Intraday Market Thoughts Archives

Displaying results for week of Aug 14, 2016Is Pound Pessimism Fading?

The first real test of the post-Brexit lows in cable has held in what may be an early sign of a more constructive view on the referendum. The pound was the top performer on the day while the Australian dollar lagged. Japan's all-industry activity index is due next. The 2nd index trade was filled and 2 equity indices are currently in progress, in addition to 2 metals and 4 FX trades. the EURUSD long trade is deepening in the green.

In markets, perception is reality. At least until reality arrives.

The perception was that a Brexit may cause a massive recession, lack of investment and flight of capital. The market's initial reaction and continued worries afterwards showed that many of those things were in the process of happening.

But as the two month anniversary of the vote nears, it's also clear that some of the worries were overblown. Europe doesn't want a trade war with Britain and there is probably room for middle ground. In the meantime, UK investment is suffering a lull but there is no race to the exits or signs of widespread layoffs.

Some of the fears may come to fruition but the market is at the point where it wants to see the reality of the situation in the economic data. Thursday's 5.4% jump in July retail sales ex auto fuel compared to 3.9% expected is a sign that consumers, at least, aren't hitting the panic button.

Technically, GBP/USD held the July low despite a dip below 1.30. That's not a bottom but it's an early sign that buyers are lurking.

In terms of US economic data on Thursday, initial jobless claims and the Philly Fed largely matched expectations. The dollar was generally soft as the momentum from the FOMC Minutes continued.

The Canadian dollar got another lift from oil, which has now climbed 23% from the lows on Aug 3. The acceleration higher Thursday in crude after six consecutive days of gains may be a sign of a short squeeze.

Friday trading in Asia-Pacific trading may focus on the yen. USD/JPY closed below 100 for the first time since 2013 and continues to chop around that mark. On the calendar, it's the June Japan all-industry index at 0430 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| All Industries Activity (m/m) | |||

| 0.9% | -1.0% | Aug 19 4:30 | |

| Retail Sales (m/m) | |||

| 1.4% | 0.1% | -0.9% | Aug 18 8:30 |

‘Prudent’ Fed Policy; Aussie Jobs Next

Initial FOMC Minutes headlines highlighted a 'split' amongst Fed voters but a closer look at the text showed a Fed patient and prudent Fed. The Canadian dollar was the top performer Wednesday while AUD lagged. The Australian jobs report is due up next. A 2nd trade in an equity index was issued today.

فيديو المشتركين== هل سيؤثر ضعف المؤشرات على الدولار و النفط؟

The dollar initially fell on FOMC Minutes headlines as news outlets played up divisions but the text showed only a 'couple', 'some' or 'a few' FOMC members with hawkish concerns. Those are code words for 2-5 members and only 'a couple' were prepared to support a hike along with George, who voted in favour of raising rates.

As Ashraf highlighted, a key concern for Fed doves is inflation or the lack thereof. Another is poor business investment. The Minutes emphasized that it was 'prudent' to accumulate more data. That's probably the best word to describe the Fed's stance at the moment. A less generous term might be 'shy' after repeatedly failing to deliver on hawkish talk.

In terms of market moves, the US dollar slumped after the Minutes and the implied probability of a Sept hike fell to 18% from 22%. EUR/USD initially jumped to 1.1316 from 1.1260 but was unable to break Tuesday's high of 1.1323 and gave back half the gains.

The Australian dollar is in focus next with the jobs report due at 0130 GMT. The consensus is for 10K new jobs but watch the breakdown of full and part time jobs. The unemployment rate is forecast to remain unchanged at 5.8%.

AUD/USD slumped to a two-week low of 0.7605 on Wed but recovered to 0.7656 at the close. Overall, the pair remains near the top end of the four month range but the recent volatility ahead of the April high is worrisome.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Employment Change | |||

| 10.2K | 7.9K | Aug 18 1:30 | |

Sluggish Inflation Standing in the Way

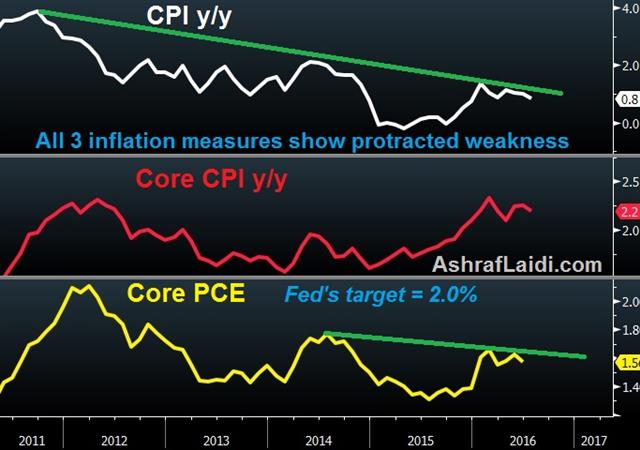

FX markets are quick to send USD down across the board after the release of the Jul FOMC minutes, as the discussions reveal no smoking gun for the hawks. US labour markets have grown unambiguously tight, but are they hot enough to warrant another rate hike when all key inflation measures continue to trend down? Aside from the Fed's preferred inflation gauge –Core PCE price index—standing at 1.6% as well as trendine lower, it continues to diverge away from the Fed's 2.0% target. The latest CPI and PPI figures have also moved lower as the charts show with the July data.

The minutes stated the FOMC was split with regards to Fed hikes as several members "… suggested that the committee would likely have ample time to react if inflation rose more quickly than they currently anticipated, and they preferred to defer another increase in the federal funds rate until they were more confident that inflation was moving closer to 2 percent on a sustained basis.". The more hawkish members said “…recent economic developments as indicating that labor market conditions were at or close to those consistent with maximum employment and expected that the recent progress in reaching the committee's inflation objective would continue”.

We could also state USD strength and hesitant wage growth as the obstacles standing in the way of the next rate hike. Not to mention the 1-year breakeven forward rate of 0.41%, the lowest since October 2015. As long as those are barriers remain intact, alongside the uncertain banking sector in Europe and more question marks with China's credit machine, US inflation measures need to be flashing the all clear green signal, rather than a flickering orange.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Dudley Speaks | |||

| Aug 18 14:05 | |||

| Eurozone Final CPI (y/y) [F] | |||

| 0.2% | 0.2% | Aug 18 9:00 | |

Ashraf's Thursday Webinar

Join Ashraf Thursday evening - 6 pm Eastern Time, 11 pm London Time - for a free webinar on the latest FX market developments and chart set-ups. The webinar will be hosted by Bob Lang of Explosive Options and contributor to CNBC's MadMoney. REGISTRATION.

Fed Jawbone Unbroken, NZ Jobs next

We mulled the inability of central bankers to influence markets yesterday and today Dudley and Lockhart showed the Fed's jaw still has some strength, at least on the hawkish side. The pound was the top performer on Tuesday while the US dollar lagged despite a rebound in New York trading. The New Zealand jobs report is due next. A new index trade was issued earlier today. There are 2 NZD trades in progress ahead of the upcoming NZ jobs. The Video for Premium subscribers is posted below.

The Fed's Dudley stole the focus from the US inflation report on Tuesday. CPI ex-food and energy rose 0.1% in July compared to 0.2% expected but dollar weakness on the headlines was swamped by a hint at a hike from Dudley. The NY Fed chief said a hike in September was possible. The Fed fund futures market was pricing in a 22% chance of a hike before the comment so it was always 'possible' but the dollar sensed it was a sign of a higher possibility and it jumped a half-cent across the board after touching session lows moments earlier.

The dollar rebound extended after US industrial production rose 0.7% in July compared to 0.3% expected. The turnaround prevented a USD/JPY close below 100.00 for the first time 2013. Despite the 75 pip climb from the lows, the pair still finished in deeply negative territory and at the lowest level since early July.

The Fed's Lockhart also helped the US dollar with a comment that two Fed hikes this year are still conceivable and that he was reasonably confident inflation will hit 2% by the end of 2017. The main risk he highlighted was poor business investment.

The comments today showed the Fed's jawbone, at least, isn't broken but it may only work in one direction. The market can't help but fear a hike while any easing bias can be brushed aside due to the limitations of the lower bound.

We also question if the dollar bounce can be sustained by talk that doesn't include action. The market may have moved more than would normally be expected on hawkish comments because of less liquid Summer markets. Ultimately, the Fed has failed countless times to back up tough talk on rates with action.

One central bank with plenty of room for traditional stimulus is the RBNZ. They will get a critical reading on the economy in the next 15 mins with the Q2 employment report due at 2245 GMT. Expectations are high with the unemployment rate forecast to fall to 5.3% from 5.7%. Make sure to watch the corresponding participation rate. It's forecast to fall to 68.8% from 69.0% and that would cover nearly half the 'improvement' in joblessness.

The other data point on the agenda is the Q2 Australian wage price index at 0130 GMT. It's forecast to rise 0.5% q/q.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Wage Price Index (q/q) | |||

| 0.5% | 0.4% | Aug 17 1:30 | |

| Employment Change (q/q) | |||

| 0.6% | 1.2% | Aug 16 22:45 | |

Central Bank Jawbreaker

We look at the market's indifference to US factory data, brewing problems in the Canadian housing market and why what central bankers say matters less than ever. The Australian dollar was the top performer Monday while the pound lagged. The RBNZ's Wheeler and the RBA Minutes are up next. The Dow trade was stopped out at 18,660, leaving 6 trades in progress.

In economic data Monday, the Empire Fed manufacturing index fell to -4.2 compared to +2.5 expected. The miss hardly elicited a response. Manufacturing has struggled at various times since the crises but has never been able to spark any kind of sustained worries. Increasingly, the market is indifferent to US factory data.

One set of data that's growing in important is Canadian housing. The 15% foreign buyers tax on the West coast and rumblings of similar moves elsewhere could put a cooler on the market, along with a struggling resource economy. July existing home sales fell 1.3% compared to 0.9% expected.

Canadian house prices were up 9.9% y/y in a poor economy and officials are increasingly concerned. Fin Min Morneau on Monday said the government is focused on minimizing housing risks. They may be able to shield the financial sector but deflating a bubble is a tall task and one that will loom large in 2017.

In central banking, the trend is openness; in the sense that officials are more open than ever to alternative ideas. In a letter Monday, the Fed's Williams mulled raising the Fed's inflation goal or targeting nominal GDP.

In the pre-crisis era, central banks worked by raising or lowering rates in an essentially binary system. Markets are now demanding more creative policymaking and punishing currencies harshly when central banks fail to meet expectations, which are often unclear.

Much of what Williams is proposing is changing the communication function. What he's underestimating is how badly central bank credibility has been damaged. Targets, forecasts and even mandates have been missed so badly that markets are indifferent to changes.

Japan is a prime example of all the issues and yesterday's dismal GDP report emphasized the inability of central banks (and even governments) to battle demographics and altered consumer attitudes.

Looking ahead, the RBNZ's Wheeler is slated to speak at 2230 GMT. At 1:30 GMT, the latest RBA Minutes are due up. The policy outlook will likely mirror the latest statement and offer nothing new but comments on the growth outlook could be revealing.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Prelim GDP (q/q) [P] | |||

| 0.0% | 0.2% | 0.5% | Aug 14 23:50 |

ويبينار الغد مع أشرف العايدي

تداعيات بيانات الوظائف البريطانية وآثارها المتوقعة

سجل هنا للمشاركة في ندوة غداPost-Retail USD Rebound, AUD Longs Grow

The US dollar shrugged off a soft retail sales and PPI reports on Friday. The yen was the top performer on Friday while the Aussie lagged. Early-week moves have been modest and include EUR strength and GBP softness. On Friday, the Premium GBPUSD short was closed at 1.2910 for 310 pt gain.

Moments ago, Japan's 2Q GDP rose 0.2% q/q vs an expected 0.7%. Private consumption roses 0.2% q/q and business spending fell 0.4% q/q vs the expected +0.2%.

The US dollar fell hard Friday on the retail sales headlines but recovered all the losses by the end of the day. That's a positive sign, especially against the pound, which sank close to fresh cycle lows. It also reflects a healthy view on the consumer overall. Sales were flat in the month but they have been solid all year and one of the few sources of US optimism. It would take at least another month of soft numbers to spook markets.

What might be more concerning is the PPI number. Inflation is the Fed's main frustration at the moment. Bullard continues to press for a new paradigm that accepts the low inflation environment rather than staying on guard against 'runaway' inflation that never seems to materialize.

In weekend news, a press report said the Brexit could be delayed until late 2019 to give government departments time to get ready. That could lend some support to the pound in the near term but it won't inspire any long term optimism (or confidence in government efficiency).

CFTC Commitments of Traders Forex speculative futures positioning. + denotes net long; - denotes net short

EUR -98K vs -104K prior GBP -90K vs -83K prior JPY +49K vs +42K prior CHF +0.1K vs -1.7K prior CAD -15K vs -18K prior AUD +35K vs +31K prior

AUD longs have risen to the highest since mid-May while the Aussie traded at the best levels since late April last week. The net long topped out at 60K earlier this year so it may yet be premature to worry about crowded longs. Still, the pullback late in the week and softness after US retail sales suggests some traders are looking to exit longs.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Prelim GDP (q/q) [P] | |||

| 0.0% | 0.2% | 0.5% | Aug 14 23:50 |