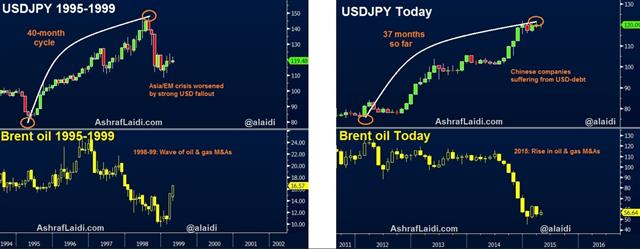

USD/JPY & oil M&As recall the late 1990s

The growing parallels between 2015 and 1998 among global market forces (soaring US dollar, plummeting oil prices, rising equities, escalating market volatility and flattening US yield curve) have been bolstered by the emergence of mergers and takeovers in the oil & gas industry as falling energy prices force “Big Oil” to seek economies of scale through strategic tie ups.

This week's announced merger by Royal Dutch Shell to buy BG Group for $70bn in the first oil & gas mega-merger in over a decade. The deal is the year's biggest buy-out and the largest in the oil sector since Exxon paid $82 bn for Mobil in 1999.

The Big Oil & Gas M&As of the Late 1990s

Not only have oil prices dropped 60% from the highs of summer 2014, but they are largely anticipated to lose more ground, or at least remain under $60 for most of the year. The motives vary. For independent (non-international) companies, the race to bolster/preserve balance-sheet strength combines with the need to overcome higher breakeven oil prices. This also includes national oil companies getting help from the host nation to acquire or partner with independent oil companies for strategic purposes.

USD strength and EM dependence

The FX similarities also raise questions. The 28% rise in the US dollar index from its May 2014 lows is the biggest since the advances of 1998-2002 and 1995-1998, when the strong dollar weighed on emerging markets' finances. Nations, which previously pegged their currency to the rising USD lost via deteriorating trade competitiveness, forcing them to devalue their currencies and further driving up the soaring cost of their state and corporate debt, which were taken in US dollars. Today, most emerging markets are better prepared for the USD bull market thanks to the use of local currency bond markets and larger holdings of central bank FX reserves, estimated to have grown nearly 6 folds from 2003 to 2013.

But concerns linger with the amount of foreign currency chasing EM investments at a time when macro dynamics have faltered. Brazil, Russia and China are among the major EMs to be in or nearing recessions. EM investors have shown greater differentiation among markets, no longer selling entire EM baskets in a single swoop as was the case throughout the 1990s. But any amplification in the cause of contagion could become a problem in and of itself. A soaring dollar may no longer be a force at the detriment of EM paper and global equities, but further intensification in USD dynamics could make the difference between a soft landing and a recession.

The minutes of the March FOMC meeting had their share of commentary on the strong dollar, citing: “further appreciation of the dollar and recent weakness in spending and production data as reasons …[revising down GDP growth] “, and …” an assessment that the headwinds that have been holding back the recovery will continue to exert some restraint on economic activity at that time, that weak real activity abroad and the recent appreciation of the dollar are likely to continue to restrain U.S. net exports for some time…”

USD cyclicality and BoJ complacency

The notion that USD/JPY will extend its appreciation towards the 130s and beyond is based on the logical premise that the Bank of Japan stands ready to step up its monthly asset purchases as early as this month to stem the tide of slowing inflation. “This time it's different” reasoning is further backed by diverging policy paths between the Fed and the BoJ. Yet, even if the Fed mustered the courage to raise rates this year (unlikely), it will keep rates in hold for an extended (and volatile) period, throughout which further USD strength will likely weigh on oil prices as was the case in in 1998, which would only complicate the BoJ's reflation objective.

It has been 37 months since USD has begun its 57% appreciation against JPY, comparing to the 85% appreciation of the 1990s, which lasted 40 months.

Will the similarity repeat itself in magnitude or duration?