GSE Bailout Good for Confidence Not for Fundamentals

The US Treasurys decision to place the Government Sponsored Enterprises (GSEs) in conservatorship may prove effective in containing the bleeding in the value of their stocks and bonds, and alleviate worries about the implications of the normal functioning of the US mortgage market but is unlikely to reverse the problems of rising home inventories, falling sales and home values.

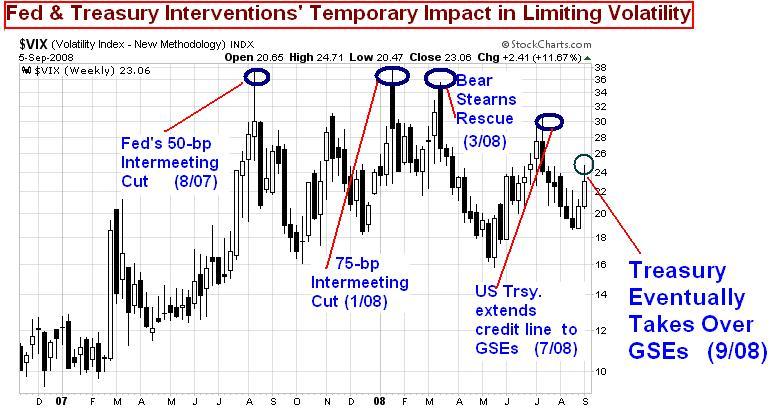

Weve learned over the past 9 months have that measures aimed at shoring up market confidence and containing surging volatility do not tackle the problems of impaired balance sheets, alleviate the books of injured hedge funds or ease the macroeconomic strains of rising unemployment and slowing consumption. This has been the theme since December 2007, the time the Fed and the US Treasury have begun taking turns to intervene with special liquidity-enhancing facilities, extending credit lines to entities outside of their jurisdiction and eventually taking over Government Sponsored Enterprises.

The rapid tide of the financial market deterioration combined with the persistent escalation in unemployment has managed to overwhelm the effectiveness of these interventions. The duration of consecutive monthly losses in US non-farm payrolls lasted 11 and 15 months during the recessions of 1990-91 and 2001-2 respectively. We are only in the 8th month. Aside from banks and housing related industries, auto-related business remain widely subjected to layoffs, due to the lingering risk of bankruptcy dogging US carmakers. Hence, our persistent forecasts of a resumption in the Fed easing campaign, which stood against the majority of opinions (and Fed funds market) calling for a rate hike. The eventual government take-over of Fannnie and Freddie is a prelude to sending the FOMCs bias back to easing from neutral.

One way to examine the effectiveness of these interventions is to point out the timing of their announcement and the passage of time before the passing of the next measure. Note how each announcement (a 75-bp rate cut, a new special liquidity facility or a US Treasury backstop) took place during periods of escalating market volatility --as seen in the VIX chart above. Each of these announcements managed was followed by a sharp decline in volatility (rise in stock indices and risk appetite), but eventually have saw its impact eroded by a re-emergence of weak fundamentals and a resulting rebound in volatility.

FX Implications

Fridays Treasury announcement triggered a sharp boost in risk appetite, namely a broad decline in the Japanese yen and a rise in the higher yielding currencies (GBP, AUD, NZD and EUR) which were initially battered following the renewed decline in global equity indices. As for the dollar, the currency fell against all major currencies with the exception of the Japanese yen, thus constituting an unwinding of the initial trades prevailing prior to the US Treasurys announcement. The resulting FX moves are in no way a reflection of changing fundamentals in these currencies, hence provide the potential for renewed selling in AUD, NZD and EUR against USD and JPY.