Fed Tightening Cycles & USD Performance

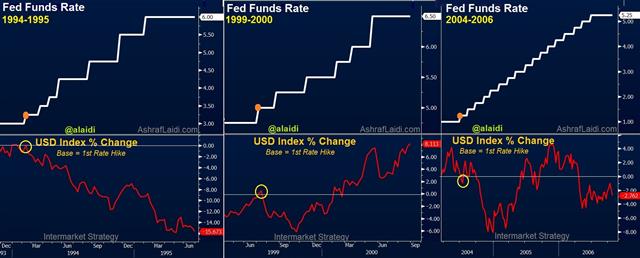

Is the peak of the US dollar behind us? Depending on your USD measure of choice, the dollar may have already peaked, when using EUR and JPY, the two largest and most liquid currencies aside from the greenback. If the bulk of the USD bull market starting in summer 2014 was based on heightened expectations of a Fed hike, then would an actual Fed hike signal the peak of the US dollar? Here is our analysis on the response of the US dollar to each of the last three Fed tightening cycles (1994-1995, 1999-2000 and 2004-2006). One common theme was found.

1994-1995 Tightening Cycle

As the Fed began raising rates in February 1994, the US dollar index wasted little time to fall more than 10% in the ensuing six months before stabilizing towards the end of the year and subsequently dropping an additional 7%. Among the main reasons to the USD selloff (despite the easy monetary policy pursued by Germany and Japan) was the resulting bond market crash following Greenspan's tightening, which eroded demand for the US currency. The resulting 10% decline in US equity indices didn't help the greenback either. Despite seven Fed hikes in 1994, the USD lost 5%-15% against all major currencies, with the exception of the CAD against which, it rallied 6%. In 1995, USD lost against all major currencies, except for GBP, JPY and AUD.

1999-2000 Tightening Cycle

The 1999-2000 Fed tightening cycle was the most positive for the greenback due to three main reasons: i) interest rates took off from a higher level of 5.00%, compared to 3.00% in 1999 and 1.00% in 2006; ii) the Clinton Administration's “strong USD” policy consisted of rhetoric backed by US-bound global capital flows as the euro crashed during its first two years due to policy errors from the ECB; iii) US-Eurozone interest and yield differentials remained firmly in favour of the US. The “New Economy” espoused by Greenspan's low-inflation-high-growth paradigm made the US stock market the only game in town as US technology stocks served as a magnet for global capital flows and emerging markets (Brazil, Russia and Asia) broke down.

2004-2006 Tightening Cycle

The Fed's 125-bps in rate hikes of 2004 didn't prevent the USD from having one of its worst years in recent history, falling against all ten top-traded currencies. Already in a 2-year bear market, the greenback went from bad to worse due to a swelling trade and budget deficit. A nascent global recovery, led by commodities and their currencies was a major negative for the buck. 2005 proved the only positive exception for the US dollar in the 2 ½ years of Fed tightening due to a temporary US tax law encouraging US multinationals to repatriate profits. But the USD rally fizzled in December 2005 over the ensuing two years, turning into a prolonged USD selloff, courtesy of a secular bull markets in commodities and higher-yielding currencies elsewhere.

Today

The USD appreciation from last summer into early spring 2015 is typical of pre-Fed hike rallies. If the Fed does tightening this autumn, will the greenback's gains could well fade away. Despite notable labour market gains, the inflation requirement remains in doubt. The 20% decline in oil since early May will further delay any recovery in price growth, which has prompted the Fed to drop its phrase in the FOMC statement that “energy prices have stabilized”.

China's devaluation is increasingly becoming the biggest barrier to any Fed tighening due to the negative growth impact on the world economy, global price growth and financial markets stability, discussed widely in this website.

It will be difficult for the Fed to raise rates this year if US crude oil remains below $48.00—The October-March decline has already triggered a chain reaction of broadening cuts in capital and labour expenditure from big oil and iron ore producers, which effectively cast a spell on the suppliers of these energy and mining companies. And barely when oil began its spring time recovery, the declines emerged anew.

Fed hawks will ignore inflation and focus on unemployment, payrolls and wages. They will add that the non-accelerating inflation rate of unemployment aka equilibrium level of unemployment is at 5.3%-5.5%, matching the current unemployment rate of 5.3%. Fed doves will point to the fact that inflation has remained below its 2.0% target for the last three years, while the true NAIRU stands a lower 5.0%.

Dissecting market and survey-based measures of inflation will become a popular sport in the months to come.

And finally, if the Fed does raise rates, it will most likely be one-&-done rate hike, owing to the deflationary pressures weighing down through commodities. At this juncture, the peak of the USD bull market is already behind us.

The borders of contemporary Lebanon are a product of the Treaty of Sèvres of 1920. Its territory was in the core of the Bronze Age Canaanite (Phoenician) city-states. As part of the Levant, it was part of numerous succeeding empires throughout ancient history, including the Egyptian, Assyrian, Babylonian, Achaemenid Persian, Hellenistic, Roman and Sasanian Persian empires.

After the 7th-century Muslim conquest of the Levant, it was part of the Rashidun, Umayyad, Abbasid Seljuk and Fatimid empires. The crusader state of the County of Tripoli, founded by Raymond IV of Toulouse in 1102, encompassed most of present-day Lebanon, falling to the Mamluk Sultanate in 1289 and finally to the Ottoman Empire in 1516.[31] With the dissolution of the Ottoman Empire, Greater Lebanon fell under French mandate in 1920,[32] and gained independence under president Bechara El Khoury in 1943. Lebanon's history since independence has been marked by alternating periods of relative political stability and prosperity based on Beirut's position as a regional center for finance and trade, interspersed with political turmoil and armed conflict (1948 Arab–Israeli War, Lebanese Civil War 1975–1990, 2005 Cedar Revolution, 2006 Lebanon War, 2007 Lebanon conflict, 2006–08 Lebanese protests, 2008 conflict in Lebanon, 2011 Syrian Civil War spillover, and 2019–20 Lebanese protests).[33]

Ancient Lebanon

Best Stock Strategy

Stock trading Strategy

Map of Phoenicia and trade routes

Evidence dating back to an early settlement in Lebanon was found in Byblos, considered among the oldest continuously inhabited cities in the world.[17] The evidence dates back to earlier than 5000 BC. Archaeologists discovered remnants of prehistoric huts with crushed limestone floors, primitive weapons, and burial jars left by the Neolithic and Chalcolithic fishing communities who lived on the shore of the Mediterranean Sea over 7,000 years ago.[34]

Lebanon was part of northern Canaan, and consequently became the homeland of Canaanite descendants, the Phoenicians, a seafaring people who spread across the Mediterranean in the first millennium BC.[35] The most prominent Phoenician cities were Byblos, Sidon and Tyre, while their most famous colonies were Carthage in present-day Tunisia and Cádiz in present-day Spain. The Phoenicians are credited with the invention of the oldest verified alphabet, which subsequently inspired the Greek alphabet and the Latin one thereafter.[36] The cities of Phoenicia were incorporated into the Persian Achaemenid Empire by Cyrus the Great in 539 BCE.[37] The Phoenician city-states were later incorporated into the empire of Alexander the Great following the siege of Tyre in 332 BC.[37]

In 64 BC, the Roman general Pompey the Great had the region of Syria annexed into the Roman Republic. The region was then split into two Imperial Provinces under the Roman Empire, Coele Syria and Phoenice, the latter which the land of present-day Lebanon was a part of.

Medieval Lebanon https://stockstrategy.net/

Stock Strategy

The Fall of Tripoli to the Egyptian Mamluks and destruction of the Crusader state, the County of Tripoli, 1289

The region that is now Lebanon, as with the rest of Syria and much of Anatolia, became a major center of Christianity in the Roman Empire during the early spread of the faith. During the late 4th and early 5th century, a hermit named Maron established a monastic tradition focused on the importance of monotheism and asceticism, near the Mediterranean mountain range known as Mount Lebanon. The monks who followed Maron spread his teachings among Lebanese in the region. These Christians came to be known as Maronites and moved into the mountains to avoid religious persecution by Roman authorities.[38] During the frequent Roman–Persian Wars that lasted for many centuries, the Sassanid Persians occupied what is now Lebanon from 619 till 629.[39]

During the 7th century, the Muslim Arabs conquered Syria establishing a new regime to replace the Byzantines. Though Islam and the Arabic language were officially dominant under this new regime, the general populace nonetheless only gradually converted from Christianity and the Syriac language. The Maronite community, in particular, managed to maintain a large degree of autonomy despite the succession of rulers over Lebanon and Syria.

The relative (but not complete) isolation of the Lebanese mountains meant the mountains served as a refuge in the times of religious and political crises in the Levant. As such, the mountains displayed religious diversity and the existence of several well-established sects and religions, notably, Maronites, Druze, Shiite Muslims, Ismailis, Alawites and Jacobites.

Byblos is believed to have been first occupied between 8800 and 7000 BC[40] and continuously inhabited since 5000 BC,[41] making it among the oldest continuously inhabited cities in the world.[42][43] It is a UNESCO World Heritage Site.[44]

During the 11th century, the Druze religion emerged from a branch of Shia Islam.

Personality refers to the enduring characteristics and behavior that comprise a person’s unique adjustment to life, including major traits, interests, drives, values, self-concept, abilities, and emotional patterns. Various theories explain the structure and development of personality in different ways, but all agree that personality helps determine behavior.

The field of personality psychology studies the nature and definition of personality as well as its development, structure and trait constructs, dynamic processes, variations (with emphasis on enduring and stable individual differences), and maladaptive forms.

gold signals

Personality psychology is a branch of psychology that examines personality and its variation among individuals. It aims to show how people are individually different due to psychological forces.[1] Its areas of focus include:

construction of a coherent picture of the individual and their major psychological processes

investigation of individual psychological differences

investigation of human nature and psychological similarities between individuals

"Personality" is a dynamic and organized set of characteristics possessed by an individual that uniquely influences their environment, cognition, emotions, motivations, and behaviors in various situations. The word personality originates from the Latin persona, which means "mask".

?????? ?????? ?????????

Personality also pertains to the pattern of thoughts, feelings, social adjustments, and behaviors persistently exhibited over time that strongly influences one's expectations, self-perceptions, values, and attitudes. Personality also predicts human reactions to other people, problems, and stress.[2][3] Gordon Allport (1937) described two major ways to study personality: the nomothetic and the idiographic. Nomothetic psychology seeks general laws that can be applied to many different people, such as the principle of self-actualization or the trait of extraversion. Idiographic psychology is an attempt to understand the unique aspects of a particular individual.

The study of personality has a broad and varied history in psychology, with an abundance of theoretical traditions. The major theories include dispositional (trait) perspective, psychodynamic, humanistic, biological, behaviorist, evolutionary, and social learning perspective. Many researchers and psychologists do not explicitly identify themselves with a certain perspective and instead take an eclectic approach. Research in this area is empirically driven – such as dimensional models, based on multivariate statistics such as factor analysis – or emphasizes theory development, such as that of the psychodynamic theory. There is also a substantial emphasis on the applied field of personality testing. In psychological education and training, the study of the nature of personality and its psychological development is usually reviewed as a prerequisite to courses in abnormal psychology or clinical psychology.

Philosophical assumptions

Many of the ideas conceptualized by historical and modern personality theorists stem from the basic philosophical assumptions they hold. The study of personality is not a purely empirical discipline, as it brings in elements of art, science, and philosophy to draw general conclusions. The following five categories are some of the most fundamental philosophical assumptions on which theorists disagree:[4]

gold trading strategy

Freedom versus determinism – This is the question of whether humans have control over their own behavior and understand the motives behind it, or if their behavior is causally determined by forces beyond their control. Behavior is categorized as being either unconscious, environmental or biological by various theories. https://www.gold-pattern.com/en

Heredity (nature) versus environment (nurture) – Personality is thought to be determined largely either by genetics and biology, or by environment and experiences. Contemporary research suggests that most personality traits are based on the joint influence of genetics and environment. One of the forerunners in this arena is C. Robert Cloninger, who pioneered the Temperament and Character model.[4]

Uniqueness versus universality – This question discusses the extent of each human's individuality (uniqueness) or similarity in nature (universality). Gordon Allport, Abraham Maslow, and Carl Rogers were all advocates of the uniqueness of individuals. Behaviorists and cognitive theorists, in contrast, emphasize the importance of universal principles, such as reinforcement and self-efficacy.[4]

Active versus reactive – This question explores whether humans primarily act through individual initiative (active) or through outside stimuli. Traditional behavioral theorists typically believed that humans are passively shaped by their environments, whereas humanistic and cognitive theorists believe that humans play a more active role.[4] Most modern theorists agree that both are important, with aggregate behavior being primarily determined by traits and situational factors being the pri

Traders can identify a trend using various forms of technical analysis, including trendlines, price action, and technical indicators. For example, trendlines might show the direction of a trend while the relative strength index (RSI) is designed to show the strength of a trend at any given point in time.

An uptrend is marked by an overall increase in price. Nothing moves straight up for long, so there will always be oscillations, but the overall direction needs to be higher in order for it to be considered an uptrend. Recent swing lows should be above prior swing lows, and the same goes for swing highs. Once this structure starts to break down, the uptrend could be losing steam or reversing into a downtrend. Downtrends are composed of lower swing lows and lower swing highs.

?????? ?????

While the trend is up, traders may assume it will continue until there is evidence that points to the contrary. Such evidence could include lower swing lows or highs, the price breaking below a trendline, or technical indicators turning bearish. While the trend is up, traders focus on buying, attempting to profit from a continued price rise.

gold signals

When the trend turns down, traders focus more on selling or shorting, attempting to minimize losses or profit from the price decline. Most (not all) downtrends do reverse at some point, so as the price continues to decline, more traders begin to see the price as a bargain and step in to buy. This could lead to the emergence of an uptrend again.

Trends may also be used by investors focused on fundamental analysis. This form of analysis looks at changes in revenue, earnings, or other business or economic metrics. For example, fundamental analysts may look for trends in earnings per share and revenue growth. If earnings have grown for the past four quarters, this represents a positive trend. However, if earnings have declined for the past four quarters, it represents a negative trend.

The lack of a trend—that is, a period of time where there is little overall upward or downward progress—is called a range or trendless period.

Using Trendlines

A common way to identify trends is using trendlines, which connect a series of highs (downtrend) or lows (uptrend). Uptrends connect a series of higher lows, creating a support level for future price movements. Downtrends connect a series of lower highs, creating a resistance level for future price movements. In addition to support and resistance, these trendlines show the overall direction of the trend.

While trendlines do a good job of showing overall direction, they will often need to be redrawn. For example, during an uptrend, the price may fall below the trendline, yet this doesn't necessarily mean the trend is over. The price may move below the trendline and then continue rising. In such an event, the trendline may need to be redrawn to reflect the new price action.

gold trading strategy

Trendlines should not be relied on exclusively to determine the trend. Most professionals also tend to look at price action and other technical indicators to help determine if a trend is ending or not. In the example above, a drop below the trendline isn't necessarily a sell signal, but if the price also drops below a prior swing low and/or technical indicators are turning bearish, then it might be.

Example of a Trend and Trendline

The following chart shows a rising trendline along with an RSI reading that suggests a strong trend. While the price is oscillating, the overall progress is to the upside.

The rising trend begins to lose momentum and selling pressure kicks in. The RSI falls below 70, followed by a very large down candle that takes the price to the trendline. The move lower was confirmed the next day when the price gapped below the trendline. These signals could have been used to exit long positions as there was evidence that the trend was turning. Short trades could have also been initiated. https://www.gold-pattern.com/en

As the price moves lower, it starts to attract buyers interested in the lower price. Another trendline (not shown) could also be drawn along the falling price to indicate when a bounce may be coming. That trendline would be have been penetrated near the middle of February as the price made a quick v-bottom and progressed higher.

Risk management occurs everywhere in the realm

of finance. It occurs when an investor buys U.S.

Treasury bonds over corporate bonds,

when a fund manager hedges

his currency exposure with currency derivatives,

and when a bank performs a credit check on an individual

before issuing a personal line of credit.

Stockbrokers use financial instruments

like options and futures,

and money managers use strategies like portfolio diversification,

asset allocation and position sizing to mitigate or effectively manage risk.

Read more onHttps://www.gold-pattern.com/en

?????? ?????

Elliott noted that a parallel trend channel typically marks the upper and lower boundaries of an impulse wave, often with dramatic precision. You should draw one as early as possible to assist in determining wave targets and provide clues to the future development of trends.

The initial channeling technique for an impulse requires at least three reference points. When wave three ends, connect the points labeled 1 and 3, then draw a parallel line touching the point labeled 2, as shown in Figure 2-8. This construction provides an estimated boundary for wave four. (In most cases, third waves travel far enough that the starting point is excluded from the final channel’s touch points.)

?????? ?????

If the fourth wave ends at a point not touching the parallel, you must reconstruct the channel in order to estimate the boundary for wave five. First connect the ends of waves two and four. If waves one and three are normal, the upper parallel most accurately forecasts the end of wave five when drawn touching the peak of wave three, as in Figure 2-9. If wave three is abnormally strong, almost vertical, then a parallel drawn from its top may be too high. Experience has shown that a parallel to the baseline that touches the top of wave one is then more useful, as in our depiction of gold bullion from August 1976 to March 1977 (see Figure 6-12). In some cases, it may be useful to draw both potential upper boundary lines to alert you to be especially attentive to the wave count and volume characteristics at those levels and then take appropriate action as the wave count warrants.

Figure 2-8

Figure 2-9

Always remember that all degrees of trend are operating at the same time. Sometimes, for instance, a fifth wave of Intermediate degree within a fifth wave of Primary degree will end when it reaches the upper channel lines at both degrees simultaneously. Or sometimes a throw-over at Supercycle degree will terminate precisely when prices reach the upper line of the channel at Cycle degree.

Zigzag corrections often form channels with four touch points. One line connects the starting point of wave A and then end of wave B; the other line touches the end of wave A and end of wave C. Once the former line is established, a parallel line drawn from the end of wave A is an excellent tool for recognizing the exact end of the entire correction.

Throw-over

gold signals

Within a parallel channel or the converging lines of a diagonal, if a fifth wave approaches its upper trendline on declining volume, it is an indication that the end of the wave will meet or fall short of it. If volume is heavy as the fifth wave approaches its upper trendline, it indicates a possible penetration of the upper line, which Elliott called a "throw-over." Near the point of throw-over, a fourth wave of small degree may trend sideways immediately below the parallel, allowing the fifth then to break it in a final burst of volume.

A throw-over is occasionally telegraphed by a preceding "throw-under," either by wave 4 or by wave two of 5, as suggested by the drawing shown as Figure 2-10, from Elliott’s book, The Wave Principle. A throw-over is confirmed by an immediate reversal back below the line. A throw-over can also occur, with the same characteristics, in a declining market. Elliott correctly warned that a throw-over at large degree causes difficulty in identifying the waves of smaller degree during the throw-over, as smaller degree channels are sometimes penetrated on the upside during the final fifth wave. Figures 1-17, 1-19 and 2-11 show real-life examples of throw-overs.

Figure 2-10

Scale

gold signals

Elliott contended that the necessity of channeling on semilog scale indicated the presence of inflation. To date, no student of the Wave Principle has questioned this assumption, which is demonstrably incorrect. Some of the differences apparent to Elliott may have been due to differences in the degree of waves that he was plotting, since the larger the degree, the more necessary a semilog scale usually becomes. On the other hand, the virtually perfect channels that were formed by the 1921-1929 market on semilog scale (see Figure 2-11) and the 1932-1937 market on arithmetic scale (see Figure 2-12) indicate that waves of the same degree will form the correct Elliott trend channel only when plotted selectively on the appropriate scale. On arithmetic scale, the 1920s bull market accelerates beyond the upper boundary, while on semilog scale the 1930s bull market falls far short of the upper boundary.

Figure 2-11 Figure 2-12

gold signals

Regarding Elliott’s contention concerning inflation, we note that the period of the 1920s actually accompanied mild deflation, as the Consumer Price Index declined an average of .5% per year, while the period from 1933 to 1937 was mildly inflationary, accompanying a rise in the CPI of 2.2% per year. This monetary background convinces us that inflation is not the reason behind the necessity for use of semilog scale. In fact, aside from this difference in channeling, these two waves of Cycle dimension are surprisingly similar: they create nearly the same multiples in price (six times and five times respectively), they both contain extended fifth waves, and the peak of the third wave is the same percentage gain above the bottom in each case. The essential difference between the two bull markets is the shape and time length of each individual subwave.

?????? ???????

At most, we can state that the necessity for semilog scale indicates a wave that is in the process of acceleration, for whatever mass psychological reasons. Given a single price objective and a specific length of time allotted, anyone can draw a satisfactory hypothetical Elliott wave channel from the same point of origin on both arithmetic and semilog scale by adjusting the slope of the 75 waves to fit. Thus, the question of whether to expect a parallel channel on arithmetic or semilog scale is still unresolved as far as developing a tenet on the subject. If the price development at any point does not fall neatly within two parallel lines on the scale you are using, switch to the other scale in order to observe the channel in correct perspective. To stay on top of all developments, you should always use both.

gold and forex signals ( ?????? ??????? ) depend on price pattern analysis of gold price and FX get gold trading signals results ?????? ????? on https://www.gold-pattern.com/en

Channeling

One of the guidelines of the Wave Principle is that two of the motive waves in a five-wave sequence will tend toward equality in time and magnitude. This is generally true of the two non-extended waves when one wave is an extension, and it is especially true if the third wave is the extension. If perfect equality is lacking, a .618 multiple is the next likely relationship (see Chapters 3 and 4).

gold signals

When waves are larger than Intermediate degree, the price relationships usually must be stated in percentage terms. Thus, within the entire extended Cycle wave advance from 1942 to 1966, we find that Primary wave ? traveled 120 points, a gain of 129%, in 49 months, while Primary wave ? traveled 438 points, a gain of 80% (.618 times the 129% gain), in 40 months (see Figure 5-5), far different from the 324% gain of the third Primary wave, which lasted 126 months.

?????? ?????

When waves are of Intermediate degree or below, the price equality can usually be stated in arithmetic terms, since the percentage lengths will also be nearly equivalent. Thus, in the year-end rally of 1976, we find that wave 1 traveled 35.24 points in 47 market hours while wave 5 traveled 34.40 points in 47 market hours. The guideline of equality is often extremely accurate.

Charting the Waves

gold signals

A. Hamilton Bolton always kept an "hourly close" chart, i.e., one showing the end-of-hour prices, as do the authors. Elliott himself certainly followed the same practice, since in The Wave Principle, he presents an hourly chart of stock prices from February 23 to March 31, 1938. Every Elliott wave practitioner, or anyone interested in the Wave Principle, will find it instructive and useful to plot the hourly fluctuations of the DJIA, which are published by The Wall Street Journal and Barron’s. It is a simple task that requires only a few minutes’ work a week. Bar charts are fine but can be misleading by revealing fluctuations that occur near the time changes for each bar but not those that occur within the time for the bar. Actual print figures must be used on all plots. The so-called "opening" and "theoretical intraday" figures published for the Dow averages are statistical inventions that do not reflect the averages at any particular moment. Respectively, these figures represent a sum of the opening prices, which can occur at different times, and of the daily highs or lows of each individual stock in the average regardless of the time of day each extreme occurs.

?????? ?????

The foremost aim of wave classification is to determine where prices are in the stock market’s progression. This exercise is easy as long as the wave counts are clear, as in fast-moving, emotional markets, particularly in impulse waves, when minor movements generally unfold in an uncomplicated manner. In these cases, short term charting is necessary to view all subdivisions. However, in lethargic or choppy markets, particularly in corrections, wave structures are more likely to be complex and slow to develop. In these cases, a longer term chart often effectively condenses the action into a form that clarifies the pattern in progress. With a proper reading of the Wave Principle, there are times when a sideways trend can be forecasted (for instance, for a fourth wave when wave two is a zigzag). Even when anticipated, though, complexity and lethargy are two of the most frustrating occurrences for the analyst. Nevertheless, they are part of the reality of the market and must be taken into account. The authors highly recommend that during such periods you take some time off from the market to enjoy the profits made during the rapidly unfolding impulse waves. You can’t "wish" the market into action; it isn’t listening. When the market rests, do the same.

The correct method for tracking the stock market is to use semilogarithmic chart paper, since the market’s history is sensibly related only on a percentage basis. The investor is concerned with percentage gain or loss, not the number of points traveled in a market average. For instance, ten points in the DJIA in 1980 meant a one percent move. In the early 1920s, ten points meant a ten percent move, quite a bit more important. For ease of charting, however, we suggest using semilog scale only for long term plots, where the difference is especially noticeable. Arithmetic scale is quite acceptable for tracking hourly waves since a 40 point rally with the DJIA at 800 is not much different in percentage terms from a 40 point rally with the DJIA at 900. Thus, channeling techniques work acceptably well on arithmetic scale with shorter term moves.

?????? ???????

gold and forex signals ( ?????? ??????? ) depend on price pattern analysis of gold price and FX get gold trading signals results ?????? ????? on https://www.gold-pattern.com/en

Elliott Wave Principle and Wave Equality

free forex signals Elliott called a sideways combination of two corrective patterns a "double three" and three patterns a "triple three." While a single three is any zigzag or flat, a triangle is an allowable final component of such combinations and in this context is called a "three." A combination is composed of simpler types of corrections, including zigzags, flats and triangles. Their occurrence appears to be the flat correction’s way of extending sideways action. As with double and triple zigzags, the simple corrective pattern components are labeled W, Y and Z. Each reactionary wave, labeled X, can take the shape of any corrective pattern but is most commonly a zigzag. As with multiple zigzags, three patterns appear to be the limit, and even those are rare compared to the more common double three.

forex signals free

Combinations of threes were labeled differently by Elliott at different times, although the illustrative pattern always took the shape of two or three juxtaposed flats, as shown in Figures 1-45 and 1-46. However, the component patterns more commonly alternate in form. For example, a flat followed by a triangle is a more typical type of double three (which we now know as of 1983; see Appendix), as illustrated in Figure 1-47.

forex signals

A flat followed by a zigzag is another example, as shown in Figure 1-48. Naturally, since the figures in this section depict corrections in bull markets, they need only be inverted to observe them as upward corrections in bear markets.

Figure 1-47

Figure 1-48

For the most part, a combination is horizontal in character. Elliott indicated that the entire formation could slant against the larger trend, although we have never found this to be the case. One reason is that there never appears to be more than one zigzag in a combination. Neither is there more than one triangle. Recall that triangles occurring alone precede the final movement of a larger trend. Combinations appear to recognize this character and sport triangles only as the final wave in a double or triple three.

forex trading signals

Although different in that their angle of trend is sharper than the sideways trend of combinations (see the guideline of alternation in Chapter 2), double and triple zigzags (see Figure 1-26) can be characterized as non-horizontal combinations, as Elliott seemed to suggest in Nature’s Law. But double and triple threes are different from double and triple zigzags not only in their angle but in their goal. In a double or triple zigzag, the first zigzag is rarely large enough to constitute an adequate price correction of the preceding wave. The doubling or tripling of the initial form is usually necessary to create an adequately sized price retracement. In a combination, however, the first simple pattern often constitutes an adequate price correction. The doubling or tripling appears to occur mainly to extend the duration of the corrective process after price targets have been substantially met. Sometimes additional time is needed to reach a channel line or achieve a stronger kinship with the other correction in an impulse. As the consolidation continues, the attendant psychology and fundamentals extend their trends accordingly.

free forex signals

As this section makes clear, there is a qualitative difference between the series 3 + 4 + 4 + 4, etc., and the series 5 + 4 + 4 + 4, etc. Notice that while an impulse wave has a total count of 5, with extensions leading to 9 or 13 waves, and so on, a corrective wave has a count of 3, with combinations leading to 7 or 11 waves, and so on. The triangle appears to be an exception, although it can be counted as one would a triple three, totaling 11 waves. Thus, if an internal count is unclear, you can sometimes reach a reasonable conclusion merely by counting waves. A count of 9, 13 or 17 with few overlaps, for instance, is likely motive, while a count of 7, 11 or 15 with numerous overlaps is likely corrective. The main exceptions are diagonals of both types, which are hybrids of motive and corrective forces.

Orthodox Tops and Bottoms

free forex signals

Sometimes a pattern’s end differs from the associated price extreme. In such cases, the end of the pattern is called the "orthodox" top or bottom in order to differentiate it from the actual price high or low that occurs intra-pattern or after the end of the pattern. For example, in Figure 1-14, the end of wave (5) is the orthodox top despite the fact that wave (3) registered a higher price. In Figure 1-13, the end of wave 5 is the orthodox bottom. In Figures 1-33 and 1-34, the starting point of wave A is the orthodox top of the preceding bull market despite the higher high of wave B. In Figures 1-35 and 1-36, the start of wave A is the orthodox bottom. In Figure 1-47, the end of wave Y is the orthodox bottom of the bear market even though the price low occurs at the end of wave W. https://www.freeforex-signals.com/

This concept is important primarily because a successful analysis always depends upon a proper labeling of the patterns. Assuming falsely that a particular price extreme is the correct starting point for wave labeling can throw analysis off for some time, while being aware of the requirements of wave form will keep you on track. Further, when applying the forecasting concepts that will be introduced in Chapter 4, the length and duration of a wave are typically determined by measuring from and projecting orthodox ending points.

Reconciling Funtion and Mode

forex signals

Earlier in this chapter, we described the two functions waves may perform (action and reaction), as well as the two modes of structural development (motive and corrective) that they undergo. Now that we have reviewed all types of waves, we can summarize their labels as follows:

— The labels for actionary waves are 1, 3, 5, A, C, E, W, Y and Z.

— The labels for reactionary waves are 2, 4, B, D and X.

As stated earlier, all reactionary waves develop in corrective mode, and most actionary waves develop in motive mode. The preceding sections have described which actionary waves develop in corrective mode. They are:

— waves 1, 3 and 5 in an ending diagonal,

— wave A in a flat correction,

— waves A, C and E in a triangle,

— waves W and Y in a double zigzag and a double three,

— wave Z in a triple zigzag and a triple three.

Because the waves listed above are actionary in relative direction yet develop in corrective mode, we term them "actionary corrective" waves.

free forex signals presents special offer

open trading account with one of the best forex brokers and GET FREE forex Signals via SMS, Email and WhatsApp

SIGN UP FOR A FREE TRIAL To Access FREE Forex Signals in the Members Area START FREE 30 DAYS TRIAL onhttps://www.freeforex-signals.com/

Elliott Wave and Triangle

A triangle appears to reflect a balance of forces, causing a sideways movement that is usually associated with decreasing volume and volatility. The triangle pattern contains five overlapping waves that subdivide 3-3-3-3-3 and are labeled A-B-C-D-E. A triangle is delineated by connecting the termination points of waves A and C, and B and D. Wave E can undershoot or overshoot the A-C line, and in fact, our experience tells us that it happens more often than not. https://www.freeforex-signals.com/

There are three varieties of triangles: contracting, barrier and expanding, as illustrated in Figure 1-42. Elliott contended that the horizontal line of a barrier triangle could occur on either side of the triangle, but such is not the case; it always occurs on the side that the next wave will exceed. Elliott’s terms, "ascending" and "descending," are nevertheless useful shorthand in communicating whether the barrier triangle occurs in a bull or bear market, respectively.

forex signals

Figure 1-42 depicts contracting and barrier triangles as taking place entirely within the area of preceding price action, which may be termed a regularr triangle. Yet, it is extremely common for wave B of a contracting triangle to exceed the start of wave A in what may be termed a running triangle, as shown in Figure 1-43. Despite their sideways appearance, all triangles, including running triangles, effect a net retracement of the preceding wave at wave E’s end.

free forex signals

There are several real life examples of triangles in the charts in this book (see Figures 1-27, 3-15, 5-5, 6-9, 6-10 and 6-12). As you will notice, most of the subwaves in a triangle are zigzags, but sometimes one of the subwaves (usually wave C) is more complex than the others and can take the shape of a multiple zigzag. In rare cases, one of the sub-waves (usually wave E) is itself a triangle, so that the entire pattern protracts into nine waves. Thus, triangles, like zigzags, occasionally display a development that is analogous to an extension. One example occurred in silver from 1973 through 1977 (see Figure 1-44).

forex trading signals

A triangle always occurs in a position prior to the final actionary wave in the pattern of one larger degree, i.e., as wave four in an impulse, wave B in an A-B-C, or the final wave X in a double or triple zigzag or combination (see next section). A triangle may also occur as the final actionary pattern in a corrective combination, as discussed in the next section, although even then it usually precedes the final actionary wave in the pattern of one larger degree than the corrective combination. Although upon extremely rare occasions a second wave in an impulse appears to take the form of a triangle, it is usually due to the fact that a triangle is part of the correction, which is in fact a double three (for example, see Figure 3-12).

forex signals free

In the stock market, when a triangle occurs in the fourth wave position, wave five is sometimes swift and travels approximately the distance of the widest part of the triangle. Elliott used the word "thrust" in referring to this swift, short motive wave following a triangle. The thrust is usually an impulse but can be an ending diagonal. In powerful markets, there is no thrust, but instead a prolonged fifth wave. So if a fifth wave following a triangle pushes past a normal thrust movement, it is signaling a likely protracted wave. Post-triangle advancing impulses in commodities at degrees above Intermediate are usually the longest wave in the sequence, as explained in Chapter 6.

free forex signals

Many analysts are fooled into labeling a completed triangle way too early. Triangles take time and go sideways. If you examine Figure 1-44 closely, you will see that one could have jumped the gun in the middle of wave b, pronouncing the end of five contracting waves. But the boundary lines of triangles almost never collapse so quickly. Subwave C is typically a complex wave, though wave B or D can fulfill that role. Give triangles time to develop.

forex signals

On the basis of our experience with triangles, as the examples in Figures 1-27 and later in 3-11 and 3-12 illustrate, we propose that often the time at which the boundary lines of a contracting triangle reach an apex coincides with a turning point in the market. Perhaps the frequency of this occurrence would justify its inclusion among the guidelines associated with the Wave Principle. https://www.freeforex-signals.com/gold signals

gold and forex signals ( ?????? ??????? ) depend on price pattern analysis of gold price and FX get gold trading signals results ?????? ????? on https://www.gold-pattern.com/en

Elliott Wave and Triangle

Feb returns +13%

https://mehabe.com/2020/02/10/mt4-statement-feb-returns-13-managed-account/

forex signals

A diagonal is a motive pattern yet not an impulse, as it has two corrective characteristics. As with an impulse, no reactionary subwave fully retraces the preceding actionary subwave, and the third subwave is never the shortest. However, a diagonal is the only five-wave structure in the direction of the main trend within which wave four almost always moves into the price territory of (i.e., overlaps) wave one and within which all the waves are "threes," producing an overall count of 3-3-3-3-3. On rare occasions, a diagonal may end in a truncation, although in our experience such truncations occur only by the slimmest of margins. This pattern substitutes for an impulse at two specific locations in the wave structure.

Ending Diagonal

free forex signals

An ending diagonal occurs primarily in the fifth wave position at times when the preceding move has gone "too far too fast," as Elliott put it. A very small percentage of diagonals appear in the C-wave position of A-B-C formations. In double or triple threes (see next section), they appear only as the final C wave. In all cases, they are found at the termination points of larger patterns, indicating exhaustion of the larger movement. https://www.freeforex-signals.com/

A contracting diagonal takes a wedge shape within two converging lines. This most common form for an ending diagonal is illustrated in Figures 1-15 and 1-16 and shown in its typical position within a larger impulse wave. https://www.freeforex-signals.com/forex-signals/

We have found one case in which an ending diagonal’s boundary lines diverged, creating an expanding diagonal rather than a contracting one. However, it is unsatisfying analytically in that its third wave was the shortest actionary wave.

free forex signals

Ending diagonals have occurred recently in Minor degree as in early 1978, in Minute degree as in February-March 1976, and in Subminuette degree as in June 1976. Figures 1-17 and 1-18 show two of these periods, illustrating one upward and one downward "real life" formation. Figure 1-19 shows our real-life possible expanding diagonal. Notice that in each case, an important change of direction followed.

Although not so illustrated in Figures 1-15 and 1-16, the fifth wave of an ending diagonal often ends in a "throw-over," i.e., a brief break of the trendline connecting the end points of waves one and three. The real-life examples in Figures 1-17 and 1-19 show throw-overs. While volume tends to diminish as a diagonal of small degree progresses, the pattern always ends with a spike of relatively high volume when a throw-over occurs. On rare occasions, the fifth subwave falls short of its resistance trendline.

forex signals free

A rising ending diagonal is usually followed by a sharp decline retracing at least back to the level where it began and typically much further. A falling ending diagonal by the same token usually gives rise to an upward thrust.

https://www.freeforex-signals.com/

Fifth wave extensions, truncated fifths and ending diagonals all imply the same thing: dramatic reversal ahead. At some turning points, two of these phenomena have occurred together at different degrees, compounding the violence of the next move in the opposite direction.

forex signals

Leading Diagonal

It has recently come to light that a diagonal occasionally appears in the wave 1 position of impulses and in the wave A position of zigzags. In the few examples we have, the subdivisions appear to be the same: 3-3-3-3-3, although in two cases, they can be labeled 5-3-5-3-5, so the jury is out on a strict definition. Analysts must be aware of this pattern to avoid mistaking it for a far more common development, a series of first and second waves, as illustrated in Figure 1-8. A leading diagonal in the wave one position is typically followed by a deep retracement

forex signals free

Figure 1-20 shows a real-life leading diagonal. We have recently observed that a leading diagonal can also take an expanding shape. This form appears to occur primarily at the start of declines in the stock market (see Figure 1-21). These patterns were not originally discovered by R.N. Elliott but have appeared enough times and over a long enough period that the authors are convinced of their validity.

forex signals

Corrective Waves https://www.freeforex-signals.com/free-forex-signals/

Markets move against the trend of one greater degree only with a seeming struggle. Resistance from the larger trend appears to prevent a correction from developing a full motive structure. This struggle between the two oppositely-trending degrees generally makes corrective waves less clearly identifiable than motive waves, which always flow with comparative ease in the direction of the one larger trend. As another result of this conflict between trends, corrective waves are quite a bit more varied than motive waves. Further, they occasionally increase or decrease in complexity as they unfold so that what are technically subwaves of the same degree can by their complexity or time length appear to be of different degree (see Figures 2-4 and 2-5). For all these reasons, it can be difficult at times to fit corrective waves into recognizable patterns until they are completed and behind us. As the terminations of corrective waves are less predictable than those for motive waves, you must exercise more patience and flexibility in your analysis when the market is in a meandering corrective mood than when prices are in a persistent motive trend.

free forex signals

The single most important rule that can be gleaned from a study of the various corrective patterns is that corrections are never fives. Only motive waves are fives. For this reason, an initial five-wave movement against the larger trend is never the end of a correction, only part of it. The figures in this section should serve to illustrate this point.

free forex signals

Corrective processes come in two styles. Sharp corrections angle steeply against the larger trend. Sideways corrections, while always producing a net retracement of the preceding wave, typically contain a movement that carries back to or beyond its starting level, thus producing an overall sideways appearance. The discussion of the guideline of alternation in Chapter 2 explains the reason for noting these two styles.

free forex signals

Specific corrective patterns fall into three main categories: Zigzag (5-3-5; includes three types: single, double and triple);

Flat (3-3-5; includes three types: regular, expanded and running);

Triangle (3-3-3-3-3; three types: contracting, barrier and expanding; and one variation: running).

A combination of the above forms comes in two types: double three and triple three.

free forex signals presents special offer

open trading account with one of the best forex brokers and GET FREE forex Signals via SMS, Email and WhatsApp

SIGN UP FOR A FREE TRIAL To Access FREE Forex Signals in the Members Area START FREE 30 DAYS TRIAL onhttps://www.freeforex-signals.com/