Battle of High Yielders

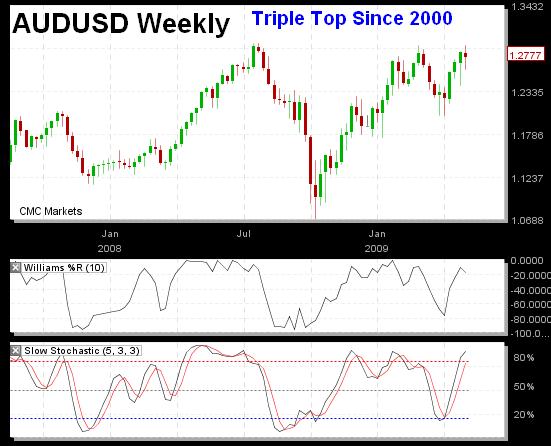

The high yielding Aussie may be outperforming all currencies but not against the next highest yielderthe NZD. With Aussie rates kept unchanged at 3.00% and Kiwi rates at 2.50%, this looks to drive a textbook case of carry trade, whereby the higher yielding Aussie rallies during improved risk appetite. Today for instance, AUDNZD rallied in early morning US trade after better than exp ADP figures and the clarification of the BoA story. But technicals on the weekly AUDNZD show a resounding sign topping out, namely a triple top at 1.29 since December 2000. Further declines in the pair could unfold on at the next bout of risk aversion, especially as Aussie rates are superior to their NZD counterpart. Note that the pairs last retreat coincided with the March recovery in global appetite only to be reversed in April amid improved economic data in Australia and protracted pick up in appetite favouring higher yielders. Failure to break above the 1.2930 high risks in triggering a decline to the initial 1.2740s, followed by the 1.24. While I often said long AUDUSD is a preferred long term trade, long AUDNZD could be a long term hedge against reduced risk appetite.

More Hot-Charts

-

GoldBugs & Levels

Mar 3, 2026 16:14 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group - -... -

Weekly & Monthly

Feb 27, 2026 13:54 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session..