Intraday Market Thoughts Archives

Displaying results for week of Nov 15, 2020Opening Video to All فيديو الأمس مفتوح للكل

Data Slows, Market Hesitant

Thursday's initial jobless claims report showed went in the wrong direction with claims up 742K from 711K the week before. This was also reference week for non-farm payrolls so there is some weakness building towards that release in early December. Pandemic emergency claims also rose week-over-week – they're slated to expire at year end.

Other reports from the Philly Fed and on existing home sales were strong but the pandemic is likely to slow activity. The latest tracking data from JPMorgan shows lower credit card spending in person and in places like restaurants and hotels. The Fed's Mester also warned that economic data is slowing and Kaplan said we could have a return to negative growth in the near-term.

More virus economic curbs continue to roll in and New York now appears to be on the brink of closing restaurants and schools. Those worries briefly hit equities on Wednesday but they bounced from an early dip on Thursday.

US health authorities reported that 1 in 5 hospitals anticipated critical staff shortages within 7 days-- the highest shortage ratio on record amid surging Covid19 cases and hospitalisations. Shortages are worst in the Midwest.

The FX market also brushed off the worries as the dollar softened and commodity currencies rebounded from European weakness. The risk-sensitive Mexican peso also traced out an outside day in an impressive move.

The market isn't blind to the looming virus curbs, the coming dark winter and the economic pain of the virus but there's a clear message that on the current path, it's not going to derail positive sentiment. The market continues to look beyond the virus and dips on negative news about the current situation will be bought – that's the power of low interest rates.

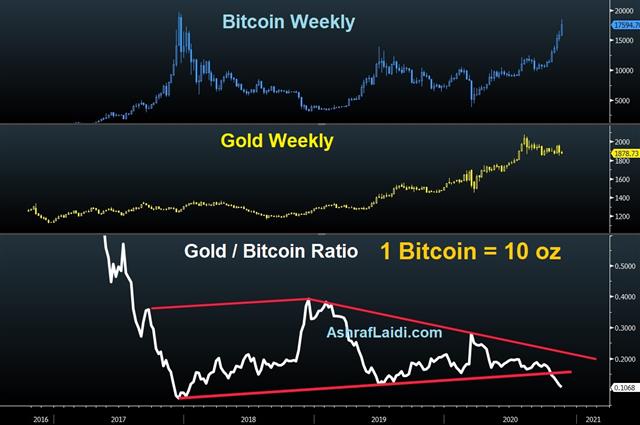

More likely to move the market is weekend positioning in sterling. There's chatter about a Brexit breakthrough (as always) but we're getting to the point where there is two-way risk in that trade.مقابلتي مع العريية عن بتكوين

تفضلوا بمقابلتي مع قناة العربية عن بتكوين و الرجاء التركيز على الاسباب و ليس على التوقع السعري الذي دهش المذيعة لارا حبيب. التسجيل الكامل

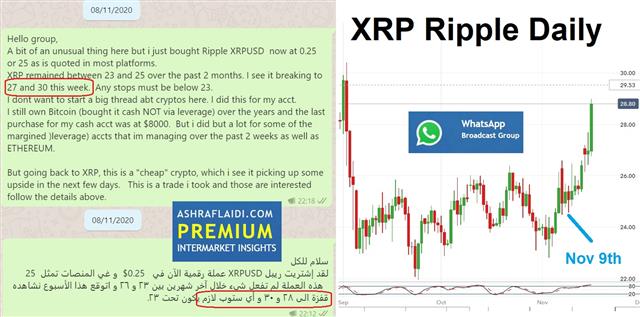

Is Bitcoin Different This Time?

Is it different this time for Bitcoin? Last time it got to these lofty levels it blew off in a spike to $19,900 and then crumbled.

It is different this time

One big difference is that the field of crypto assets has narrowed. In the initial boom, money flowed into thousands of speculative instruments and scams. This time it's in a few assets. That concentration means that even with less money going into crypto overall, Bitcoin can go significantly higher.

Secondly, there are now established and trusted ways to buy crypto. The first run-up was characterized by fly-by-night operators and even the reputable firms had short track records. This is less of a barrier this time and that will attract more people looking to establish a toe-hold in the market as a minor investment or hedge.

Thirdly, there is a growing argument for utility. The announcement that Paypal would facilitate crypto in the fall was the catalyst for the latest run-up in Bitcoin and it's a powerful, lasting message.

Finally, the lack of mainstream hype at this point is a positive. It's building and on a break of $20,000 it will build further, adding fuel to the fire.

Ashraf tells me he sees $26,000 Bitcoin before year-end.

Naturally, prices are stretched in the 70% rally since September but Bitcoin is not an asset that follows the rules. The FOMO hasn't even started yet.

In other markets Tuesday, the tone was more-negative in large part due to a soft October retail sales report that also included downward revisions to September data. It could be a blip after six months of surprisingly strong spending but it could also be an early sign of consumers pulling back as the pandemic rages. But even if that's the case, the modest blip in markets suggests investors can easily look past it.ندوة مساء الاربعاء مع أشرف العايدي

Peak Virus World, Post-Virus Market

The Moderna vaccine news on Monday is wonderful news and it solidifies the tilt in the market to the post-virus world. Yields rose, dragging down gold and silver off their Asia Monday session highs, but later stabilized. More on the VIX and Cryptos below. Then after the NY close, S&P announced the addition of Tesla to its prominent index the S&P500, lifting the shares by as much as 10%. The chart belows highights the importance of 22.0 on the VIX. More below.

Moderna revealed preliminary vaccine data Monday and it showed similarly positive results to Pfizer a week earlier. Two candidates will further speed progress to delivery and even better news is that the Moderna vaccine is easier to transport because it can be stored at warmer temperatures.

This comes at the same time as virus cases are hitting new daily peaks globally and hospitals are maxing out at capacity. It's a horrible human tragedy and we urge all our readers to stay safe because it's now increasingly clear that effective vaccines will end the pandemic in months.

For the markets, it's clear now that the pandemic hardly matters. Governments have taken all the fiscal weight and central banks have made borrowing ultra-cheap.

From an equity market perspective, traders are watching the crucial 22 level on the VIX, which marks the 100-week MA, coinciding with the February gap.

Why should this year and 2021 matter? So long as companies can be debt and cash-flow neutral, the market will value them based on 2022 earnings. And why not? There is no safe yield so even zero earnings or a small dividend is better than fixed income.

This same thinking is helping to boost emerging market currencies. RUB, ZAR and MXN all started the week strong and event the beaten-down Brazilian real is showing signs of life.

The important question going forward will be how long the fiscal and monetary impulse lasts. Central bankers have tied their own hands and governments have no reason to pull back any time soon.

Looking towards Tuesday, the week's top data point is due out at 1330 GMT with US retail sales. The consumer has shown no signs of slowing down and the Fed's Clarida highlighted the high savings rate on Monday. The consensus is for a 0.5% rise following September's 1.9% climb.