Watch the 2023 Dots

US retail sales fell 1.3% in May, well shy of the -0.8% expected but the headline didn't tell the whole story. The prior was revised to +0.9% from 0.0% and that left the overall sales numbers close to expectations. It was a similar story in the control group, where a big revision higher outweighed a small miss on the headline.

The Fed will note the slowing trajectory though and mixed signals from the consumer. Spending is shifting towards restaurants and travel from durables and home improvement. The overall pace of spending is still high but that's just after some large stimulus payments.

The main factor for the Fed is jobs. Disappointing readings on the past two jobs reports weighed heavily on yields and that's the top metric Powell is focused on. Expectations for a direct hint to tapering are low.

Powell is also likely to push back the timeline for taper discussions to August as he highlights uncertainty and a lack of urgency to shift policy. One market mover is likely to be the dot plot. The current median forecast is for no hikes in 2023 but we could see a shift to a slim majority calling for at least one 2023 hike. The prior dots showed 11 forecasting no 2023 move and 7 forecasting a hike.

If there's a shift it would boost the US dollar but risks are two way: some of the recent dollar appreciation could unwind if there's no signal from the dots and Powell stays dovish.

Part of the reaction will depend on how well Powell navigates questions about inflation. He's sure to point to transitory factors and bottlenecks, while also adding a nod to say that if high prices are persistent, they have the tools to deal with it. Lately, that messages has resonated with markets and bond yields have fallen but there will be many minefields for Powell to navigate.

Also in focus is BoC's Macklem speech at 2230 GMT, where he's more likely to offer a hint on tapering along with a hawkish bent. Lately the loonie hasn't responded to higher oil prices but if the climb continues, it surely will.Latest IMTs

-

Is that it for Oil?

by Ashraf Laidi | Mar 9, 2026 13:27

-

Oil Metrics & Gold Risks

by Ashraf Laidi | Mar 6, 2026 20:39

-

Oil Inflection 77, 78

by Ashraf Laidi | Mar 5, 2026 12:02

-

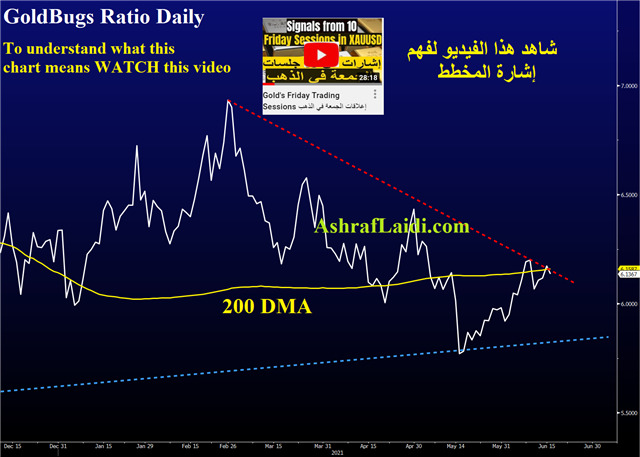

Gold Daily, Weekly & GoldBugs

by Ashraf Laidi | Mar 4, 2026 16:35

-

Gold and Silver Repeat June 13 Playbook

by Ashraf Laidi | Mar 3, 2026 13:35