BoJ expands QE, Fed exits QE, ECB expected to enter QE

Two days after the Federal Reserve exited its quantitative easing, the Bank of Japan surprises the markets by expanding its own QE and unleashing a fierce wave of buying in global equities, with currencies dominated by USD strength and yen weakness. The Bank of Japan unexpectedly expanded its monetary base by 80 trillion yen per year from the previous 60-70 trillion yen. The plan will also increase the purchase of exchange-traded funds by about three trillion yen and real-estate investment trusts by about 90 billion yen annually.

The yen had already come under pressure a few hours before last night's decision, when the Nikkei newspaper reiterated that Japan's Government Pension Investment Fund would boost its holdings allocation for both local and overseas stocks to 25% each from 12%.

The Nikkei report was later confirmed as the GPIF – the world's biggest pension fund – announced it will raise its allocation to foreign bonds to 15% from 11% and reduce domestic debt exposure to 35% from 60%.

The Fed concluded its third quantitative easing (QE3) by announcing the tapering of the remaining $15bn of asset purchases it began in September 2012. Despite re-affirming interest rates would remain exceptionally low for a “considerable time”, it cautioned that rate hikes were “likely to occur sooner” if information on inflation and employment indicated “faster progress” towards the Fed's goals.

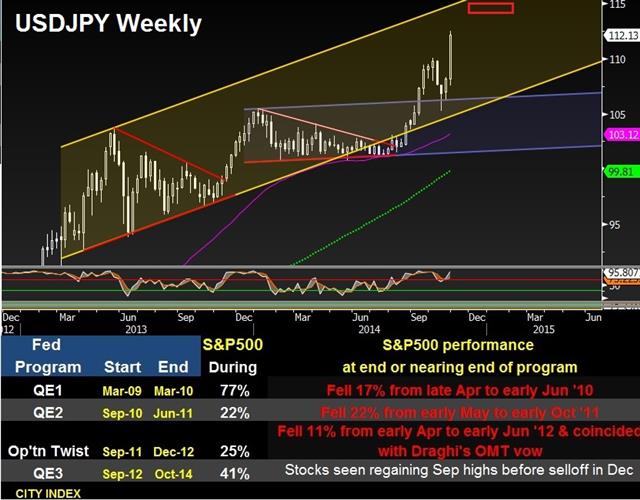

The yen plunged across the board, with USDJPY being the biggest performer. Our USD/JPY chart predicting a break of 109.00 seen here is a thing of the past and today's chart suggests 115 to be the next destination.

BoJ fills Fed's QE gap

We said earlier this week, prior to the Fed's decision, that global equities would enter a new wave of buying following the conclusion of QE3, until reaching a technical barrier right before the year's end. The rationale for anticipating a subsequent pullback in the markets is partly related to pattern of market declines occurring between Fed programs.

But the QE action surprise from the BoJ was not anticipated

This was not different from ECB president Draghi's vow to authorise Outright Monetary Transactions in September 2012, which propelled equities across the board, especially as it emerged in tandem with Operation Twist and the Fed's QE3.

Or else…

The chart below reminds us that equities, as measured by the S&P500, consistently fell by more than 10% between the conclusion of the Fed stimulus programs; between the end of QE1 and start of QE2; and between the end of QE2 and the start of Operation Twist (OR).

Interestingly, OT, which started in September 2011, was supposed to have ended in June 2012, but market turbulence in summer 2012 forced the Fed to delay the expiration of OT into December 2012. This means that both QE3 and OT functioned simultaneously during September-December 2012, shortening the duration of the usual inter-period selloff, but the magnitude of the market correctionremains considerable.

Turning to the ECB's QE

The combination of yen-depreciating QE expansion from Japan and a second round of Targeted Long Term Refinancing Operations from the ECB will likely cushion risk appetite, but this time to the favour of the US dollar, at the expense of the euro and the yen.

Favouring USD/JPY, AUD/JPY and CAD/JPY may prove positive during November, but USD propositions against GBP and CHF will require more tactical prowess.