Is Everything Back to Normal ?

Is everything back to normal after Friday's speech from Federal Reserve Chairman Powell? There was no surprise when Powell stated US markets were pricing some downside risks to the economy and that the central bank ought to be “patient” on interest rates. Markets widely interpreted the remarks that the central bank will not be increasing in interest rates this quarter and maybe not at all this year. As a result, the US dollar is lower against all currencies and stock market indices could be entering their 3rd consecutive rising week for the first time in four months. So where do we go from here?

Starting with the strong US jobs report

Some say the stronger than expected release in the US jobs report showing 312,000 net new jobs in December and earnings grew by a higher than expected 0.4% would keep the door open for further interest rate increases. But the in depth analysis shows that the bulk of the jobs created in December were “seasonal” in nature, aimed at hiring temporary workers for the holiday shopping season. What about the strong wages number? Fed chairman Powell said after the release of the data that the numbers showed US labour markets are steady but there is no reason to worry about inflation. Translation: Fed will most likely take a pause over the March and June decisions.

What about the overall disappointing US data?

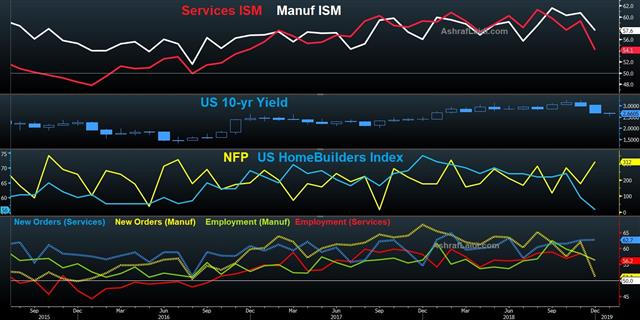

Let us not forget that the Federal Reserve's 5 regional indicators (covering all the major areas of the USA) show manufacturing and services activity slowing to the lowest pace in 2-3 years. [See the above chart] In some areas, new business orders have seen their biggest decline since the recession of 2008. The worries are not simply a question of nervous markets and falling share price of Apple. The index of economic surprises for US indicators (updated every day by the bank giant Citi) has fallen to its lowest level in 6 months.

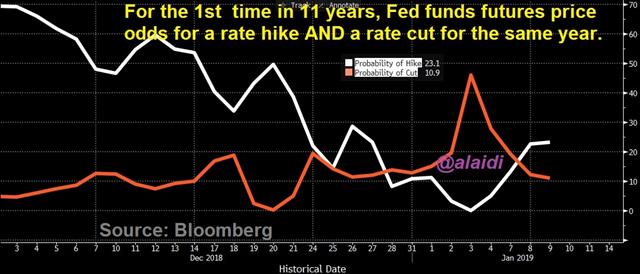

Fed funds futures haven't been this confused since 2008

What it means for stock indices?

Instead of waiting for the green light from Fed Chair Powell, we issued a "Long" DOW30 trade for Premium subscribers 15 minutes prior to his Friday speech as we remain positive on indices from a tactical point of view (not a long term view). The risk-reward balance for the Dow Jones Index currently suggests that more upside can be seen despite that the index has already risen 8% or 2000 points from last month's low.

Warning: Do not get comfortable in your speculation. Although you may correctly predict that the Dow Jones could rise by another 1000 points from here, the road can remain treacherous and volatile. Pay extra care when using financial leverage. Find the suitable trade size and leverage that enable you to absorb drawdowns or fluctuations. For our subscribers, we entered two “LONGs" on the Dow Jones index over the last 3 weeks, but the road was not free of shocks and fluctuations.

The days of + (-) 500 points are here to stay

Do I think the Dow Jones Index will return to 26,000 just because the chairman of the Federal Reserve signaled that they will pause on interest rates? As long as there are no returning signs of increases interest rates and as long as the futures markets in interest rates continue to price a chance of a reduction interest rates in Q4 of this year of early next year, then there is a 70% probability that the Dow Jones will return to 25,500. How will this path occur I do not know and nobody knows.

One thing is certain, we will continue to have days of + and - 500 points in the Dow Jones index. Why? The structure of higher interest rates compared to 3 years ago, rising debt, and increased digitization of the financial markets (robots, algorithms, programmed trading)

What it means for the US dollar?

The decline in the US dollar of the last 3 weeks is fairly similar to the weakness seen in the first six months of 2016. And to confirm this, Fed chair Powell said last week that economic conditions are similar to what was seen in early 2016. What happened during that time? A sharp decrease in equity indices partly owring to the 70% decline in oil prices and due December 2015 rate hike led to further volatility, thus forcing Yellen's Fed to back off from raising interest rates for the subsequent 11 months -- before resuming with the rate hike in December 2016. This helps explain why the US dollar fell 8% in the first 6 months of 2016 (pre-election dynamics were also a solid force).

As long as the Federal Reserve refrains from giving signals for higher interest rates, the US dollar shall remain under pressure (into mid Q2) against selected commodity currencies (Canadian dollar, New Zealand dollar) and safe haven currencies such as the Swiss franc. Considering that the Japanese yen has had its strongest 6 months in over 2 years, the Japanese currency will pause for breath for now. After all, the yen is the ONLY currency to have rallied agains gold in 2017 and 2018. No other currency has ended higher vs the metal for 2 straight years.