Bovespa, Sensex & Cable

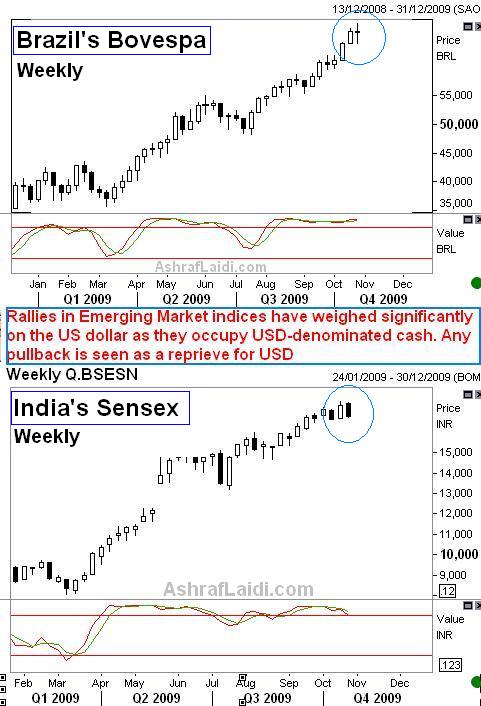

Sterlings failure to breach above the $1.6730 right shoulder in the H&S formation following the unexpected decline in Q3 GDP should help call up $1.63 and $1.6210. GBP could especially lose more ground in the event of upcoming risk aversion as equities near key technical levels. While the S&P500 is nearing the 50% retracement of the decline from its all time high to March lows; emerging market indices such as Brazils Bovespa and Indias Sensex are struggling (see charts below). WATCH A POTENTIAL DOJI CANDLE in the WEEKLY BOVESPA and ENGULFING BEARISH CANDLE in the SENSEX. Any prolonged retreat in these indices would cause a drying up of liquidity from emerging markets to the benefit of the USD (at expense of GBP).

More Hot-Charts

-

GoldBugs & Levels

Mar 3, 2026 16:14 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group - -... -

Weekly & Monthly

Feb 27, 2026 13:54 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session..