Intraday Market Thoughts Archives

Displaying results for week of Dec 01, 2013Dectaper Bells Deflated Despite Jobs

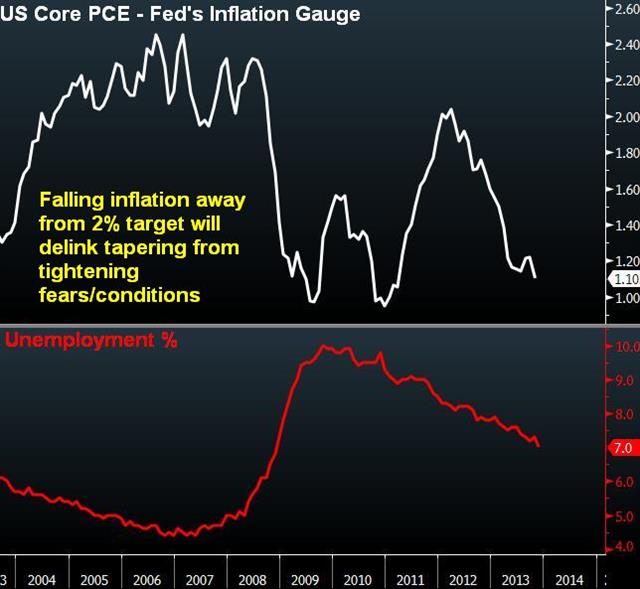

Today's simultaneous release of the Fed's preferred inflation indicator with the November jobs figures is a fresh reminder of the dual forward guidance at the Fed's disposal used at tempering enthusiasm of an imminent reduction in asset purchases. Here is my take on why EURUSD has shrugged today's US jobs. Full Chart & Analysis

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Unemployment Rate | |||

| 7.0% | 7.2% | 7.3% | Dec 06 13:30 |

Ashraf's Video Take Ahead of NFP

Watch Ashraf's interview with Reuters Insider, giving his expectations for NFP parameters, EURUSD, GBPUSd and bond yields Full Video

Quiet Fed Shift Underway

Fed members endorsed a roadmap to tapering in comments Thursday, something that could lay the groundwork for a US dollar rally. The yen outperformed for the third consecutive day while the pound lagged. The calendar is light as the Asian week winds down.

Ashraf wrote about the strong euro reaction, jumping to 1.3677 from 1.3543, and how it was all about what the ECB didn't say – namely the lack of dovish rhetoric. The other surprise is that an LTRO may be less likely than many analysts believed. Technically, the EUR/USD move is a breakout to the highest since Oct 31.

Initial jobless claims were strong at 298K compared to 320K expected. It was the lowest in two months but Thanksgiving may have skewed the numbers. Other data also pointed to a taper with Q3 GDP revisions pushing the estimate to 3.6% from 2.8% -- much higher than 3.1% expected. Core durable goods orders were also revised to -0.6% from -1.2%.

Data that points to a taper is generally good news for the dollar but that wasn't the case in US trading as the buck was battered on every front. USD/JPY slipped to 101.70 and other dollar declines were steeper.

One factor that could restore the dollar rally is a Fed effort to spell out how the Fed will complete the taper when the first move is made. The market expected a meeting-to-meeting approach but a roadmap, even if tentative, adds considerable certainty and is a hawkish move. Atlanta Fed President Lockhart called for setting a timetable on QE tapering, adding his name to a list that includes Plosser, Williams and Fisher.

There are no major economic data releases in Asia and pre-NFP will also cap price action.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (q/q) [P] | |||

| 3.6% | 3.0% | 2.8% | Dec 05 13:30 |

| GDP Price Index (q/q) [P] | |||

| 2.0% | 1.9% | 1.9% | Dec 05 13:30 |

| Challenger Job Cuts (NOV) (y/y) | |||

| 45.314K | 45.730K | Dec 05 12:30 | |

| Continuing Jobless Claims (NOV 22) | |||

| 2.744M | 2.820M | 2.765M | Dec 05 13:30 |

| Initial Jobless Claims (NOV 29) | |||

| 298K | 325K | 321K | Dec 05 13:30 |

ECB Rate Cut is Beyond Last Resort

Markets have reacted to NOT what the ECB said, but instead to what the ECB did NOT say. My analysis on the euro's jump to 1.3650s, the UK autumn statement and the US GDP. Full charts & analysis here

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (q/q) [P] | |||

| 3.6% | 3.0% | 2.8% | Dec 05 13:30 |

| GDP Price Index (q/q) [P] | |||

| 2.0% | 1.9% | 1.9% | Dec 05 13:30 |

Searching Through the Noise

A series of major data points left no clear signal on the direction of the US economy or the Fed but created plenty of volatility. The yen was the top performer while the Australian dollar lagged. Australian trade balance is on the agenda after AUD/USD breached 0.9000.

Traders hoping for a clear signal on the taper or no-taper debate didn't get it Wednesday. ADP employment rose to the highest of the year at 215K compared 173K and October data was also revised higher.The dollar kicked higher on the release but was reluctant to move ahead of the ISM non-manufacturing report and after the data was released it became clear why. The index fell to 53.9 from 55.0 and the employment component fell to the lowest since May.

USD embarked on an extended decline after the data but it stalled late in the day. The Beige Book anecdotal Fed report didn't show any fresh enthusiasm for the economy, saying that hiring increased modestly or was unchanged.

It's premature to draw conclusions ahead of Friday's NFP report but a December taper is likely to lose support among traders. One reason why is inflation. The Bank of Canada is dealing with the same stubbornly low inflation as the Fed and acknowledged growing disinflation risk in the BOC statement. That helped send USD/CAD above 1.07 to a three-year high.

The strangest signals of all came from gold. It rose as high as $1252 from $1211 and began climbing on the ADP number – something that should have hurt gold. There was talk of a single, large buyer and the move stalled out ahead of technical resistance at $1258.

The Australian dollar was also sold relentlessly, despite Aussie 10-year yields at the highest since 2011. A slightly soft GDP report was not enough to justify the nearly 1.5 cent drop in AUD/USD to 0.8999. Instead, it could be signaling capitulation from the bulls.

Data is light in Asia today ahead of the ECB and BOE decisions later. One event to watch is Australian trade balance for Oct at 0030 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance | |||

| -40.64B | -40.00B | -42.97B | Dec 04 13:30 |

| Trade Balance | |||

| 0.08B | -1.00B | -0.30B | Dec 04 13:30 |

| Trade Balance (OCT) | |||

| -375M | -284M | Dec 05 0:30 | |

| ADP Employment Change (NOV) | |||

| 215K | 173K | 184K | Dec 04 12:15 |

| ADP Employment Change | |||

| 215K | 173K | 184K | Dec 04 13:15 |

| ISM Non-Manufacturing Employment | |||

| 52.5 | 56.2 | Dec 04 15:00 | |

| GDP (q/q) | |||

| 0.6% | 0.8% | 0.7% | Dec 04 0:30 |

| GDP (y/y) | |||

| 2.3% | 2.6% | 2.4% | Dec 04 0:30 |

Central Bank Guidance & Currency Strength

GBP is the best performing currency since the 2nd half of the year. Aside from continuing upside surprises in UK data, GBP remains fundamentally superior to EUR and USD due to these factors: Full article and analysis

A Yen Correction? Aussie GDP Next

The US dollar corrected and yen crosses slipped ahead of the large data risks coming up. The yen was the best performer while USD and CAD lagged. Australian GDP is the main event on the calendar.

The high flying yen crosses – USD/JPY, EUR/JPY and GBP/JPY -- fell more than a full cent from the highs earlier in the day, triggering fears about an earlier correction. Ultimately, the strong seasonal trend of yen weakness (and Nikkei strength) in December is a major risk and argues for buying a dip rather than betting on declines.

Data was light Tuesday but in the day ahead the market will be hyper-focused on the Fed with a series of tier-1 data points out in the next three days including ADP employment, ISM non-manufacturing and NFP.

Under the radar, the Japanese government will be releasing details of a $52 billion stimulus program designed to counteract April's sales tax hike. That may prove to be a larger factor in USD/JPY. The rumored program size is close to expectations but part of the market was hoping for a bigger splash, that could change if reports of an extra budget are true.

The Fed's Williams spoke with Reuters and, reading between the lines, he may have outlined a plan for QE tapering. He said the market should cap QE then end it over a period of months. He also advocated clarifying that unemployment falling to 6.5% doesn't mean rate hikes and cutting interest on excess reserves. That's a realistic roadmap.

USD/CAD was in focus Tuesday as it cleared the 2011 high but it failed to close above the mark, at 1.0658. Oil prices also posted an impressive reversal, nearing $97 from below $94 earlier in the day. A larger correction could be in order if the BOC doesn't fret about inflation or offer anything to the doves in Wednesday's rate decision.

The main event on the calendar is Australian GDP at 0030 GMT. The consensus is for a 0.7% q/q rise following a 0.6% quarterly rise in Q2.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Net Exports of GDP (Q3) | |||

| 0.70 | 0.35 | -0.04 | Dec 03 0:30 |

| Gross Domestic Product (Q3) (q/q) | |||

| 0.8% | 0.6% | Dec 04 1:30 | |

| Gross Domestic Product (Q3) (y/y) | |||

| 2.6% | 2.6% | Dec 04 1:30 | |

| ADP Employment Change (NOV) | |||

| 173K | 130K | Dec 04 12:15 | |

| RBA Interest Rate Decision (DEC 3) | |||

| 2.5% | 2.5% | 2.5% | Dec 03 3:30 |

Ashraf on CNBC Discussing Forward Guidance & FX

Ashraf tells CNBC's Louisa Bojesen that detailed central bank forward guidance implies weaker currencies--dicussing BoE, Fed & ECB & their impact on GBP, USD & EUR. Play full interview

The Breakouts Continue, RBA Preview

Add gold and the Canadian dollar to the long list of trades that are breaking out. The taper trade added to USD strength Monday after solid ISM manufacturing numbers while JPY lagged. The RBA decision is the main risk in the hours ahead.

The main news in US trading was a rise in the ISM manufacturing report to the highest since 2011 at 57.3 compared to 55.2 expected. The employment and new orders components were also upbeat, adding another check mark for the Fed hawks.

USD/JPY jumped above 103 on the ISM headlines to the highest since May. The technical breakout of GBP/JPY also continued and NZD/JPY climbed above a previous double top.

The larger technical developments were in gold and USD/CAD. Gold broke below its recent range, falling $34 to $1218 and the lowest since July. USD/CAD hit 1.0654 and is threatening to break the 2011 high of 1.6058, which would pave the way for further gains.

The main event in Asia-Pacific trading is the RBA decision at 0330 GMT, which comes 3 hours ahead of the retail sales report. The market firmly believes there will be no rate cut and the RBA is unlikely to change its neutral bias. The key may be language about the Australian dollar, the statement already says AUD is 'uncomfortably high' but Stevens may use the recent Aussie weakness to press the momentum.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR +0K vs +0K prior JPY -123K vs -112K prior GBP +0K vs -2K prior AUD -33K vs -36K prior CAD -29K vs -16K prior NZD +10K vs +12K prior CHF +4K vs +3K prior US Dollar Index longs at 16K vs 15K prior

Yen shorts carved out a new six-year high in the data, which reflects the close on Nov 26. The important change might be flat positioning in EUR and GBP, which suggests traders are unsure on Europe but could be swayed strongly by any new and convincing developments.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ISM Manufacturing Employment | |||

| 56.5 | 53.5 | 53.2 | Dec 02 15:00 |

| ISM Manufacturing Prices | |||

| 52.5 | 55.0 | 55.5 | Dec 02 15:00 |

| Retail Sales (NOV) (m/m) | |||

| 0.4% | 0.8% | Dec 03 0:30 | |

Charting S&P500 Breadth & Multiples

S&P500 is up 27% YTD, which if maintained, would be the strongest year since 1997. Price to earnings ratio is at 17.0, dangerously close to the 17.60 level reached in October 2007, just prior to the 2007-09 crash. But 17.0 is no comparison to the 30.0 multiples February 2000. Here is a measure of multiples, breadth and price to book with previous rallies. Click here for full charts & analysis.

China PMI Solid But Focus on Charts

China's official manufacturing PMI edged above expectations, helping AUD to a solid start to the week. The New Zealand dollar is a half-cent higher to start the week on upbeat terms of trade numbers while the rest of the market is flat. A busy day of low-tier economic data starts the week in Asia.

China's official manufacturing PMI rose to 51.4 from 50.5, beating out the 51.1 reading expected. Confirmation of the uptick in factories could come at 0145 GMT when HSBC releases the final reading on its private PMI.

Data has been mixed to start the week. The Australian Industry Group's manufacturing index plunged to 47.7 from 53.2 and has now been in contractionary territory in every month this year except one.

The big surprise was New Zealand Q3 terms of trade data showing a 7.9% jump to the highest since 1973. Despite the NZD/USD jump, there are some concerns in the data, mainly a 2.9% drop in export volumes and 5.6% rise in imports. They were overshadowed by an 8.9% rise in export prices but relying on price gains to balance trade is losing game in the longer-term.

There is a full menu of data for the rest of the day including Japanese capital spending at 2350 GMT and a speech from Kuroda at 0230 GMT. A report from Nikkei suggests companies plan to increase capital spending and the consensus is for a 3.2% rise y/y.

Aside from the news, we focus on the technical breakouts and signals in a number of pairs.

- GBP/USD piped above the January high on Friday to the highest in two years, also posting the highest weekly and monthly highs in 2.5 years.

- USD/JPY, EUR/JPY and GBP/JPY: highest monthly closes since Sept 2008

- GBP/JPY gained nearly 1000 pips on the month

- USD/CAD highest monthly close since Aug 2008

- S&P 500 up for 8 consecutive weeks for the first time since 2004

Aluminum closed at the lowest since 2009

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (NOV) | |||

| 51.8 | Dec 02 13:58 | ||

| ISM Manufacturing PMI (NOV) | |||

| 55.5 | 56.4 | Dec 02 15:00 | |

| PMI (NOV) | |||

| 51.4 | 51.1 | 51.4 | Dec 01 1:00 |

| PMI (NOV) | |||

| 50.5 | 50.9 | Dec 02 1:45 | |

| Capital Spending (Q3) | |||

| 3.1% | 0.0% | Dec 01 23:50 | |

| AIG Performance of Manufacturing | |||

| 47.7 | 53.2 | Dec 01 22:30 | |