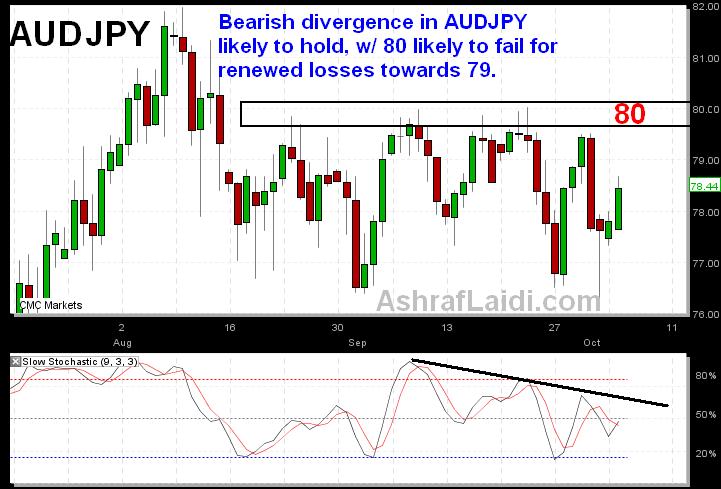

AUDJPY Clarifies the Hint

The recurring failure of AUDJPY to regain 80 since mid August reflects mostly yen strength and speculators relative comfort to maintain the AUDJPY carry trade rather than AUDJPY. RBA is expected to hold rates unchanged at 3.00% tonight, but could well open the door further open for a November/December rate hike, in which case may boost Aussie across the board in Tuesday Asian tradeespecially in the event of a rebound in regional indices. Nonetheless, the chart below suggests selling AUDJPY on the rallies near 80 continues to be the modus operandi for AUD traders, especially as the lower highs in the stochastics signal a continued bearish divergence.

More Hot-Charts

-

GoldBugs & Levels

Mar 3, 2026 16:14 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group - -... -

Weekly & Monthly

Feb 27, 2026 13:54 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session..