A50 Smooth, Fed Amps up Rhetoric

The long-awaited Article 50 trigger was largely taken in-stride by a market that had months to prepare. Instead, it was the ECB that stole the show on a report that the market had got ahead of itself. In the US, two influential FOMC member offered a hawkish shift. There are 7 Premium trades currently in progress, 3 in FX, 2 in indices and 2 in commodities.

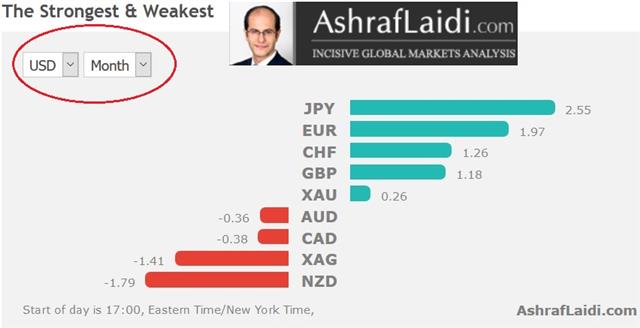

Wednesday's focus was on the pound but it finished just a handful of pips lower. The Australian dollar was the top performer while the euro lagged.

The lack of volatility on the Article 50 trigger shouldn't be a huge surprise. It was an event that was telegraphed for months and politicians on both sides avoid any inflammatory rhetoric. The next phase of GBP trading will be all about the details of negotiations but with EU leaders still getting their mandate organized, the next month may be quiet and that could send some GBP shorts to the exits.

As Article 50 headlines were crossing, the ECB had a surprise of its own. A newswire ECB sources story said markets had over-interpreted the message from the March meeting and that it was meant to convey fewer tail risks, not a change towards a more dovish policy.

The report helped to confirm the false breakout in EUR/USD as it fell more than 50 pips and back into the Dec-Feb range.

What strikes us as odd is that Nowotny and Praet have recently doubled down on the hawkish talk by signaling a potential change in the deposit rate. Perhaps this is some fine tuning by the ECB to signal a tighter corridor but no move higher in the main refi rate any time soon.

In the US, the message was clear from Williams and Rosengren – the risks are to the upside. Rosengren argued for four hikes this year and Williams said it was possible. Both pointed to a tighter labour market and upside risks.

With all the Trump, Brexit and other political jostling this week, we remind readers that ultimately economic data wins out and yesterday's consumer confidence reading was the best in 17 years. On Friday the PCE report is due and next week, the ISMs and non-farm payrolls could easily put the Fed on a more hawkish course and the dollar back in charge.

Latest IMTs

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46

-

Revisiting Gold Bugs Ratio

by Ashraf Laidi | Feb 13, 2026 11:10

-

Typical Trading Errors

by Ashraf Laidi | Feb 12, 2026 10:04

-

Trade Tips from Washington DC

by Ashraf Laidi | Feb 11, 2026 9:56

-

The Signal is Finally Here

by Ashraf Laidi | Feb 10, 2026 11:09