Intraday Market Thoughts Archives

Displaying results for week of Apr 15, 2018Carney Cuts Cable

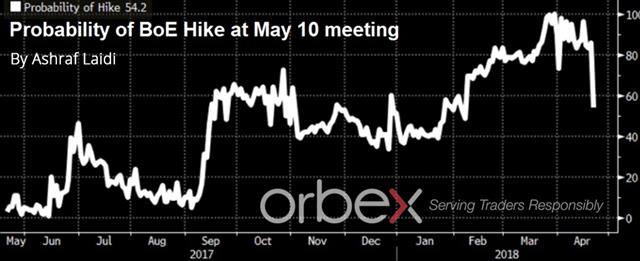

The British pound sustains its biggest weekly decline in over four months after BoE governor Carney sparked a rethink of interest rate hike expectations for next month's meeting. Is the BoE the latest central bank to panic over the rapid appreciation in its currency, or is there more to Carney's comments? Full analysis

كارني يهز الجنيه الإسترليني

سجل الجنيه الإسترليني أكبر انخفاض أسبوعي له خلال أربعة أشهر بعد أن أثار محافظ بنك إنجلترا إعادة التفكير في توقعات رفع أسعار الفائدة خلال اجتماع الشهر المقبل. هل بنك انجلترا من بين أحدث البنوك المركزية التي تشعر بالهلع بسبب الارتفاع السريع في عملتها ، أم أن هناك المزيد من التعليقات وراء تصريحات كارني؟ (التحليل الكامل)

الدولار الكندي: بين التوقعات والواقع

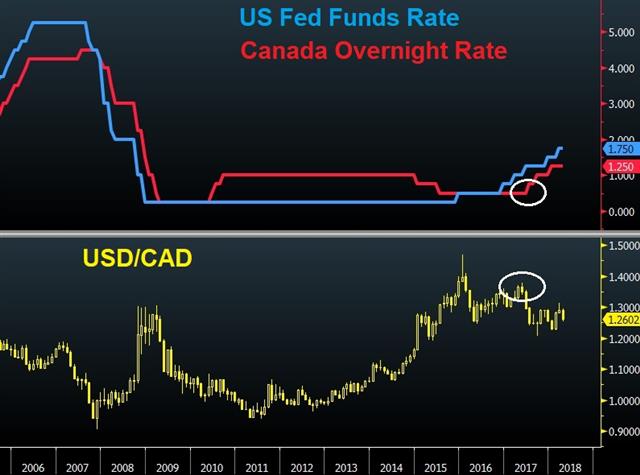

يجب أن تتساءل عن سبب استمراري في تحليل الدولار الكندي. ارتفع الدولار الكندي بنسبة 8 ٪ مقابل الدولار الأمريكي. والكندي العملة الأقوى بين العملات العشرة الكبرى خلال الأسابيع الأربعة الماضية. ما الذي حدث للعملة بعد إعلان الأمس من بنك كندا وإلى أين من هنا؟ التحليل الكامل

CAD: Expectations vs Reality

You must be wondering why I keep writing about the Canadian dollar.Over the last 12 months, the Canadian dollar has risen 8% against the US dollar. Since the start of April, CAD outperformed all G10 currencies. So what happened to CAD yesterday and where do we go from here? Full analysis.

Finding the Bank of Canada Bias

Today's Bank of Canada decision on interest rates (10:00 Eastern, 15:00 London/BST) could be a signal that stretches beyond Canada. The loonie was the top performer Tuesday in anticipation of a hawkish move while the Swiss franc lagged. The latest video for Premium subscribers below highlights this week's trade action on CAD.

The loonie has been the hottest currency this month as NAFTA negotiations improve but it will be BOC Governor Poloz in the spotlight on Wednesday at 1400 GMT with a tricky decision to make.

The latest Canadian inflation and jobs numbers were good but other data has been soft, especially housing figures, jobs and inflation reports lately may have been skewed by minimum wage hikes. In addition, the BOC is inclined to play it safe on NAFTA until the smoke clears.

That leaves the market pricing in about an 18% chance of a hike, which is probably higher than what it should be, but it reflects Poloz's recent flair for the dramatic.

In his most-recent comments a month ago, Poloz said the BOC was obliged to allow some capacity building occur and that more workers could enter the economy. That indicates he wants to wait and see before making any decisions. Yet, the timetable may have been moved up by last week's BOC business outlook survey. It showed far more firms expecting price hikes in the year ahead along with a blockbuster year for US demand.

Assuming rates are left unchanged, the first thing to look for is the central bank's revisions for GDP growth and inflation. This will shape up market's pricing for the June meeting. That's when the market is evenly split in the hike/no hike camps.

So the BOC is left with the decision to wait and see if its upbeat predictions materialize or to wait for hard evidence first. Sound familiar? That's the predicament that virtually every major central bank is facing, at least to some extent. At the moment, most are in the 'hike now' camp but economic data this year has been roundly disappointing and a shift towards patience from the BOC could be a sign of things to come.

هل فاتك قطار الاسترليني؟

سجل زوج الاسترليني-دولار أعلى مستوى له في أكثر من ٢٠ شهر. هل ما زال المجال مفتوح نحو المزيد من الإرتفاع أم حان وقت التراجع؟ يعالج هذا الموضوع الأستاذ أشرف العايدي باستعمال: التحليل الفني؛ عقود الخيارات؛ العقود الآجلة ؛ وتفاعل الأجور مع التضخم الفيديو الكامل

No Scare in Syria Strikes

Talk about striking Syria with missiles finally turned to action early Saturday as the US, France and UK fired more than 100 missiles at three main targets. Markets were closed during the event and the lack of follow up or retaliation soothed fears of an escalation. CFTC positioning data showed increasing bets on the euro. US retail sales follow shortly. The short GBPUSD trade hit its final target of 1.4330 from its 1.4100 entry 3 weeks ago. A new USD trade has been issued for the Premium service. Broad USD weakness ensued as the control group of US retail sales came in within expectations.

Syria strikes turned out to be less of an event than feared and since they hit during non-market hours, there was no kneejerk reaction. Trump also declared this would be the end of this action so that further calmed markets.

One thing that could upend the positive mood is a fresh round of US sanctions against Russia on Monday. US officials announced they will be coming in the day ahead and that could add to recent volatility in ruble trading.

The US President will also have to navigate a tell-all interview with former FBI director Comey. In all likelihood, there won't be any truly surprising headlines but Trump will surely tweet his displeasure.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR +147 vs +134K prior GBP +43K vs +40K prior JPY +3K vs -4K prior CAD -32K vs -32K prior CHF -11K vs -10K prior AUD -3K vs +0 prior NZD +23K vs +18K prior

Euro longs continued to build despite the recent string of soft economic data points. That's a sign of either foolishness, or confidence that better numbers are coming and that the ECB won't be shaken from its rate-hike path. The other spot that's vulnerable is CAD as the loonie squeezes the shorts.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 0.2% | 0.2% | 0.2% | Apr 16 12:30 |