Retail Sales' Message from Main Street

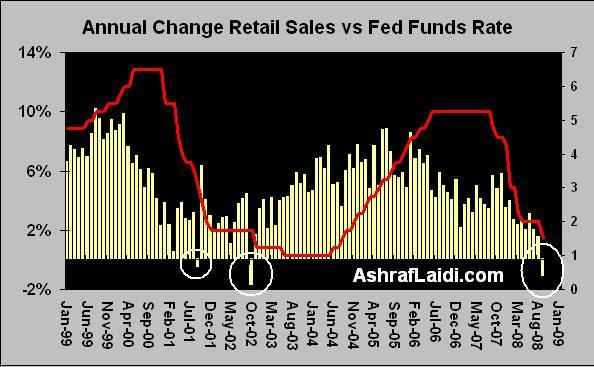

The attached chart shows the year on year change in retail sales of 1.03% was the first decline since October 2002. There has been only 3 annual declines since 1992 (September 2001 and October 2002). The sales report carries negative implications for September retail jobs, especially as retail payrolls have now been in the red for longer than in the 2001-2 last recession.

Were seeing a repeat of autumn 2007 and summer 2008 when surging market volatility of summer 2007 and spring 2008 gave way to deepening economic deterioration as shaky equity market confidence impacted consumer demand, corporate earnings and planned capex. Separately, US Empire state manufacturing index fell to -24.6 in October from -7.4, the worst level on record. New orders tumble to -21 from 4.4. Fed Chairman Bernanke's speech at noon on the economic outlook to further indicate macroeconomic weakness and open the door for rates to drop as low as 1.00% before year-end. US Empire state manufacturing index drops to -24.6 in October from -7.4, the worst level on record. New orders tumble to -21 from 4.4. Prices paid index drops to 32 from 45.

USDJPY to Revisit 100.45 Weak macroeconomic data diverts attention from governments banking sector to the real economy, thus dragging USDJPY towards 101 and onto 100.50s. The failure to breach 103 yen has been cemented, shifting focus towards the 98 figure. The USDJPY pair is also increasingly reflecting eroding confidence among Japanese investors, whose losses in their own equity indices are dealing a major blow to investment appetite abroad, hence, yen crosses. Technically, the 2-hour chart shows a trend line resistance at 101.55, calling for 101.05-38% retracement of bounce from Oct 9 low. Subsequent target stands at 50% retracement i.e.100.44.

Time for More Declines in Sterling The increasingly negative correlation between sterling and risk appetite allows for renewed losses towards $1.7450 and $1.7380 especially on the combination of eroding consumer demand and anticipated pessimist tone from Bernankes speech. We should start hearing the word recession being uttered more often by Federal Reserve officials, as we have already heard from Yellen and Lockhardt earlier.

Trend line resistance stands at $1.7450, backed by $1.7380. Upside capped at 1.7380.

Euro Eyes $1.35

Despite negative economic figures from the US, EURUSD will go unscathed as the impact of further deleveraging in capital markets is to drag higher yielding currencies against the dollar. With currency markets continuing to move to the tune of risk appetite, $1.3550 stands as the next interim support, followed by 1.3500.