US jobs put dollar bears in check

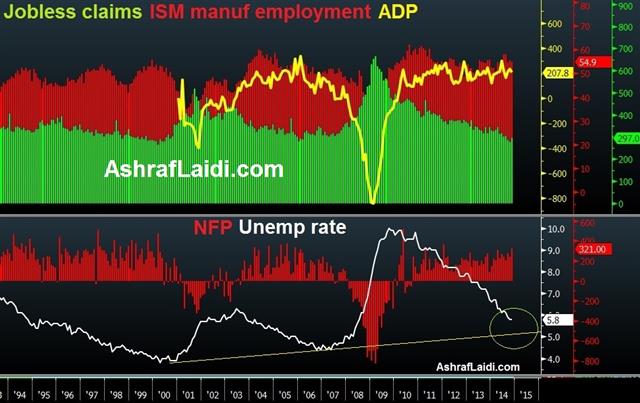

The dollar index hit a fresh five-year high and USD/JPY hit fresh seven-year highs at 121.69 as the US jobs market shifted to a higher gear of improvement, bolstering chances of a 2015 Fed rate hike. The November increase of 321,000 in US non-farm payrolls was the biggest monthly gain since January 2012. The unemployment rate held unchanged at six-year lows of 5.8%, while labour participation also remain unchanged at 62.8%. The underemployment rate continued to declined, reaching 11.4% from 11.5%, helping alleviate concerns that the falling jobless rate was caused by lower participation in the labour force.

The 44,000 increase in the prior two months' revisions is also a positive.

Average hourly earnings rose 0.4% m/m, the highest since October 2011, translating into a y/y rise of 2.1%, weaker than expected but inched up 0.1% m/m from flat, while the y/y series rose 2.0% as in the previous month.

Manufacturing showed a net increase of 28k, posting the 14th straight monthly increase, while the retail sector added 50.2k jobs, aconsecutive monthly increase for the third straight month, up 50.2k.

The combination of accelerating gains in employment and multi-year lows in the jobless rate, coupled with broad-based sector growth in jobs lend credence to the Fed's exit from its five-year quantitative easing programme, further highlighting the contrasting monetary policy between the US on one side, and Japan and the Eurozone on another.

Parallels and contrasts with 2007

With USD/JPY rallying to its highest level since July 2007, the pair draws clear parallels with the heights in global equity markets of seven years ago, but strongly contrasting in terms of global inflation, when oil and rest of commodities levitated at record highs.

But the yen was the only currency against which the dollar rose in 2007. Today, the greenback is at multi-year highs against all majors a time when commodities are drifting at their lowest in four years, as indicated by the CRB commodities index in our recent piece.

We reiterated that the current USD rally shows characteristics not seen since 2005, as it is accompanied by advances against the Japanese yen, which is unlike any of the USD advances of the past six years when the greenback mainly reflected debt and austerity woes in continental Europe and the UK. Aside from domestic strength in the US, as well as the windfall of falling oil prices on the US economy, the striking contrast of policy divergence between the Fed and the three other major central banks (ECB, BoJ and BoE) will keep the greenback standing tall.

Fed to focus on disinflation

As US labour markets gain in strength, the Fed will inevitably acknowledge the improvement at this month's FOMC meeting, but without failing to highlight the ever slowing rate of inflation. The doves at the Fed, led by Chair Yellen, shall find a way to rein in the dollar rally in order to contain the risk of deflation. The Fed's priority in containing any unwarranted rise in bond yields has been displaced by that of monitoring the dollar as yields drift 2.40%. But this may quickly change.