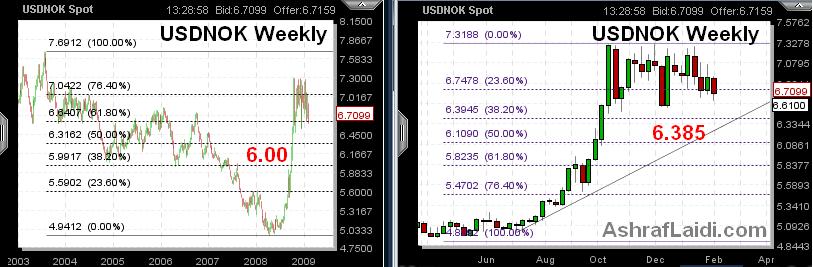

USDNOK Position Trade

NOK remains boosted across the board faring best performing currency since NY Tues close and second best performer over past 5 days after NZD. With my pro-NOK calls vs GBP already materializing, I offer a a longer term negative outlook for USDNOK (bullish NOK vs USD) calling for 6.4 before end of quarter. More extended outlook favours 6.00, as emerging signs of global stability will boost the already higher yielding and better equipped NOK.

More Hot-Charts

-

Mystery Charts

Feb 5, 2026 20:48 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

2hr Gold Chart

Feb 3, 2026 13:09 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold Net Longs

Feb 2, 2026 17:16 | by Ashraf LaidiI really dislike after-the-fact analysis, but looking at this chart of Gold speculative net longs at the Comex, it shows speculators began lightening their longs on Jan 23.