Intraday Market Thoughts Archives

Displaying results for week of Oct 11, 2020Stimulus Exhaustion & European Woes

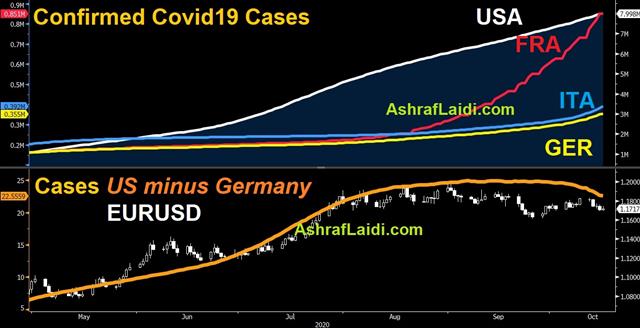

Back to the virus story. A number of countries set new-case records this week including Germany on Thursday with 7313 cases. Granted that comes on many tests and hosptializations remain low but what is frightening governments into lockdowns is the pace of increase. A week earlier there were 4010 cases in Germany. The +80% w/w rise is terrifying and quick increases in the region have already led to partial shutdowns in Spain, France, the Netherlands and elsewhere.

This is all likely to lead to Q4 growth downgrades. The clearest signal Thursday came from the German bund market where yields fell for the fourth day and broke the April low of -0.59% to end a medium-term consolidation pattern.

With that the euro grows increasingly vulnerable, particularly against the Swiss franc and yen.

Boris’ Deadline Looms & Four in One

A call between Boris Johnson and Ursula von der Leyen didn't achieve any visible progress. Johnson lamented the lack of progress afterward and said he had to “reflect”. Von der Leyen said that they're working on a deal but not at any price.

Johnson is approaching his deadline for talks and will make a decision Thursday or Friday. Sterling bounced on reports suggesting his aides will tell him that a deal is still possible if intensive talks begin in the coming days. Both sides believe that early November is the real deadline, according to reports.

This is a critical point in negotiations but – as we often write – negotiations are always the hardest at the end. Boris is well-known for playing games of brinksmanship and that's how he got his previous deal. No doubt he will do the same this time and that will entail stubbornness. The EU will surely have seen this though and could dig in, leading to a messy outcome.

In all likelihood, a deal is eventually made but like in the US election, the ride may not be worth it for traders.

In terms of the US economy, we get back to some data on Thursday with the Empire and Philly manufacturing surveys along with initial jobless claims. Claims are expected to remain sky high at 825K, a small dip from 840K last week.Appetite for Consumption

The rejection of the range-top in Treasuries Tuesday underscores the broader range trade in markets. That shouldn't be surprising ahead of a pivotal and uncertain US election. That question won't be answered for at least three weeks but there is a risk of losing focus on the global economy.

The IMF was out with its latest forecasts Tuesday and now sees the global economy shrinking 4.4% this year compared to its -5.2% estimate in June.

The pandemic was a true global shock but the sharpness of the recovery has been a surprise itself. Thankfully, it didn't expose any hidden fault lines in the global economy or financial system that would have led to a deeper breakdown. Or if it did, those vulnerabilities were quickly covered up by unprecedented monetary and fiscal stimulus.

At the beginning of the crisis, economists were front and centre predicting harder times than it has been. Once bitten, twice shy.

There's certainly no shame in not seeing every eventuality of an unknown virus and unbelievable stimulus. Even those who preached the power of central banks underestimated the power of zero rates and balance sheet expansion.

Yet we're now in an uneasy spot in the recovery. Economic data has leveled off and the virus is resurging. Governments are preparing various levels of stimulus but it's less than in earlier rounds; central banks are largely out of ammunition.

The IMF is forecasting 5.2% global growth next year but that's highly dependent on stimulus; or on your view of how much that stimulus has held economies together.

Early lockdowns and then reopenings much better for consumption than anticipated. People redirected spending towards the home and a shift to remote working. In a second lockdown people may hunker down and stop spending, they might rebel. The virus could spiral.

The US election and Brexit are highly uncertain but relative to the next 8 months of the pandemic, they're a life raft of certainty. Since the pandemic bottoms, the news flow and market flow has been almost entirely positive. How prepared are we – really – for disappointment?China Move Highlights Looming Vacuum

The US Presidential election is a chance to transfer power every four years but it also creates a scheduled power vacuum that rivals may look to exploit.

China loosened FX hedging rules on the weekend to allow banks to hold no cash reserves against client yuan forward contracts. Previously they needed to hold 20% and that extra cost filtered back to clients.

The net effect is that it will now be easier to sell yuan forwards and that led to a 0.6% dip in the yuan at the open.

The timing also raises the risk that China could do more to weaken the yuan between now and the election or during the transfer of power if Biden wins. Last quarter was the best for the yuan in 12 years as China reopened much more broadly than almost anywhere and the government unleashed stimulus.

The trade front has been a particularly sore spot for US partners in the Trump administration. Some may simply hope for better under Biden but other may try to use this moment to recalibrate. China in particular bears watching. The yuan weakened to 6.98 from 6.68 from October to year end in 2016, during the prior election period. It finished last week at 6.68 and it would be no surprise if China wanted to start a new administration much closer to 7.00.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +174K vs +188K prior GBP -11 vs +13K prior JPY +21K vs +25K prior CHF +13K vs +13K prior CAD -18K vs -19K prior AUD +11K vs +9K prior NZD +5K vs +3K prior

Euro longs remain near extremes but they have pulled back in the last two weeks and the net is the narrowest since late July. The resurgence in virus cases – particularly in France – highlights the euro's vulnerability in the months ahead. The other notable move is the switch in cable positioning to net short ahead of a big week of Brexit negotiations.