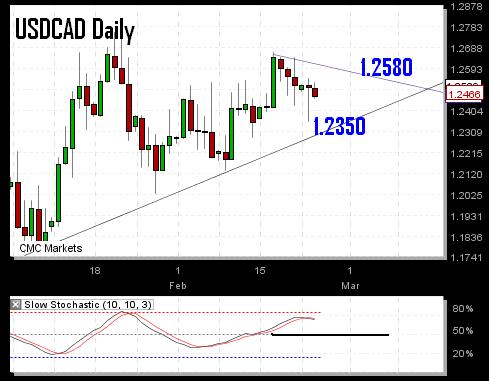

USDCAD Approaches Wedge

USDCAD has increasingly shown its negative... correlation with equities as the Canadian dollar currency is positively related with the risk appetite. Markets may drop following another shocking US number (US confidence at 25 vs expectations of 35). But with markets unlikely to engage in a hard sell-mode before tonights Obama State-of-the-Union speech, we could expect a relatively robust performance in equities and short-lived declines in USDCAD towards 1.2400, followed by 1.2355. TL support is expected to hold and counter the downturn in stochastics, making way for a testing of the 1.2580 by mid week.

More Hot-Charts

-

GoldBugs & Levels

Mar 3, 2026 16:14 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group - -... -

Weekly & Monthly

Feb 27, 2026 13:54 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session..