Intraday Market Thoughts Archives

Displaying results for week of Mar 01, 2026Oil Metrics & Gold Risks

Here's a 120 min video on extensions of Crude oil metrics and the risks to gold. Watch here.

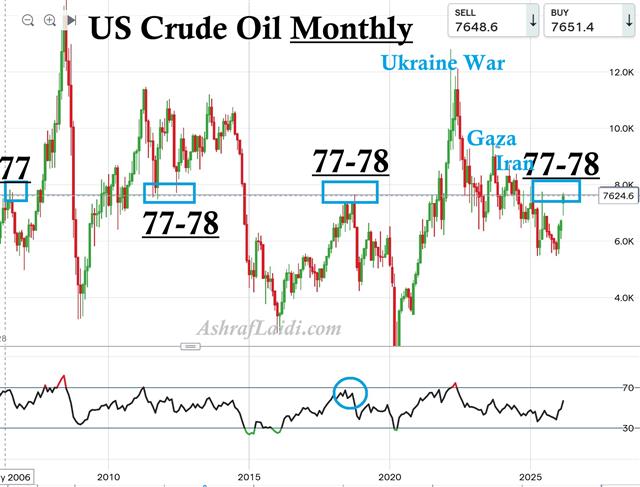

Oil Inflection 77, 78

I usually do not trade oil, especially in uncertain times like these. It is foolish to speculate on a fast-changing market, especially when trading on margin. Nonetheless, for those of you who trade it, here is a MONTHLY chart of US Crude oil. Notice the current price is near $77-78 pb, which over the last 19 years, has proven to be a key inflection point. The level worked as repeated resistance in July 2006, October 2018, July 2021 and June 2025. Increasing reports and statements that the crisis could extend for weeks raise the probability of a breakout above $80. The weekly RSI is above 70--the highest since the outbreak of the Russia-Ukraine war in February 2022. Daily oscillators appear over extended, but this means a pullback may only be temproary. While $74.78 appears as temporary support, the ceiling of the Gapup around $69 is the more important foundation. I avoid oil for now, with clearer opportunities in USDJPY, US100 and XAUUSD. Be careful out there. More detailed levels sent for the English & Arabic WhatsApp Bdcst Group.

Gold Daily, Weekly & GoldBugs

Here are some of the charts I occasionally send to our WhatsApp Bdcst Group to make the case for intraday and even intra week trades. If you do not understand how to read the GoldBugs Ratio chart, there are detailed explainers in my Youtube and Instagram videos over the past 12 months. Due to the generally inverse relation between XAUUSD and GoldBugsRatio (GBR), I tend to use technicals in GBR to help me read moves in XAUUSD. In the case below, GBR chart faces a trendline resistannce of 6.0. This means as long as 6.0 is not broken, XAUUSD shall remain supported. The weekly candle on the right hand side, suggests it is a bearish engulfing pattern, but the warning went to members of the Group that not only it was too early in the week to assess a bearish engulfing candle, but beware from interpreting it as a clear bearish signal as was seen in the preceding example. We shorted XAUUSD at 5190, targetting 5145 and repeated the process throughout the afternoon.

Gold and Silver Repeat June 13 Playbook

Gold seems to be repeating the playbook from the June 13 attacks on Iran. I start with the chart comparisons for gold and silver, followed by detailed explanation in the 2nd half of the video. Watch the 3 mins video here.

How I Grew the Account 5x

Here is the full recording of Friday's Live detailing how I grew the trading account 5x. 70% in Arabic and 30% in English. Watch here.