Intraday Market Thoughts Archives

Displaying results for week of Aug 13, 2017Euro Far from Brutal

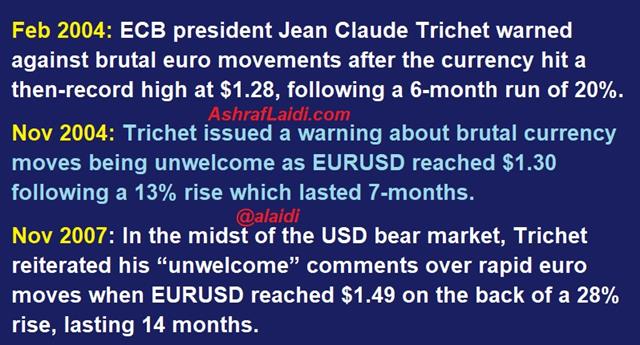

The big moves today were undoubtedly in equities. But the euro suffered a minor bump on the release of the minutes from last month's ECB Governing Council policy meeting, which revealed growing concerns with a possible overshoot in the value of the euro. Before we start speculating over when ECB policy makers may start jawboning the currency lower, it's worth reminding the times when and why the ECB warned over excessive euro strength. Full charts & analysis here.

Ahead of Fed & ECB Minutes

Commodity currencies dominate a quiet Wednesday summer session as traders await this evening's release of the minutes from the Jul 26-27 FOMC meeting. Recall the dollar fell sharply on that day, partly due to escalating adversity between the White House and Washington as well as the Fed statement itself.

So what did the Fed say on Jul 27? The Committee made two minor changes: i) saying inflation was 'below' target rather than 'somewhat below'; and; ii) that the balance sheet runoff will start 'relatively soon' which could mean later than September. Also note that 3 weeks after the Fed decision, July CPI was a miss. Today's minutes may further enlighten us and whether the inflation tweek was a mark-to-market reflection or a possible sign of the Fed's plan, the latter could be USD bearish.

Let's also not forget tomorrow's release of the ECB minutes from the Jul 20 meeting/press conference, which triggered broad EUR strength and sharp DAX selling after the ECB was perceived to be largely on course towards curtailing QE. Today's rally in the DAX and retreat in the euro were spurred by Reuters reports that Draghi will not make any policy-related remarks at next week's scheduled speech at the Jackson Hole symposium, thus, allaying (or delaying) worries about any references to a curtailing QE. Yet, this remains a matter of “when” rather than “if”.

A new index trade has been issued to Premium subscribers after the two previous trades were closed at a profit.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Final CPI (y/y) [F] | |||

| 1.3% | 1.3% | Aug 17 9:00 | |