GDP & Gold's Disinflation Plunge

The bigger than expected downward revision in US Q2 GDP to -1.0% from an initial reading of +0.1% mainly resulted from an inventory drawdown of 1.62% (three times what was originally expected), lower private investments, and more negative contribution from net trade. The good news is that personal consumption was revised to 3.1% from 3.0% on better auto sales. Whether the certainty of expecting a contraction in Q1 GDP will be offset with the growing certainty of a +3.5% growth in Q2 GDP will depend on continued growth in consumption and resulting bounce in inventories, as well as the extent of the recovery in home sales and net exports following inclement weather in Q1.

And in order for US GDP to reach 3.0% in 2014, it will require an average of 4.0% per quarter.

A repeat of 2011?

The Q1 contraction may just be a repeat of 2011, when Q1 GDP contracted 1.3%, only to be followed by a Q2 rebound of merely 3.2%. Q3 and Q4 showed 1.4% and 4.9% respectively, prompting the Fed in September 2011 to start its Operation Twist program of selling short-term bonds (less than three years) and buying longer-term ones (6-30 years).

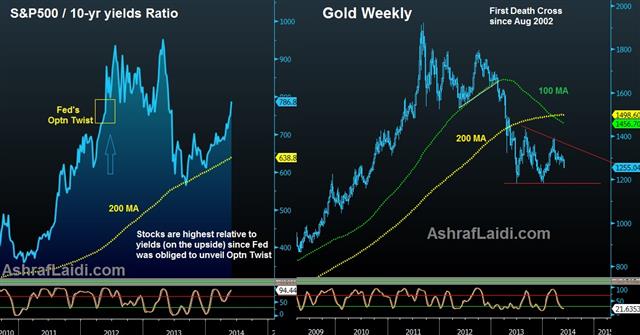

Operation Twist had been aimed at reducing longer-term bond yields relative to short-term bonds in order to boost the mortgage market and encourage investors into stocks and away from low yielding bonds.

The last time stocks had been at these levels relative to yields was last summer. But the last time the stocks/yields ratio stood near current levels during a rising trajectory was in spring-summer 2012, when the Fed was halfway into its Operation Twist program.

As yields hit new cycle lows – partly on dovish reminders from the Fed about the labour market requiring more participation and China's broadening weakness (including yuan weakness) – the US will import lower inflation, giving the Fed no choice but to further delay any assessment of higher interest rates.

Gold's disinflation erosion as equities alternative soars

And if the explanation of rising gold benefiting lower yields alternative in bonds, then the current environment in yields isn't helping the argument.

Rather, the absence of inflation combined with the onset of imported disinflation from the Eurozone and China's weakening currencies lends credence to the selloff in gold.

The metal's shine is further eroded when new record highs in US & European stocks operate in a low-inflation environment. This is especially highlighted by the fact that the goldbugs index (miners' index) is only 5% away from the five-year lows reached in December.

We ask not whether gold will revisit its 1180 cycle low, but whether it will reach 1130 now that a rare death cross (100-week MA fell below 200-week MA) is underway.