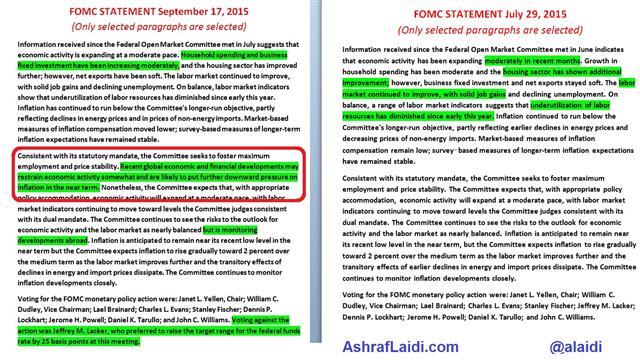

Comparison of Sep & Jul Fed Statements

The Fed kept rates unchanged with an unambiguously dovish statement, focusing on weakening inflation, rising market turbulence and a new reference to foreign developments. The dot forecasts pointed to slower growth and lower core inflation and lower fed funds projections. The only hawkish dissent to the decision was from Richmond Fed's Lacker, but this point was made moot by not only due to Lacker's well documented hawkish stance, but also by the fact that the dot plot showed one Fed member expecting negative rates, even if this member is the widely dovish Minneapolis Fed's Kocherlakota.

New way to worry about the world

The most important part of the Fed statement is the following: "Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term." Still, we expect the Fed to tighten by year-end; we continue to look for the initial rate hike to come in December."We made the case against a Fed hike since the start of the year and our latest argument was clarified today on here (see final 3 paragraphs): Subscribers to our Premium trades are sitting on a long EURUSD trade at 1.1210 and long EURCAD.

More Hot-Charts

-

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session.. -

Before and After the New Tariffs

Feb 23, 2026 12:49 | by Ashraf LaidiThe chart on the left is Nasdaq100 CFD (US100) which opened on Sunday night at 11 pm London Time after Trump announcement of 15% tariffs, and the other chart is the Nasdaq cash, ending on Friday... -

Mystery Charts

Feb 5, 2026 20:48 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات Will send detailed note on latest parameters to our WhatsApp Bdcst Group...