European FX Surge vs. Commodity FX

The following has been sent to CMC Markets clients right after today's Bank of England rate announcement.

Sterling has already knived through our projected resistance of $1.5150, making yesterdays $1.5280 high a less challenging target, especially amid potentially negative US jobs data ahead (weekly claims and payrolls). GBP likely to demonstrate the usual pattern of tempering current gains going into the US opening bell before rebounding later in NY trading. $1.5350 appears a viable target based on retracement/recoveries of the past 5 sessions.

Shifting onto the US session, Obama's speech comes one day after the Congressional Budget Office did the inevitable and revised up its 2009 budget deficit estimate to $1.2 trillion, fuelling the imbalance to 8.0% of GDP from the last $438 billion estimate (3.0% of GDP). The FY2010 estimate was revised to $703 billion from $438 billion.

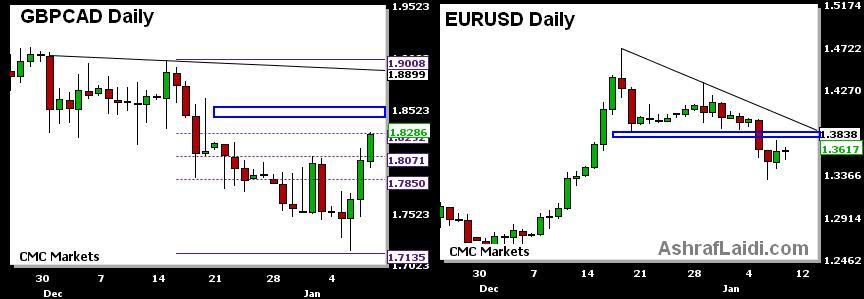

Commodity currencies took a back seat in Wednesday trade after the higher than expected crude stock builds and news of Israels acceptance of the principles of truce in Gaza. As crudes Feb contract fell by more than $7 to below $44 pp, CAD and AUD followed suit, even against the broadly weaker USD. EURCAD and GBPCAD are making notable advances, exploiting oils retreat, which may extend towards $40, according to the daily stochastics. And with the BoE opting for the smaller option of -50 bps, GBPCAD may well accumulates gains towards 1.83 and onto 1.85. EURCAD reflects both the euros broad recovery and loonies broad pullback, setting sight onto the 1.6650 trend line resistance. AUDUSDs 2-day decline tests a 2-week trend line support of 0.6950, which is backed by a clearer foundation of 0.6861.8% retracement of the 0.6070-0.7268 rise. Recovery now targets 100-day MA of 0.7170.

Euro Struggles to Ride GBPs Climb EURUSD attempts to cling on GBPUSDs gains but latest German factory orders and poor Eurozone sentiment figures support the case for a possible 75-bp cut to next week from the ECB, which would bring rates to 1.75% vs 1.50% for BoE and reduce the differential from 50-bps to 25-bps. Such a scenario could provide renewed short-term selling interest in EUR, but the ECB is wary of excessive currency weakness regardless of falling inflation and would be the first to express itself via pronoucements on monetary policy. EURUSD drops below 100-day MA facing interim support at $1.35, followed by $1.3420. The breach of 1,37 resistance follows onto staunch trend line resistance of $1.3830.

JPY Yen Still Has USD to Knock Around USDJPY at 94.50, S&P500 at 945 and VIX at 35 were all limits of the recent bout of risk appetite projected in previous research notes for end of Dec . The 35 support in the VIX was our most convincing signal representing the 200-day MA, a tech level not breached since September. The 94.50 yen level was the 100-day MA, which was also last breached in September. Such are the manifestations of intermarket analysis dictating risk appetite through currencies and equities. USDJPY seen extending losses below 91 towards 90.70, but Fridays NFP may provide a case of relief if the unemployment rate remains below 7.0%. A breach above 7.0% and a payroll loss of more than 550K is expected to drag the USD towards 89.80s.