UK vs France Ratings Battle

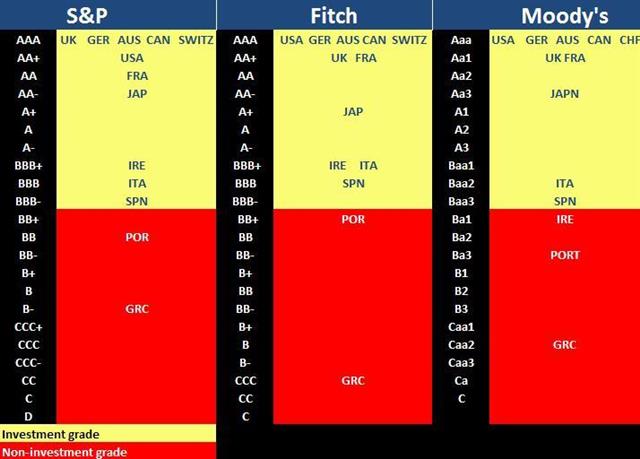

The UK-France war of words over who's the more secure borrower has taken a turn to the worse for France after Standard & Poor's downgraded the 2nd largest Eurozone economy to AA from AA+ on November 8, 2013, citing restrictive tax policies and slowing growth. S&P was the first of the three major credit agencies to have stripped France of its AAA status in January 2012 before Fitch and Moody's followed suit.

France and the UK carry the same rating level by Fitch and Moody's at AA+ and Aa1 respectively, while S&P holds the UK at AAA and France 2 notches below at AA. From a ratings standpoint, the UK appears to be in the lead. And with UK GDP set to growth more than three times faster than France at 1.6%, the balance continues to tip in favour of the UK. Although both countries' debt stands around 90% of GDP, France's debt deficit (total debt minus government receipts from exports and taxes) is below 5.0% of GDP versus nearly 6.0% of GDP for the UK. Another key factor considered by credit rating agencies is the interest cost and principal owed by a country over a specific period of time, In 2014, France must repay nearly £250,000 in principal and interest payments, compared to £142,268 by the UK, implying a bigger burden.

One key reminder is that the UK the enjoys greater monetary autonomy than France or any other Eurozone member via currency policy (ability to talk down the pound via BoE's inflation & growth pronouncements), monetary policy (stepping up asset purchases programs to reduce supply of outstanding gilts and reduce borrowing costs) and European policy (unburdened by contributing into the European Financial Stability Facility or upcoming European Stability Mechanism).

More Hot-Charts

-

GoldBugs & Levels

Mar 3, 2026 16:14 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group - -... -

Weekly & Monthly

Feb 27, 2026 13:54 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session..