How Disorderly can Dollar Demand Get?

At the time of writing this, matters have stabilised with respect to USD liquidity after a few centbank easings. Also news of no Corona virus cases from China for the 1stime in over 7 weeks is also helping sentiment. Sharp moves lower overnight in the pound and commodity currencies highlight a spiraling dollar-funding crunch. The Australian dollar tumbled to the lowest since 2002 and sterling to the lowest since 1985 – both in extremely abrupt moves. RBA cut rates last night before the BoE cut rates by 15 bps to 0.10% w/ fresh round of QE, pushing GBPUSD across the board on what's perceived as an out-of armoury central bank. Here are Ashraf's thoughts on possible FX intervention. DOW30 attempting to regain the 38% retracement level near 20750/20800. A new FX trade was issued last night for Premium subscribers, whose stop/target have just been adjusted moments ago. The latest Premium Video is posted below.

The magnitude of the moves in financial markets is in some way secondary to the speed of the drop. Combined, they've created an immense liquidation event and a need for liquidity. It's deleveraging in overdrive and the only place anyone wants to be is US dollars.

Neither gold nor bonds have provided any level of safety this week and that's leading investors to pour money into the only thing that's working – the US dollar. The flows are self-reinforcing as the dollar climbs higher and risk assets crumble. As a result, haven assets like gold and bonds are being liquidated to raise cash and meet funding commitments.

The financial world works on US dollars and this may be the most-powerful demonstration of that phenomenon. Even in South Korea, which is one of the few countries that has the upper hand on conronavirus, there is overwhelming demand for dollars. The won fell to the lowest since 2009 on Thursday and officials warned that the moves were excessive, which is a threat to intervene.

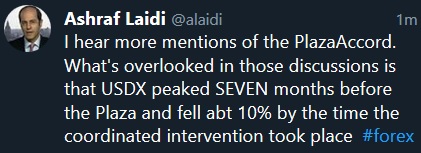

The drop in the pound to 1985 levels harkens back to the Plaza Accord that year. We may be days away from a similar coordinated intervention in the FX market. Before then, the Fed may try to open swap lines to more central banks to relieve the pressure. But beware of those monthly candles and their monthly close.

With now joining in the extreme volatility, we've reached a make-or-break point in the crisis. Bond markets have grown disorderly and it will take a new page from the central bank playbook to stop it.

In the meantime, the trend is our friend. The dollar is soaring across the board and authorities will need to truly shock the system to reverse the demand.

Latest IMTs

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40

-

Trade Already in Profit

by Ashraf Laidi | Feb 17, 2026 18:16

-

I will go LIVE in 10 mins

by Ashraf Laidi | Feb 16, 2026 21:49

-

3 Stocks Against Nasdaq

by Ashraf Laidi | Feb 13, 2026 17:46