Intraday Market Thoughts Archives

Displaying results for week of Aug 16, 2020Dollar Runs out, GBP Storms on

The US dollar was strong throughout New York trade on Wednesday but got an extra lift after the FOMC minutes. The report from the July 27-28 Fed meeting highlighted that 'many' Fed officials warned of the potential costs associated with yield caps and targets, including 'excessively rapid' balance sheet expansion along with the difficulty in making an exit.

The market emphasized that last point as the dollar jumped and risk trades ebbed. More than ever, the market has a gun to the Fed's head and doesn't want to hear anything but the sound of a printing press.

The minutes also said the US virus resurgence would slow H2 growth more than previously forecast and that business spending wasn't following the same positive pattern as consumers. On the latter point, US retailer target reported impressive sales growth in Q2 and said that sales strength has continued in July/Aug.

The reversal in the dollar stopped what looked like a breakout in the euro, pound and other currencies. Both broke out of ranges to multi-month highs on Tuesday but were sucked back to the range tops. Gold also abruptly reversed in a $75 drop.

Is this a game-changer? It's not. The expectations for more Fed help are modest and none of the comments in the minutes raised the odds of tighter policy any time soon. Combined with stimulus uncertainty and high stock valuations, there is a chance of more trouble.New Highs but Beware of these 3 Points

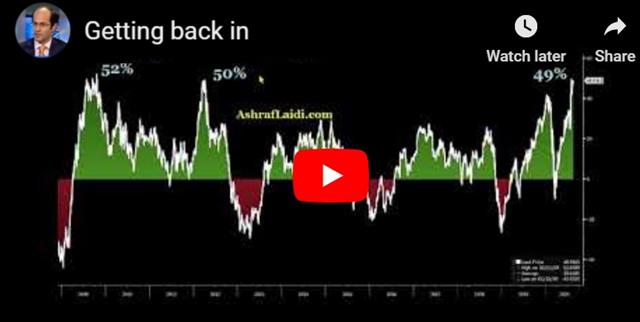

ظاهرة نادرة ترافق قمم جديدة في المؤشرات. هل يعيد التاريخ نفسه؟

ظاهرة فريدة من نوعها في المؤشرات الأمريكية حدثت في تداولات يوم أمس، فما هي هذه الظاهرة؟ وهل تُدعى إلى القلق أو أنها مجرد نتيجة سيولة الصيف المنخفضة؟ تعرّفوا على التفاصيل في الفيديو الكامل

What Could Turn the Dollar?

The obvious catalyst for a dollar rebound is a round of risk aversion but given the buy-the-dips mentality and optimism about a virus vaccine, it's tough to see that as a lasting paradigm shift.

The main problem for the dollar is that it's embroiled in politics. The US stimulus standstill is dragging on with no breakthrough in sight and time is ticking towards the November 3 election. Notably, Republicans have seen a recent uptick in support and that may setup a Biden win with a Republican-controlled Senate. In this climate, that's a recipe for economic stagnation.

There is also the ongoing problem of relative valuations. US markets deserve a higher multiple after a generation of outperformance but there is a limit.

Aside from risk aversion or a broad spike in the virus, it's extremely tough to make a case for the dollar before the election. With that, the moves are continuing to stretch.

Back to the Fed, Ashraf tells me to watch out for the annual Fed symposium at Jackson Hole to be held late next week online for any clues on the details of moving towards formalizing a higher inflation target. The implications for such a move would be enormous for USD and metals.

On Wednesday, we get the latest FOMC minutes and there are questions about what they will do next. At the moment, there is no scope for a hawkish shift, even with US housing creeping towards a boom. The minutes are likely to touch on forward guidance or yield curve control but we struggle to envision anything that could lead to lasting dollar support.Euro Bets Hit Record: Why & How?

There are no easy answers because the same things that have been dogging the euro for a decade are still there: namely, the lack of dynamic growth along with painfully slow efforts to integrate and cooperate. Instead, we get years-long battles about an extra 0.2% of debt-to-GDP in Italy's budget.

One thing that has changed is the coronavirus response. It hit Europe hard before the US but the response has been better and cases are now much lower. There is a growing belief that will lead to a faster recovery this year and in 2021. With that in mind, the recent tick higher in cases in Europe bears watching because it could easily undo that narrative.

The second factor is asset valuations. The MSCI US index trades at a 22.5x forward P/E while the eurozone equivalent is at 17.4. The FX market for a generation has been focused on global yield differentials but with those zeroed out, marginal dollars are instead moving based on stocks.

A third factor is the US election and the potential uncertainty. Investors have grown used to uncertainty and Europe has had plenty of its own scares but there is still a portion of the investment community that would rather be invested in Europe than the US on November 3.

The final factor is the structure of the euro. Debt monetization is a real threat in the decade ahead and the deficits in the US in years to come will be enormous. That may spark better growth but if it comes with inflation, the governance structure of the euro is better equipped to handle it. Moreover, no country has ability to print in the same way the US Treasury does. So while the ECB has certainly waded into QE, the market is more comfortable with the checks and balances in Europe.

Ultimately, all questions of price are value and some or all of the things noted above are already priced in. At +200K, the trade is arguably more crowded than ever. But futures positioning tends to move slowly and reflects long-term positioning. Certainly the virus and the election could be game-changers but signal from the futures market is to buy the euro dips.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +200K vs +180K prior GBP -3K vs -15K prior JPY +27K vs +31K prior CHF +17K vs +12K prior CAD -30K vs -23K prior AUD -1K vs -1K prior NZD 0K vs -1K prior