Intraday Market Thoughts Archives

Displaying results for week of Jun 13, 2021Reflation Goes off the Rails

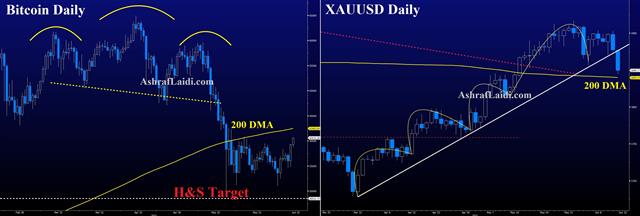

The pullback in yields confused bond bears, indicating market sees declining chances of an inflation overshoot and a consistent return to +2% CPI. The commodity market was quick to jump on the shift, with nearly everything falling sharply, including a 2.2% fall in gold, a 7% fall in soybeans and a 5% decline in copper.

With that, the commodity currencies also dropped. The declines in AUD and NZD were particularly stark given that Australian employment and New Zealand GDP were both very strong.

In equities, the trade manifest itself as a fall in small caps and a jump in tech.

Is the Fed displeased with the market reaction? They fought hard for credibility on an inflation overshoot but have squandered it. That said, this may also be a tactical retreat from Powell and the Fed governors. They don't have any control over the dots but he hasn't conceded any ground on a taper or rate hikes yet. The real discussion won't take place for a few months yet and by that time they might have a clearer idea on whether or not inflation is transitory or not.

For now though, the dollar is ascendant and because shorts are such a crowded trade, there is some room to run.Fed Shift Boosts Dollar, Yen Holds

Ahead of Wednesday's FOMC, we highlighted the risk of a hawkish shift in the dots but it went well beyond expectations. Previously there were no hikes priced in for 2023 but now the median sees two. In addition, 7 of the 18 Fed members now see a hike in 2022.

"Many participants are more comfortable that the economic conditions in the committee forward guidance will be met somewhat sooner than previously anticipated” Powell said while also noting that in 1-2 years there will be a “very, very strong employment market.”

He tempered that slightly by saying that the taper threshold of 'substantial further progress' is 'still a ways off' but that hardly slowed the dollar move. Cable fell through 1.40 and the euro through 1.20.

It's now clear that the inflation data has spooked many at the FOMC. Powell had previously highlighted employment as the key metric but even with back-to-back soft non-farm payrolls report, they've cast aside the talk about patience to allow for a 'broad and inclusive' recovery while waiting for the data to arrive. Instead, Powell is now relying on forecasts that employment will pick up as daycares reopen and unemployment benefits run off.

This isn't just a superficial shift. The timeline for a taper and hike have now moved up. The Eurodollar market is fully priced for a hike in 2022. US 5-year note yields rose by 11 bps to 0.89%.

The change undercuts the Fed's hard won credibility on patience and underscores that the market is in charge of the Fed, not the other way around. Given the crowded bets against the US dollar, the move could run.تسجيل ندوة أمس قبل الفدرالي

من فاتته نطوة أمس عن قرار الفدرالي و الذهب تفضلوا بمشاهدة تسجيل الندوة الكاملة

Watch the 2023 Dots

US retail sales fell 1.3% in May, well shy of the -0.8% expected but the headline didn't tell the whole story. The prior was revised to +0.9% from 0.0% and that left the overall sales numbers close to expectations. It was a similar story in the control group, where a big revision higher outweighed a small miss on the headline.

The Fed will note the slowing trajectory though and mixed signals from the consumer. Spending is shifting towards restaurants and travel from durables and home improvement. The overall pace of spending is still high but that's just after some large stimulus payments.

The main factor for the Fed is jobs. Disappointing readings on the past two jobs reports weighed heavily on yields and that's the top metric Powell is focused on. Expectations for a direct hint to tapering are low.

Powell is also likely to push back the timeline for taper discussions to August as he highlights uncertainty and a lack of urgency to shift policy. One market mover is likely to be the dot plot. The current median forecast is for no hikes in 2023 but we could see a shift to a slim majority calling for at least one 2023 hike. The prior dots showed 11 forecasting no 2023 move and 7 forecasting a hike.

If there's a shift it would boost the US dollar but risks are two way: some of the recent dollar appreciation could unwind if there's no signal from the dots and Powell stays dovish.

Part of the reaction will depend on how well Powell navigates questions about inflation. He's sure to point to transitory factors and bottlenecks, while also adding a nod to say that if high prices are persistent, they have the tools to deal with it. Lately, that messages has resonated with markets and bond yields have fallen but there will be many minefields for Powell to navigate.

Also in focus is BoC's Macklem speech at 2230 GMT, where he's more likely to offer a hint on tapering along with a hawkish bent. Lately the loonie hasn't responded to higher oil prices but if the climb continues, it surely will.تمركز الصفقات قبل اجتماع الفيدرالي الأمريكي

كيف يمكن التمركز قبل لقاء الفيدرالي الأمريكي يوم الأربعاء؟ يقترح لكم خبير الأسواق العالمية أشرف العايدي استراتيجية مركبة من صفقتين، قبل وبعد قرار الفيدرالي ومؤتمر "جيروم باول" الصحفي. التفاصيل في هذا الفيديو

Another Bond Conundrum

The weakest performing currency in the past week was the kiwi while the Swiss franc led the way. The move in the pair wasn't huge but that's a classic 'risk off' signal and it tees up the first theory:

1) Economic weakness

The past two non-farm payrolls reports have been weak and the drop in yields started immediately after the most-recent release. Maybe it's as simple as that? Markets often move on the second-derivative and while the US economy is growing at a +6% pace, the rate of change is no longer faster. Moreover, there may be too much optimism built into consumer spending going forward. Could the bond market and FX (to a lesser extent) simply be sending a warning sign?

2) Transitory inflation

The main economic indicator last week was CPI and it was above expectations at 5.0% compared to 4.7% y/y expected. Despite that, yields continued to fall. It's bordering on madness to be rushing into bonds at rates less than 1.5% when inflation is running at 5% unless you strongly believe that the worst has past. Perhaps the signal here is that high one-off items like used cars and durable goods will unwind in the year ahead, leading to an undershoot in inflation. This flies in the face of oil prices near 3-year highs but other commodity markets are showing cracks.

3) Infrastructure Is dying

Bank of America was out with a note last week saying its base case is still that Democrats will pass a $2 trillion infrastructure package via reconciliation. They must be seeing different news that us because some Democratic Senators appear to be digging in on a much smaller bi-partisan deal that would struggle to win left-leaning Democrats, or perhaps even the President. Politics is tough to handicap but the odds of an infrastructure deal are falling. That means less growth and less debt, which would both put pressure on yields.

4) Fed buying outpacing issuance

Due to seasonal effects, the Fed's QE programs are currently larger than US bond issuance. Could it be as simple as that? At times small imbalances in markets can lead to large moves but 20 bps in 6 days on something anyone with a calendar and calculator could see coming? That's a stretch.

5) Foreign flows

This is one of those cop-out answers that's impossible to prove before or with later data. We wrote earlier about the insanity of buying something that pays 1.5% when inflation is 5% but it's certainly a more-sober move than holding bunds at -0.27% or Japanese 30s at 0.65%. What's missing from that puzzle is the timing. We're not at quarter end; there's no obvious catalyst.

6) Short squeeze

This fits into the same 'usual suspects' category as flows but our many of friends in the bond market believe it. There is a large and durable short base in the Treasury market in a trade that was seen just a week ago as a sure thing – with only the timing in dispute. If this is a squeeze, it will reverse in a week or two and everyone will pretend it never happened.

Final Thoughts

What's most concerning – and probably right – is that it's a bit of all these elements. At some point though, price action itself because the story. That's particularly spooky if shorts haven't yet capitulated because if they do, we could see this move accelerate. That could create a feedback loop of risk aversion and some real turmoil.

With the Fed on tap for Wednesday, the stakes are suddenly higher.