Intraday Market Thoughts Archives

Displaying results for week of Mar 15, 2015USD crushed on Fed rethink

USD suffered its biggest weekly decline since Nov 2011, FTSE-100 broke (and closed) above the 7,000 for the first time in its history amid markets' stark rethink of the FOMC announcement. Full charts & analysis.

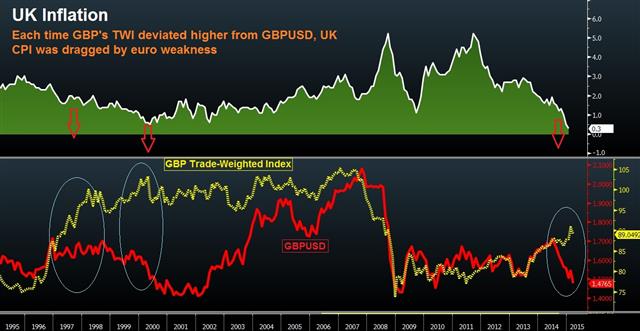

Another BoE member talks down GBP

The pound has been hit by yet another speech from a member of the Bank of England's Monetary Policy Committee. Today it was BoE's chief Economist Andy Haldane, noting that risks of prolonged slowdown inflation may force policy makers to be prepared to cut interest rates further if needed. Full charts & analysis.

USD Damaged by Fed’s Cautious Removal of Patience

The Fed dropped its pledge to be 'patient' in normalizing monetary policy, while its latest forecasts suggest Fed members “will not be impatient” in acting on rates. The Fed's summary of economic projections were downgraded for GDP growth and infation, alongside unemployment. USD Index ndex plunged 3% due to a swift repricing of interest rate normalization by currency and bond traders. EURUSD soared to $1.1043 from a low of $1.0580, a rally not seen in recent years. Full charts & analysis.

Fed Preview: Patience won’t be transitory

Although oil rallied more than 20% following the Jan Fed their swift decline to fresh six-year lows raises questions about whether the Fed will underestimate threat of deflation as it did with GDP growth over the last three years. USD index heading for its biggest quarterly gain since Q4 1992. Adding Q3 & Q4, the USD index is up 23%. And yields remain muted as bond traders do not buy into a summer rate hike. Full charts & analysis.