IFO Sustains Euro Weakness

Another day of decoupling in the dollar and US stocks in favor of the US currency as risk appetite failed to hold following a boost of confidence from Warren Buffets $5 billon investment in Goldman Sachs. The Feds $30 billion currency swap with the central banks of Australia, Denmark, Sweden and Norway aimed at increasing the supply of dollars to foreign banks has also helped drag down overnight USD LIBOR rates to 2.69% from yesterdays 2.95% . Despite a bigger than expected 2.2% decline in US August home sales, the dollar held up across the board.

IFO to Sustain Euro Weakness

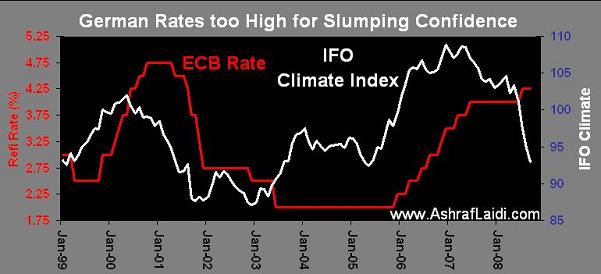

The bigger than expected decline in Germanys September IFO survey had initially failed to keep EURUSD below $1.4680, but once forex players witnessed a less contentious session in the House of Representatives than yesterdays proceedings, the dollar re-emerged. The IFO index fell fresh 3-year low, prompting IFO economist to urge for interest rate cuts by the ECB. Posting its third straight daily decline, EURUSD seems slated to target the $1.4560s, especially if Congress agrees on a final package by weeks end. The negative repercussions of prolonged status quo in ECB rates in the face of a deteriorating German economy increases the downside risks for the currency back to as low as $1.45. In the medium term, we stick with the medium term bullishness in EURUSD reaching the $1.53 territory

Cable Eyes $1.8400

The inability for GBPUSD to breach above $1.8630s has created a 2-day consolidation around the $1.85-$1.86 territory. Renewed calls for interest rate cuts by the David Blanchflower, the most dovish member of the Bank of Englands Monetary Policy have failed to drag down the currency due to improved risk appetite that is helping the high yielding currency. This evenings release of the Nationwide House Price Index (7.30m EST) expected to show a 1.3% m/m and 10% y/y declines in September may also weigh on the currency. Recoveries back to $1.8600 are increasingly dragged by GBP bears. We were too early in calling for a sub $1.83 reading yesterday, but chances for this development are ripe by beginning of next week.

USDJPY Eyes 106.60s But Beware of Thursday Data

After struggling to hold above 106 yen, USDJY amazes fresh gains on improved risk appetite. The 105.20 support continued to hold firm, making way for a robust recovery towards 106.60. At this point, USD bears and JPY bulls may re-emerge on tomorrows release of US new homes sales, building permits, durable goods and weekly jobless, all of which are expected to worsen and potentially trigger fresh risk aversion in favor of the Japanese currency against all major currencies.