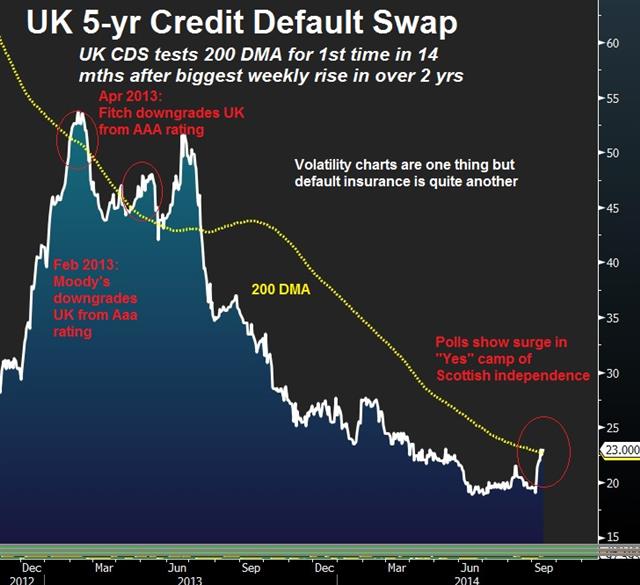

Surging UK CDS ahead of Scottish Referendum

UK CDS continue gaining following the biggest weekly increase in over 2 years. The 5-yr CDS is testing its 200-DMA for the first time since June2013. The UK Treasury has sought to calm bond market fears by guaranteeing the Scottish part of UK debt in case a newly independent Scotland goes on with its threat to not honour its obligations of the UK debt. Part of the decline in interest rate hike odds has emerged from anticipation that the BoE would be forced into its “lender of last resort” role during the uncertainty-filled period following a “yes” vote, and preceding the official independence. So, can the UK handle such guarantees one year after emerging from a triple dip recession and barely graduating from the school of austerity?

More Hot-Charts

-

GoldBugs & Levels

Mar 3, 2026 16:14 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group - -... -

Weekly & Monthly

Feb 27, 2026 13:54 | by Ashraf Laidiسأرسل رسالة صوتية و كتابية توضيحية لأعضاء مجموعة الواتساب الخاصة حول هذه المخططات - Will send detailed note on latest parameters to our WhatsApp Bdcst Group... -

Gold 5000?

Feb 24, 2026 14:19 | by Ashraf LaidiCan gold drop back to $5000 per ounce. Here are 2 possible technical scenarios. China's return to the market could also bring back selling pressure during Asian session..