Gold Hits 5-Year Low, What’s Next?

The rout in gold over the past month has been relentless and it continued Tuesday as prices hit the worst levels since 2010. The FX market was more subdued with AUD leading and CHF lagging. Australian Q3 wage inflation rose by 0.6%, matching the pace of Q2.

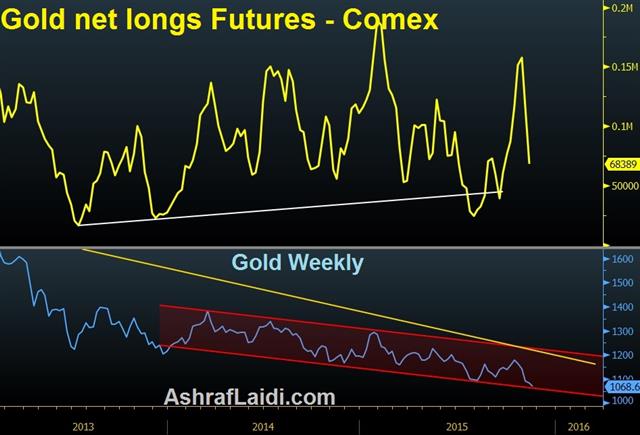

Gold old has now declined in 21 of the past 24 trading days. It's been a cascade of selling since the three-month high on Oct 15. The heavier sales began after the Oct 28 FOMC and continued after non-farm payrolls but the most notable signal may have been this week.

Gold started the week higher on terror worries but despite heavily oversold conditions and the nearby support of the July low, yesterday's rally fizzed before the end of the day. Today the selling resumed and gold fell $13 and touched $1065.

The Fed hike and USD strength is the predominant reason behind the strength in gold prices but like other commodities, over-investment in production is also a factor.With the break of $1070 today, there is little near-term support. Unless the Febacks away from a rate hike, it's difficult to envision any more than a fledgling bounce.

More broadly, the US dollar was mildly higher on the day. The CPI report was in line with estimates but showed services inflation running near 3% y/y. That's likely to give the Fed confidence that inflation will pick up once commodity-driven skews pass.

The euro also touched aresh 5-month low at 1.0630. The downside isn't remains alluring with little support ahead of 1.05. The risk, like gold, is that a bounce turns into a squeeze but unless it's driven by Fed dovish news, it's unlikely to last.

Latest IMTs

-

Silver's Road to 102

by Ashraf Laidi | Jan 19, 2026 13:25

-

Avoid Yen Intervention Trap

by Ashraf Laidi | Jan 17, 2026 11:20

-

Winners & Losers

by Ashraf Laidi | Jan 15, 2026 16:22

-

Forecaster App التطبيق الذي كنت تنتظره

by Ashraf Laidi | Jan 15, 2026 13:55

-

Update on Gold & Silver after USSC

by Ashraf Laidi | Jan 14, 2026 19:54