Intraday Market Thoughts Archives

Displaying results for week of Mar 15, 2020Central Banks Keep Plugging Holes in the Dam

The list of central bank emergency actions continues to grow with 9 new swap lines, BoE QE, an RBNZ loan facility and Sweden's Riksbank offering USD loans. Signs of success are fleeting but the signal is that central banks desperately don't want another 'Lehman moment' and are determined to do whatever they can. Will it be enough? Only if the fiscal side does not hold back. US Treasury Mnuchin urged both sides of the aisle to speed up the passing of a second package. California ordered its 40 million residents to stay home. This means that at least 15% of US GDP is inactive.

In a sense, the financial crisis was a blessing because it gave central banks a playbook to deal with a sudden stop. If not for the quick and extreme actions of central banks in the past three weeks, we would be seeing cascading bankruptcies and bank failures right now.

The worry is that we've only bought a bit of time. The bond market is particularly worrisome at the moment. The bid/ask spreads are beyond belief. It appears as though all the earlier Fed programs to provide liquidity simply led to leverage. JPMorgan said some bond strategies featured levers as high as 50:1. The dump in bonds this week may simply be levered longs trying to unwind and the Fed has had to step in on the other side to keep rates from spiking.

The response has been astounding, even by crisis standards. By the end of Friday, the Fed will have bought $250B in Treasuries – half of the total program. That compares to $600B each in QE1 and QE2, which took 14-months and 8-months, respectively. QE3 was a pace of $40B per month. This week's pace is $1 trillion per month. What's frightening is that yields are still higher on the week.

With regards to equity indices, nmarkets attempt to return towards key retracement levels, such as the 21500 level in the DOW30 and 2550 on the SPX. Ashraf goes in further detail in Thursday's Premium video.

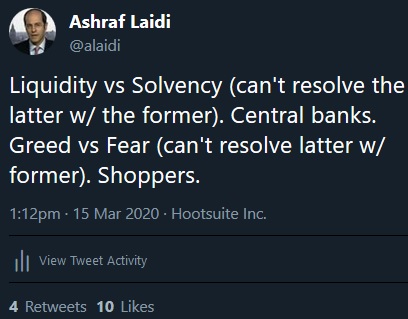

The panic in the past two days has spread to FX. In particular via disorderly moves in GBP, AUD, NZD, NOK and several other countries. The latest programs show utter resolve from central banks but also desperation. Markets are looking at a +3-month lock-in that will trigger far too many solvency events to bail out.

If there's another black swan or some other major break in the central bank dam – like a systemic-company failure – it could still get much worse.

For now, we take it a day at a time and traders will remember that last Friday there was a major squeeze higher in US equities into the close. FX wasn't taken along for the ride and is a better place to watch sentiment at the moment. If dollar demand doesn't slow, central banks may be forced to counter it on the weekend.

How Disorderly can Dollar Demand Get?

At the time of writing this, matters have stabilised with respect to USD liquidity after a few centbank easings. Also news of no Corona virus cases from China for the 1stime in over 7 weeks is also helping sentiment. Sharp moves lower overnight in the pound and commodity currencies highlight a spiraling dollar-funding crunch. The Australian dollar tumbled to the lowest since 2002 and sterling to the lowest since 1985 – both in extremely abrupt moves. RBA cut rates last night before the BoE cut rates by 15 bps to 0.10% w/ fresh round of QE, pushing GBPUSD across the board on what's perceived as an out-of armoury central bank. Here are Ashraf's thoughts on possible FX intervention. DOW30 attempting to regain the 38% retracement level near 20750/20800. A new FX trade was issued last night for Premium subscribers, whose stop/target have just been adjusted moments ago. The latest Premium Video is posted below.

The magnitude of the moves in financial markets is in some way secondary to the speed of the drop. Combined, they've created an immense liquidation event and a need for liquidity. It's deleveraging in overdrive and the only place anyone wants to be is US dollars.

Neither gold nor bonds have provided any level of safety this week and that's leading investors to pour money into the only thing that's working – the US dollar. The flows are self-reinforcing as the dollar climbs higher and risk assets crumble. As a result, haven assets like gold and bonds are being liquidated to raise cash and meet funding commitments.

The financial world works on US dollars and this may be the most-powerful demonstration of that phenomenon. Even in South Korea, which is one of the few countries that has the upper hand on conronavirus, there is overwhelming demand for dollars. The won fell to the lowest since 2009 on Thursday and officials warned that the moves were excessive, which is a threat to intervene.

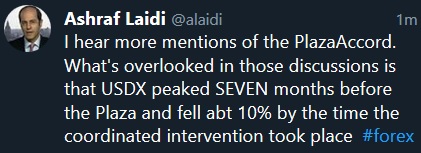

The drop in the pound to 1985 levels harkens back to the Plaza Accord that year. We may be days away from a similar coordinated intervention in the FX market. Before then, the Fed may try to open swap lines to more central banks to relieve the pressure. But beware of those monthly candles and their monthly close.

With now joining in the extreme volatility, we've reached a make-or-break point in the crisis. Bond markets have grown disorderly and it will take a new page from the central bank playbook to stop it.

In the meantime, the trend is our friend. The dollar is soaring across the board and authorities will need to truly shock the system to reverse the demand.

مخططات هامة لمؤشر الداو جونز

لا شك أن الانخفاضات العنيفة الحالية في الأسواق المالية الناتجة عن الانتشار العالمي السريع لفيروس كورونا هي بالفعل تاريخية بكل المقاييس، من حيث السرعة والعمق والضرر الاقتصادي الواسع النطاق. بالنسبة للمتداول، يحتل موضوع المستويات الأولوية. التحليل الكامل

Mnuchin's Bazooka & best vs worst stocks

Monday's bazooka from the Federal Reserve fizzled and on Tuesday Treasury Secretary Mnuchin and other finance ministers fired theirs. The initial results were better with a modest bounce in risk, but there are good reason to think this will fizzle as well. Futures are already down 4%, US crude oil is below 27 and gold above 1540. The US dollar climbed across the board earlier on Tuesday, as the funding squeeze continues. Moments ago, Ashraf has issued a 3rd Premium trade, backed by charts & supporting notes. Below are the best and worst performing stocks of the S&P500's consumer stapes sector since the high.

The fiscal plans that are leaking out of the White House and Congress to fight the virus comprise astonishing numbers. The latest is a $1.2 trillion program that will include direct payments to Americans of about $2000 along with business backstops.

That dwarfs the $700B crisis-era TARP bailout. It would be a shock if we didn't exceed the $1.4T crisis-era deficit this year. It could be triple as revenues collapse on the slowdown.

The bailouts could also balloon the number. Yesterday there was talk of a $50B airline loan, today Boeing is seeking a minimum of $60B in liquidity after drawing down its credit lines. Shares of the company are down more than 70% in a month.

The long-end of the US Treasury curve pushed much higher Tuesday and that's probably due to forced selling for liquidity but the wave of issuance coming is another reason to worry. It's not just the US, Spain unveiled plans for up to 200B, which would be 15% of GDP.

Again, much of that is in credit backstops but every big business bailout demands a small business bailout. In turn that demands a consumer bailout, and it's banks that are holding all the bad loans.

To illustrate, there are $1.2 trillion in low-grade leveraged loans in the US. Those are trading at 84-cents at the moment. Shale companies have $300B in bank debt and virtually all of the companies are on borrowed time with WTI at $26.

The deeper you look, the more daunting it appears.

Even more daunting are the growing political concerns. There is some level of belief in markets that both sides in the US can come together but that's rarely a good bet. Some Democrats are pushing for a higher minimum wage, bans on buybacks and zero dividends. Some Republicans have other priorities.

In FX, the dollar funding squeeze continues despite the swap lines. That argues for severe stress in the financial system despite dramatic Fed actions. They added to that with a 90-day loans to primary dealers backed by collateral as flimsy as stocks. That's a sign of panic and something far worse than even the drastic declines in stocks are pricing in.

We’re Beyond Coronavirus

The rout in risk assets is no longer just about the coronavirus. Yes, we can highlight a dozen economic negatives directly from the virus but we have gone beyond that, or a close to that point. We are not efficient market proponents, but the market is certainly capable of looking out beyond a year or two, when we will recover from the virus. The EU announced it's highly likely to be in recession, while the US Empire State index spoke the same words for the US.

فيديو المشتركين اذا كانت هناك صفقتين للشراء، ما هي؟

Even in a worse-case scenario of about 4% global mortality, you could argue that several assets are underpriced. Yet, what's being priced in now are the second-order effects. There are increasing solvency risks in the energy sector and mass bailouts in aviation are already underway. The entire hospitality industry is under threat with countless small restaurants and businesses likely to be pushed over the edge.

An early tell on how the government will proceed, is the structure of an airline bailout. The WSJ reports the White House is looking at $50B for airlines in an expensive precedent. The report says one of the possibilities is cash grants, and that's a borderline-dangerous precedent. Ashraf estimates that by end of June, bailouts and federal govt assistance will reach a total of about $500 bn or about 3% of US GDP.

Markets today, yesterday, Thursday, Wednesday, month to date, Year to date.

While the market may initially cheer anything that safeguards shareholders, that may quickly prove to be shortsighted. Not only will it escalate costs and deficits but it raises the risk of social disruption. This is the time when the moral hazard from the 2008-09 bank bailouts looms large. Everyone wants, expects and demands a bailout now.

That's going to prove to be impossible. What the market is pricing in – at least partially – is social and political disruption. We have written often in the past year about the growing fractures in politics as many countries diverge from the center. This event is another spark that will light fuses around the world.

In FX, the yen continued to gain ground in the volatility as the classic safe havens rose. USD/CAD hit 1.40 for the first time since 2016 and remains far too low for a global recession.

We got a first taste of the scope of the US slowdown Monday with the Empire Fed falling the most on record in a single month. It plunged to -21.5 from +12.9. That's merely the leading edge of the economic cliff of coronavirus. Another real-time data point to watch will be Tuesday's German ZEW survey. The consensus is a drop to -27.2 from +8.7.

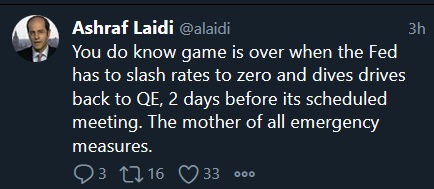

Fed Plunges Back to Zero

Even as the Fed plunges back to zero interest rates, stocks fall by another 10%. This is officially not only a recession, but potentially depression. The Federal Reserve fired its policy bazooka on a Sunday night in an attempt to counteract what increasingly looks like a massive economic shock. The US dollar initially sank on the headlines, but the initial bounce in sentiment faded and US stock futures hit the -5% limit. The Fed cut rates to a range of 0%-0.25% in the second emergency move this month, while pledging $700B in QE. They promised to keep rates at this level until the economy has "weathered recent events" and is on track to meet inflation and employment goals. CFTC positioning data confirmed a huge euro-short covering rally. A new Premium trade was issued, backed by 3 charts. 2 trades are currently open.

In truly what was a 'kitchen sink' move, Powell ruled out negative rates at the press conference.They also unveiled swap lines on signs of dollar-funding strain that contributed to the USD bid on Friday. Other moves included opening the discount window for 90 days and cut reserve requirements.

Separately, the RBNZ lowered rates by 75 bps to 0.25% and pledged to leave it there for at least 12 months. The bank also said QE is on the table if needed. Let's not forget that the Bank of Canada cut rates again by 50 bps on Friday.

The early returns on the central bank action weren't positive. WTI crude fell below $30 in a 5% decline and yen crosses sank, led by a 3% drop in NZD/JPY.

The economic shock that's unfolding is cataclysmic. France, Spain, Austria, South Africa, Dubai are among the new countries that have halted retail commerce and closed schools. We're at the point of pricing in similar actions virtually everywhere. The UK has so far resisted and the FX market is punishing the pound in part because London is a nightmarish place to try and stop a pandemic. The leverage of the economy to the service sector, tourism and banking makes it doubly vulnerable.

The next question is how long the activity halts last. We note that even with China's ultra-tight quarantines, activity is still at a standstill seven-weeks later. The wave of unemployment claims is going to be staggering and the cost of bailouts is barely fathomable.

As for strategy, anything leveraged towards global growth remains extremely vulnerable and that includes the commodity currencies. The loonie was the second-best G10 performer last week and that's nonsense in this environment.

Market participants are liquidating risk and carry trades at the moment. Retail equity holders have had no chance to hedge and will soon panic. The CFTC positioning data underscores a theme we've highlighted for the past two months around the unwind of euro carry trades. Once positioning is flat (and that may be now) a decline could resume, but there may be more straightforward trades elsewhere.

Above all, manage risk.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -13K vs -87K prior GBP +26K vs +35K prior JPY +8K vs -42K prior CHF flat vs -3K prior CAD -2K vs +11K prior AUD -54K vs -52K prior NZD -15K vs -17K prior