Intraday Market Thoughts Archives

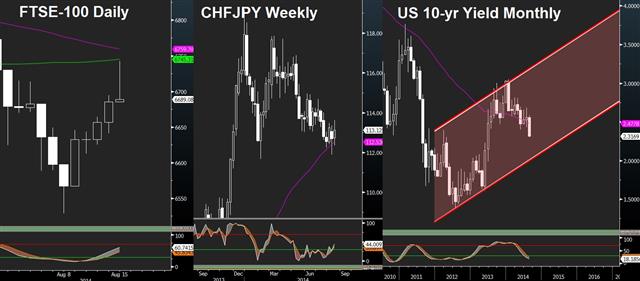

Displaying results for week of Aug 10, 2014FTSE Shooting Star & Yields' Ominous Channel

The extended divergence between rallying stocks and tumbling bond yields came to a halt today on news that Ukrainian government troops attacked an armed Russian convoy. Here's how the FTSE, CHFJPY and bond yields are looking like, Full charts & analysis

Canada's Jobs "Correction"

As Canada corrects its previously released July jobs report with a massive 41.7K rise in net employment vs. expectations of 20K, and a decline in the unemployment rate to 7.1% from 7.2%, the loonie is back to its winning ways. USDCAD remains supported at the key 1.0860s (confluence of 100 & 200 DMA), while CADJPY shoots back up towards its 55-DMA. We issue a new Premium long in a CAD cross after our Monday short in GBPAUD reached its 1.7890 target, producing a 250-pip gain in 4 days. Meanwhile, stocks continue rallying, gaining for the 3rd straight day, while yields plunge (10-yr at 2.35%), down for the 3rd straight day and extending the socks/yields divergence to 17-month highs. There are currently 9 existing (open) Premium trades, with today's CAD cross being the latest addition. Full details in the Premium Insights.

Sterling's Carnage

Following today's GBP carnage on those UK earnings figures and dovish BoE inflation report, has our positive take on GBPUSD been completely invalidated? Cable will post its 6th consecutive straight weekly decline, which is the longest losing streak since that ugly Nov-Dec 2009. But as it approaches its 200-DMA for the first time in 12 months, is time to issue new longs? The key question is how far will any longs reach? Or, is their fresh downside beyond 1.66? Monday's Premium short in GBPAUD is currently netting 180 pips as the cross posted its biggest daily drop since January. This Premium trade alongside today's Premium call are found in the latest Premium Insights.

GBP Slump Deepens on BoE & Earnings Contraction

Today's release of UK Q2 earnings growth showing the first contraction in four years couldn't have come at a better time for the Bank of England. As bond markets scaled down expectations for a 2014 interest rate hike, the pound was hit across the board while FTSE-100 pushed higher. Full charts & analysis.

ZEW & August 2011

The biggest decline in Germany's ZEW survey since the infamous August 2011, raises an opportunity for the upcoming releases of German PMI & IFO. But dont forget this week's release of Q2 GDP. Full charts & analysis.

Canadian Dollar Rebounds, Ukraine Fears Cooling

If USD/CAD can't break 1.10 on a dreadful Canadian jobs report, how will it make gains? The Canadian dollar was the top performer on Monday while the euro lagged. Volatility could pick up in Asian trading with the Japanese PPI, Australian business confidence and Australian home prices.

Mundane Mondays have been the trend in the past month and that was no different this time. The good news is that the other four days of the trading week have seen better moves.

The long trend in New York trading was a slide in USD/CAD down to 1.0920 as the pair virtually eliminated the 70 pip rally on Friday's weak Canadian jobs report. The decline flashes a double top in the pair ahead of 1.10 and with some indicators flashing oversold, the bulls have reason to be nervous.

The main story remains the battle in Ukraine and most signs continue to point to government forces slowly gaining control. Russia had pushed for a humanitarian mission and that appears to be headed to fruition but it will be led by the Red Cross and include participation from the US and EU along with Russia. Yet NATO's leader Rasmussen again warned on Monday of a high probability of Russian troops invading Ukraine. That left traders wonder what he knows and they don't.

Overall risk trades did a bit better on the day with the S&P 500 up 5 points and USD/JPY edging to 102.20. Most are circling Wednesday on the calendar because of a large slate of tier 1 data, including Japanese GDP, the UK claimant count, the BOE inflation statement, German/French CPI, speeches from Dudley/Rosengren and US retail sales.

But first the market is watching several Asia-Pacific releases. The first comes at 2350 GMT when July Japanese PPI numbers are expected to rise 4.4% y/y as the soft yen weighs.

The focus shifts to Australia at 0130 GMT with July NAB business confidence (prior +8) and the Q2 Australian home price index. It's a reminder of the unstoppable house price acceleration with the market looking for a 9.3% y/y rise.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| BRC Retail Sales Monitor - All (JUL) (y/y) | |||

| 0.55% | -0.80% | Aug 11 23:01 | |

| NAB's Business Confidence (JUL) | |||

| 8 | Aug 12 1:30 | ||

Is GBP Done?

After having been stopped out of our last two Premium GBPUSD longs, we remain out of the pair and issue a new trade on a GBP cross with greater confidence, due to heightened GBP volatility ahead of (and after) Wednesday's super-UK-release of UK jobs data (June ILO unemployment rate seen at 6.4% from 6.5%, Jul jobless claims seen at -30K from -36.3K, June average weekly earnings seen at -0.1% from 0.3%) and the BoE's quarterly inflation report due an 1 hour later. The multi-component UK jobs report will likely have something for everyone as GBP has grown increasingly responsive to all three components of the report. Yet, the expected negative print on average weekly earnings could dominate GBP on the downside if the other two components come in within expectations. As for the BoE report, this too will have three major components. All of these key elements, in addition to Carney's subsequent testimony and response to questions will shape the overall impact of GBP flows into the rest of the UK day. This is the same GBP cross we issued four months ago, which pocketed 300 pips. Will we be lucky again this time? Key in the latest Premium trades.

Geopolitics in Focus, Euro Short Trade Crowded

The late turnaround on Friday put risk trades back in control but geopolitical concerns remain at the top of the agenda. The Australian dollar is a fractional outperformer in early trading while the yen lags. The weekly CFTC data showed euro shorts continuing to pile in.

Weekend news was mostly benign. On Saturday China reported CPI up 2.3% y/y, which matched the consensus forecast. The m/m results and PPI were also in line with forecasts.

The US launched a number of airstrikes in Northwestern Iraq and Obama said the campaign won't be ended in 'weeks' and that it will 'take some time'. When the bombs first fell on Friday it sparked a surge in oil prices but that later cooled. The timeline from Obama, however, is longer than most anticipated and that could put a geopolitical bid into oil.

The main geopolitical story remains in the Ukraine. Hints at a bid for peace from Russia on Friday were the catalyst for the big turnaround that sent the S&P 500 up 1.15% and sent USD/JPY to 102.20 from as low as 101.60.

Rebels asked for a humanitarian ceasefire on the weekend but it was outright rejected by Kiev, in the clearest sign yet of who has the upper hand. Government forces shelled Donetsk hard and a collapse in the rebel ranks is increasingly possible. The risk is that Russia decides to intervene and then the tables will be quickly turned.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.- EUR -129K vs -108K prior

- JPY -95K vs -73K prior

- GBP +12K vs +25K prior

- AUD +33K vs +39K prior

- CAD +21K vs +22K prior

- CHF -19K vs +11K prior

- NZD +15K vs +15K prior