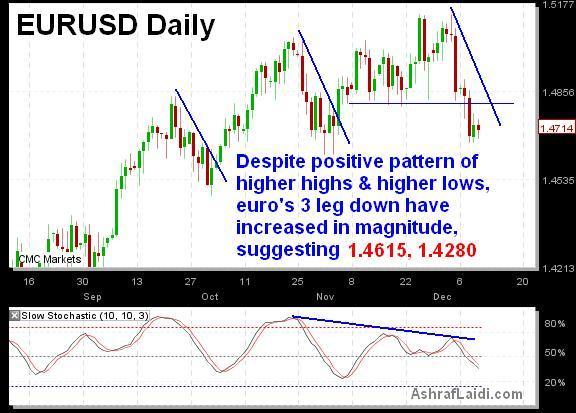

Euro's Third Down Leg

The current leg down in EURUSD has exceeded each of its previous 2 down cycles in magnitude (22 Sep-Oct 2nd & Oct 26-Nov 2nd) and is at risk of extending losses towards an preliminary target of $1.4615, followed by $1.4280. With the USD index has finally closing above its 55-day moving average for the first time since April and crude oil vulnerable to extending losses towards $66 after having broken below its Jul trend line support, EURUSD is apt to test its next preliminary target at $1.4615 (Sep 11 high, Sep 21 low, Nov 1 low, Nov 2 low). The fundamental arguments for these euro risks emerge from increased global risk aversion (Dubai, Ireland, Spain & Greece), as well as nascent signs of stability in US jobs. Although we see no change in US interest rates before H1 2010, markets pricing of USD-favourable yield spreads is helping to lift the greenback. EURUSD upside capped at initial resistance of $1.4770, but the previous support of $1.4820-25 will be the barrier for the bulls.

More Hot-Charts

-

GoldBugs & Levels

Mar 3, 2026 16:14 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group - -... -

Weekly & Monthly

Feb 27, 2026 13:54 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session..