with current level of 1.5045 (lowest 1.5034) as the near bottom and more upside to come?

Do you have an idea where the NOK/CHF is going?

Ashraf