Intraday Market Thoughts Archives

Displaying results for week of Nov 15, 2015Sterling's 180° Turn

Is it finally catching up with GBP? The British pound defied gravity during most of the week, shrugging disappointing figures on inflation, retail sales and the CBI trend survey. A somewhat hawkish speech by BoE MPC member Ben Broadbent on Wednesday may have been among the causes behind the gains. The pound even managed to rally against the US dollar on Tuesday and Wednesday ahead of an expectedly hawkish set of FOMC minutes. Eventually, GBP saw the peak on Thursday evening with GBPUSD giving up at the near confluence of the 55-DMA and 200-DMAs at $1.5312 and $1.5336. Unfortunately, our short GBPUSD trade in the Premium Insights (opened on Nov 6) was stopped out at $1.5330, only 6 pips below the high of the week. After that, GBPUSD shed 1.5 cent to settle near $1.5200.

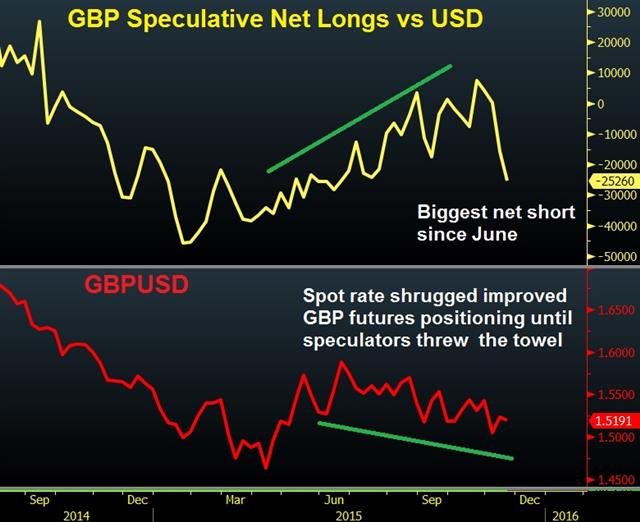

The latest figures from speculative futures' commitment report show sentiment continued to worsen in the week ending on Tuesday, following the 8,500% collapse (from 188 net long contracts to 8,488 net shorts) in the aftermath of aggressive downgrade in the BoE's quarterly inflation report. More interestingly, note the clear divergence between the steadily improved futures positioning since April and the downtrend in the GBPUSD spot rate since late June, which extended until the last two weeks. And just as GBPUSD seemed to mount its own positive divergence, Friday's sell-off happens.

Fortunately, we had two additional shorts in GBP, one of which, was locked in at a gain, the other allowed to progress. As for GBPUSD, a new note/trade will be issued for our Premium Insights subscribers ahead of Tuesday's inflation report testimony by governor Carney and chief Economist Haldane. Stay tuned.

Stocks & Yields ahead of the Fed

The rebound in the Japanese yen and pullback of US yields emerging after Wednesday's release of the Fed minutes has been attributed to various factors, such as “buying the USD rumour, selling the fact”, less dovish than expected minutes and/or the expectations that rates liftoff could be one-&-done rather than the start of a tightening cycle. This helped explain the corrective decline in the US dolla, bringing us to the persistent strength in equity indices and their reluctance to follow yields lower as seen in the charts below.

When the usually positive correlation between US 10-year yields and a major US equity index such as the S&P500 is halted during key releases or speeches, questioning the reason to the break or interruption opens new and old ideas. Yields failed to break above their 100-WEEK MA for the 3rd time since over the past 12 months, while S&P500 attempts to escape higher, chasing the elusive 2100 barrier.

The relationship between equities and bonds will be closely monitored over the next 3 weeks' release of US data on consumers, manufacturing, services, inflation and jobs. Later into the start of the Asia Friday session, a new trade shall be issued in the Premium Insights to capitalise on the above relationship fundamental rationale and technical charts.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Bullard speech | |||

| Nov 20 14:00 | |||

USD Frowns at Minutes

The steady-stream of US dollar positive news finally stalled when the FOMC Minutes failed to offer any clear nudge about a Dec liftoff. The pound was the top performer while the Swiss franc lagged. Japanese Oct trade data is due next. A new Premium note was issued on the FSE-100 ahead of tomrrow's UK retail sales release. GBPUSD, GBPCAD and GBPAUD Premium trades are also in progress.

Throughout the early part of New York trading anticipation about hawkish Fed minutes was clearly building. The US dollar was solidly bid, pulling EUR/USD down to a fresh five-month low at 1.0621. The dollar bulls wanted a sign that a hike was highly likely.

Instead, the Minutes told us the things Fed officials have been saying for a few weeks. They're pleased with employment and will hike if they're confident in rising inflation and that no foreign troubles are brewing. That sparked a tactical retreat in the dollar as the 30-40 pip pre-Minutes gains dissipated.One part of the Minutes that stands out to us is some light commentary on the possible disinflationary effects of the dollar. Expect that to be a key theme in 2016 as the Fed begins to more actively jawbone against the US dollar, led by Fischer. It's a theme that's slowly been building and it's likely to be the reason the Fed delays hikes next year.

The turnaround in the dollar argues that a fresh catalyst is needed to spark gains. Fed rhetoric will be mum or repetitive over the next three weeks. Instead dollar trades may be driven by the other side of the equation. On Thursday, that means the ECB minutes and on Friday there is yet another BOJ decision.

In the shorter-term the focus will be on Japanese Oct trade data at 2350 GMT. The weaker yen surely hasn't delivered the spark Abe and Kuroda would have hoped for as Japan re-entered recession after this week's GDP data. The consensus is for an adjusted trade deficit of 343B yen, a slight decrease from the prior month. Exports are expected down 2.0% y/y and imports down 8.6%. The soft yen, it seems, is hurting importers more than boosting exporters and that argues for patience on further QE and USD/JPY declines.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (OCT) (m/m) | |||

| -0.5% | 1.9% | Nov 19 9:30 | |

| Retail Sales ex-Fuel (OCT) (m/m) | |||

| -0.5% | 1.7% | Nov 19 9:30 | |

| Retail Sales (OCT) (y/y) | |||

| 4.2% | 6.5% | Nov 19 9:30 | |

| Retail Sales ex-Fuel (OCT) (y/y) | |||

| 3.9% | 5.9% | Nov 19 9:30 | |

| Exports (OCT) (y/y) | |||

| -2.1% | 0.6% | Nov 18 23:50 | |

| Exports (OCT) (m/m) | |||

| 16,950M | Nov 19 7:00 | ||

| Imports (OCT) (y/y) | |||

| -8.6% | -11.1% | Nov 18 23:50 | |

| Imports (OCT) (m/m) | |||

| 13,903M | Nov 19 7:00 | ||

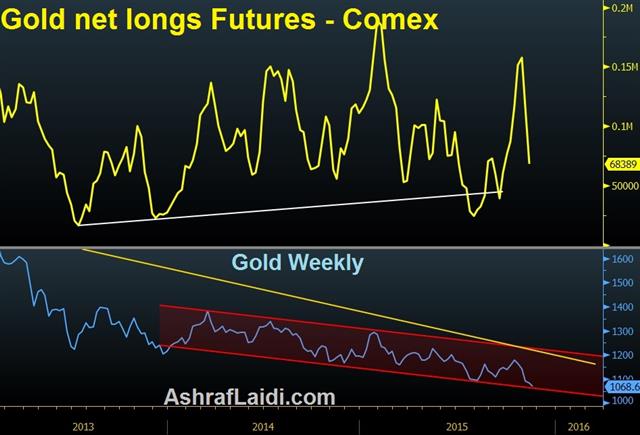

Gold Hits 5-Year Low, What’s Next?

The rout in gold over the past month has been relentless and it continued Tuesday as prices hit the worst levels since 2010. The FX market was more subdued with AUD leading and CHF lagging. Australian Q3 wage inflation rose by 0.6%, matching the pace of Q2.

Gold old has now declined in 21 of the past 24 trading days. It's been a cascade of selling since the three-month high on Oct 15. The heavier sales began after the Oct 28 FOMC and continued after non-farm payrolls but the most notable signal may have been this week.

Gold started the week higher on terror worries but despite heavily oversold conditions and the nearby support of the July low, yesterday's rally fizzed before the end of the day. Today the selling resumed and gold fell $13 and touched $1065.

The Fed hike and USD strength is the predominant reason behind the strength in gold prices but like other commodities, over-investment in production is also a factor.With the break of $1070 today, there is little near-term support. Unless the Febacks away from a rate hike, it's difficult to envision any more than a fledgling bounce.

More broadly, the US dollar was mildly higher on the day. The CPI report was in line with estimates but showed services inflation running near 3% y/y. That's likely to give the Fed confidence that inflation will pick up once commodity-driven skews pass.

The euro also touched aresh 5-month low at 1.0630. The downside isn't remains alluring with little support ahead of 1.05. The risk, like gold, is that a bounce turns into a squeeze but unless it's driven by Fed dovish news, it's unlikely to last.

Fear Trade Fades, CPIs on Deck

Big intraday turnarounds in USD/JPY and the S&P 500 were the story on Monday. Fear about the fallout from the Paris attacks faded and the US dollar was the top performer while the euro lagged. The RBA minutes are due later. Ashraf's Premium Video sheds light on the latest spin on the "052008 Parallel" undergoing major equity indices ahead of Tuesday's UK and UK CPI figures, as well as other key figures later in the week. GBPAUD Premium trade is in focus.

Early fear turned into a furious rally in the stock market that underpinned a bid in the US dollar. The S&P 500 fell as low as 2019 early. Selling pressure was largely on geopolitical fears but the Empire Fed at -10.7 compared to -6.2 added to the sour mood. Shortly after the open, sentiment changed as stocks held the late Oct low and began to turn around. The buying continued into the close with the S&P 500 surging 30 points to 2053 at the close, splashing a bullish reversal on the chart.

USD/JPY trading offered an early preview into the turnaround. The selling stopped early in Europe at 122.40 and its marched a full cent higher since.

Technically, the euro is in focus after it fell nearly a full cent and hit 1.0675. That level matches last week's low and leaves stops below vulnerable and opens the way towards the March/April lows near 1.05.

We wrote yesterday that the fear trade was likely to fade but the speed and magnitude of the turnaround was impressive and highlights the latent strength in risk assets and the US dollar. Even gold wasn't able to hold onto gains.

Two spots to watch closely in the day ahead are oil and CAD. Crude fell early in US trading but bids at $40.00 held and crude rebounded $2. USD/CAD hit a six-week high when oil but fell 35-pips on the reversal. The loonie has been surprisingly insensitive to the latest slump in oil. If crude can continue to bounce, it will be interesting to see if the reaction is symmetrical or if some latent USD/CAD weakness will be exposed by an oil bounce.

In the shorter term, the Aussie is in focus with the Nov RBA meeting minutes due at 0030 GMT. The RBA kept the door open to a cut at the meeting but struck an optimistic tone. Since the decision, the employment report will have added to positive outlook so if the Minutes have a negative tinge, it will be brushed aside. The risk is that the Minutes were already upbeat; that could signal the RBA on the sidelines for an extended period and boost AUD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core CPI (OCT) (y/y) | |||

| 1% | 1% | Nov 17 9:30 | |

| CPI (OCT) (y/y) | |||

| -0.1% | -0.1% | Nov 17 9:30 | |

| CPI (OCT) (m/m) | |||

| 0.1% | -0.1% | Nov 17 9:30 | |

| Eurozone CPI (OCT) (m/m) | |||

| 0.1% | 0.1% | 0.2% | Nov 16 10:00 |

| Eurozone CPI (OCT) (y/y) | |||

| 0.1% | 0.0% | 0.0% | Nov 16 10:00 |

| Eurozone CPI - Core (OCT) (y/y) | |||

| 1.1% | 1.0% | 1.0% | Nov 16 10:00 |

| RPI (OCT) (m/m) | |||

| 0.1% | -0.1% | Nov 17 9:30 | |

| RPI (OCT) (y/y) | |||

| 0.9% | 0.8% | Nov 17 9:30 | |

Euro Down After Attacks, Japan Back in Recession

Stocks and the euro are lower as markets respond to the tragic events in Paris. The yen is the top performer while the euro opened 75 pips lower. The first reading on Japanese GDP showed yet-another recession. Each of the Premium shorts in DAX-30 and FTSE-100 is +300 points in the money and in progress.

French President promised a 'ruthless' response to the attacks in Paris. That's boosted traditional safe havens and weighed on the euro at the open. The yen is the classic safe harbor and it's leading early along with Treasuries and gold.

S&P 500 futures are 14 points lower after a 23 point decline on Friday. Ashraf noted on Friday that the weekly decline was the worst since the Chinese devaluation. That decline occurred four weeks prior to the Sept FOMC. Last week's is four weeks prior to the Dec FOMC.

There is no sign the Fed is planning to back away from hikes and the Paris attacks won't be a factor. The Fed's Rosengren spoke to the FT on the weekend and he focused on the pace of hikes rather than liftoff. That's similar to other doves who appear more to have accepted a Dec hike and are now staking out positions on how gradual to hike afterwards.

In terms repercussions from France, there will likely be a long-term escalation in airstrikes in the Middle East and that raises risk for oil. In the shorter term it's difficult to see how this meaningfully changes the trajectory of Europe's economy. For now the fear trade has taken hold but it's likely to fade.

The economic news in early Asia-Pacific trade is focused on Japan where the economy contracted for the second consecutive quarter. Q3 GDP contracted 0.8% compared to 0.2% expected. The miss isn't nearly as bad as it appears because Q2 was revised to -0.7% from -1.2% but it's still a miss.

The BOJ pushed out easing expectations after the latest meeting but if the economy continues to struggle, more QE is inevitable.

Weekly CFTC data is delayed until Monday because of last week's US holiday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (Q3) (q/q) [P] | |||

| -0.2% | 0.0% | -0.3% | Nov 15 23:50 |

| GDP Deflator (Q3) (y/y) [P] | |||

| 2.0% | 1.5% | Nov 15 23:50 | |

| GDP Annualized (Q3) [P] | |||

| -0.8% | -0.2% | -1.2% | Nov 15 23:50 |