Intraday Market Thoughts Archives

Displaying results for week of Sep 14, 2014Late Bets Boost Cable, What to Expect Next

Cable regained the 1.64000 figure, alongside all GBP pairs as polls closed in Scotland's independence referendum, with the first poll from YouGov finding a 54% No, 46% Yes. The pound was a top performer on the day along with CHF after the SNB didn't introduce negative rates. The first referendum results could hit around 0100 GMT. In today's Premium Insights, we issued 2 new GBP trades with 2 charts ahead of ahead of the upcoming Scottish referendum announcement. NZDUSD, USDCHF and NZDCAD have all hit their final targets. Full trades & trades Latest trades & charts

Cable has inched back from as low as 1.6054 last week and a flurry of buying hit just hours before the results as the final polls showed a 4-6 point lead for the No side. The first referendum results are expected from Stirling at 0100 GMT which is believed to be a stronghold for separatists. If they do poorly there, the market will quickly price in a No victory.

At 0300GMT (0400BST) results from the anti-separatist stronghold South Lanarkshire and independence stronghold of Dundee are due. If one side takes both, it's over.

By the time a final result is announced the 'buy the rumor and sell the fact' trade in cable could be underway.

If it remains close it could be a long night as ballot boxes arrive from remote areas. One of the late announcements will come from Aberdeen, which is a wealthy area and likely to tilt the balance back toward No if it's extremely close. The final votes should be in by 0700 GMT but if it's still close then, the market will be running scared and cable in free-fall.

What was also notable Thursday was the paring of post-FOMC gains in the US dollar. Aside from USD/JPY, the US dollar took a break and all the gains against CAD and NZD have now evaporated.

How to hedge GBP

Six hours until the preliminary results of the Scottish Referendum start emerging from Scotland's 32 regions, GBP accumulates fresh upside against all currencies after all, but one poll show majority for the 'No' camp. GBPUSD nears the top of its 2-month trendline resistance and GBPJPY hits a fresh 6-year high. Holding two GBP shorts in our Premium trades, we added 2 GBP trades to hedge those positions ahead of what promises to be a volatile 5-7 hours. Reflecting recent stabilisation, GBPUSD 1 month call options have fallen for two straight days. Meanwhile, our Premium trades in NZDUSD, USDCHF and NZDCAD have all hit their final targets over the past 24 hours, with an average gain of 170 pips per trade. The latest trades and charts are found in the Premium Insights.

Dollar Rips as Market Eyes Fed Forecasts

The main Fed focus ahead of the decision was on the inclusion of the words “significant slack” to describe the labor market and “considerable time” to describe when the first rate hike would come after QE3. Neither was altered as the doves remained in control.

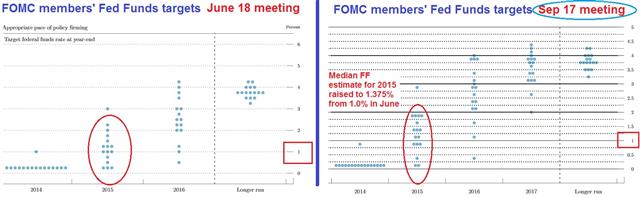

However, the hawks made some progress with Fisher adding his dissent to Plosser's and 14 members now expecting a hike in 2015, up from 12. But perhaps the most notable change was in the dot chart as the median estimate for the end of next year rose to 1.375% from 1.125%.

Yellen and other Fed members have lamented the dot chart in the past and even talked about removing it because of the mixed signals that it sends. On the dovish side, the Fed added some language about low inflation after a soft CPI report.

We don't question the wisdom of the market but looking at the statement alone and knowing the lousy history of Fed forecasts we struggle to see a clear justification for the level of dollar buying following the statement. An alternative view is that the strength of the dollar rally represents the pent up demand for USD that was sidelined ahead of the Fed and unleashed afterwards.

In that case, the dollar rally could have much more room to run.

The focus now shifts to the Scottish referendum. The final opinion polls showed the No side ahead 2-6 points. The largest poll placed the anti-independence side in the lead 52% to 48%.

In the aggressive round of US dollar buying that followed the Fed decision the pound held up better than its rivals in a sign that traders are betting that independence will fail. That could mean the cable rally following the results could be short lived.ni fedFOMC Triggers USA Trifecta

A rallying trifecta in the US dollar, equity indices and bond yields emerged after the FOMC issued slightly more hawkish projections on the Fed Funds rate. 14 of the 16 Fed members expect a rate hike in 2015, but more importantly, the median estimate for the Fed Funds rate by end of 2015 is now 1.375% from 1.0% in the June projections. Red-line comaprison of FOMC statement and dots forecasts are here.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Yellen Speech | |||

| Sep 18 12:45 | |||

The Dragon Awakes, Fed and Indyref in Focus

Fears that China wanted to wring out some of the excesses in the lending sector were put to sleep by the massive injection from the PBOC into the 5 largest lenders. It's good news that officials are willing to act but it's also worrying that they felt the need to react so strongly.

As always with China, there's a lingering feeling about what we don't know. There was talk about added liquidity in Asia but the size of the move didn't become apparent until US trading and it quickly sent the Aussie nearly a cent higher to 0.9113.

A few other headlines hit at the same time, including WSJ Fedwatcher Hilsenrath saying the Fed is unlikely to alter guidance on “considerable time”. Add it up and you have a dovish PBOC and a continued dovish Fed.

The moves dislodged the US dollar more broadly for a period and USD/JPY slumped 35 pips down to 106.81 and then back to 107.15 in a whipsaw.

But the nastiest whipsaw was in cable. Initial headlines on a poll from ICM showed the Yes side ahead 52-48 but it was an error. The true result was 52-48 for the No side. It was quickly corrected but the pound dropped 35 pips in a flash only to bounce right back.

We suspect more of the same in the day ahead.

The economic calendar is light in Asia-Pacific trading but look for more details on the PBOC liquidity operations. After that the focus will shift to CPI and the Fed.Ahead of Tomorrow's Key UK Data

GBP traders preparing for Thursday's Scottish independence referendum will first have to deal with Wednesday's triple releases of the BoE minutes, Jul ILO unemployment rate and the all-important Jul average earnings figures. These will be followed by Thursday's release of Aug retail sales. Tomorrow's jobs figures will likely be dominated by the earnings figure, whose negative figure in June was largely behind the sharp selloff in GBP on Aug 13. If we mentioned each single “If and but” of this week's UK data as well as the run-up to Thursday's referendum announcement and the plethora of polls and projections, then confusion will have the final word. Ahead of these events, we issued a new GBP trade for our Premium Insights subscribers, which can be seen in the latest trades & charts.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Average Earnings excluding Bonus (JUL) (3m/y) | |||

| 0.7% | 0.6% | Sep 17 8:30 | |

| Average Earnings including Bonus (JUL) (3m/y) | |||

| 0.5% | -0.2% | Sep 17 8:30 | |

| ILO Unemployment Rate (JUL) ((3m)) | |||

| 6.3% | 6.4% | Sep 17 8:30 | |

| Claimant Count Change (AUG) | |||

| -30.0K | -33.6K | Sep 17 8:30 | |

| Claimant Count Rate (AUG) | |||

| 3% | Sep 17 8:30 | ||

China Worries Fade, Kuroda Next

As the hours pass, there is almost always nothing new to the story and it begins to fade around the time US traders begin to roll in. That's a group that's notoriously domestically focused and Fed-talk dominated the New York session as China-sensitive trades like AUD and oil rebounded.

It's a familiar narrative and one to keep in mind the next time Chinese fears begin to percolate.

Other drivers in US trading were mixed reports on the economy. The Empire Fed manufacturing index jumped to 27.5 versus 16.0 expected but the employment component fell to 3 from 14. Industrial production also put a dent in the US dollar at -0.1% compared to +0.3% expected.

For the most part, it was an inside-day in the forex market as we all look forward to some of the events in the days ahead.

One of the more notable moves was in USD/CAD as it failed at 1.1100 and skidded down to 1.1035. The magnitude of the correction was similar to other dips and the low print remained above other recent lows in a sign that the uptrend will continue. The major risk to buying USD/CAD is a dovish Fed (or fears thereof).

Looking ahead, Japan returns from holiday and BOJ Governor Kuroda speaks at 0530 GMT with a press conference about 2 hours later. In comments last week he didn't try to jawbone the yen lower but said they are ready “without hesitation” to take more steps but only if they're needed.

He had a meeting with PM Abe last week and may have got marching orders to be more dovish in today's speech in something that could help restart upward USD/JPY momentum.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (AUG) (m/m) | |||

| -0.1% | 0.3% | 0.2% | Sep 15 13:15 |

| Industrial Production (y/y) | |||

| 6.9% | 8.8% | 9.0% | Sep 15 |

| Bank of Japan Governor Kuroda Speech | |||

| Sep 16 5:30 | |||

| RBA Assistant Governor Kent Speech | |||

| Sep 16 0:00 | |||

AUD on its Knees, GBP Flat After Polls

The Australian dollar is threatening to break 0.9000 early in the week after a round of soft Chinese data and a report that officals are reluctant to cut rates. The aussie was also the best performer last week while US dollar edged out the euro as the top performer. CFTC data showed cable traders leaning toward a No vote.

The early-week story is a quarter-cent slide in the Australian dollar after a round of softer Chinese data. Retail sales were expected up 12.1% y/y but rose just 11.9%. The larger miss was in industrial production as it rose just 6.9% y/y compared to 8.8% expected.

Compounding the softness was a report from MNI that said the PBCO is reluctant to ease the the reserve requirement further because two targeted cuts earlier this year failed boost small businesses and rural areas.

AUD/USD fell as low as 0.9003 in early trading -- the lowest March 19. The pair has now fallen hard in six straight sessions in a swan dive after a failed push to 0.9400.

The focus of many traders is the pound after a mixed bag of weekend polls. The largest polls showed a 6-7 point lead for the No side, which rejects independence. But an internet poll with a small sample of 705 people from ICM showed the Yes side with a 54% to 46% lead.

GBP/USD is virtually unchanged to start the week at 1.6267 but managed to poke to a one-week high of 1.6278 in thin, early trading. The gap toward 1.6315 from last week continues to close.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -158K vs -162K prior JPY -101K vs -118K prior GBP +27K vs +10K prior AUD +41K vs +49K prior CAD +11K vs +13K prior CHF -14K vs -13K prior NZD +10K vs +10K prior

What stands out is the speculative market buying up the pound sterling after the dip at the start of last week. Traders have had a chance to size up the referendum and they think independence will fail.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (AUG) (m/m) | |||

| 0.3% | 0.4% | Sep 15 13:15 | |