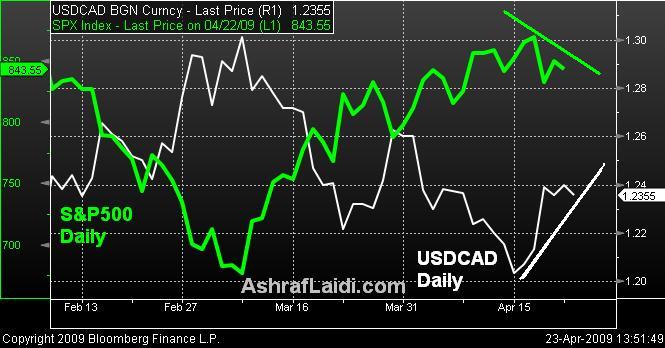

USDCAD vs S&P500

The increasingly negative correlation between USDCAD and S&P500 reflects the increasingly positive correlation between the Canadian dollar and equities, as the current represents risk appetite (widely vulnerable to declines in US weakness and oil prices and vice versa). Just we have seen S&P500 topping out at 869, USDCAD bottomed at 1.1980, while the bounce in USDCAD to 1.25 from the BoC rate cut occurred along with

the retreat in equities. Considering expectations for equity indices to consolidate into the next week before pulling back towards 800,we could see USDCAD retest 1.2440 and 1.2550. USDCAD support remains at 1.2270-80, while S&P500 resistance stands at 855 and 870.

More Hot-Charts

-

GoldBugs & Levels

Mar 3, 2026 16:14 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group - -... -

Weekly & Monthly

Feb 27, 2026 13:54 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session..