Intraday Market Thoughts Archives

Displaying results for week of Mar 17, 2019توازن بين الخروج السريع والبقاء الصبور

كيف يمكنك معرفة التوقيت المثالي للخروج السريع من الصفقة أو البقاء بصبر؟ نجيب على الأسئلة عبر أمثلة صفقات آخر أسبوعين في الفيديو المجاني

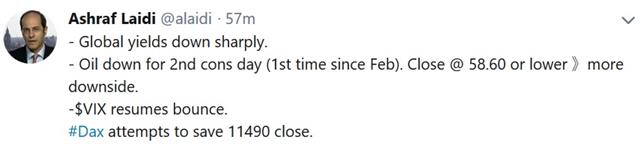

Yen up as Yields Break Down

Bonds rally across the boards as yields tumble on renewed conerns about global growth. The latest catalyst is German manufacturing deepening into recession. All currencies down vs USD except for JPY. Germany's 10 year bund yield retest zero% and their US counterpart break the Jan low to hit 2.48%--lowest since Jan 2018. UK gilt yields are at their lowest since Sep 2017. Ashraf tweeted that falling yields combined with the 2nd consecutive drop in oil leaves no choice but for renewed selling in equity indices, thus helping the existing Premium trades.

The US dollar erased its post-FOMC declines against the euro, pound and commodity currencies on Thursday. One of the catalysts was investors returning to US equities in the hopes that low rates will spur growth and profits. The S&P 500 opened lower then found support at the old quadruple top of 2816 and then ripped higher, finishing up 31 points to a new 2019 high.

The biggest dollar move was against the pound but that was mostly a story of Brexit worries. The low of the day came ahead of May's meeting with EU leaders and request for an extension. There were murmurs about France rejecting a deal and the low was 1.3004. Once the meeting got underway the leaks displayed a more-constructive tone with several options for conditional and unconditional Article 50 extensions. The situation will change as the meeting wraps up but the EU's aim is either a very short extension – as little as two weeks – in order to get the deal through parliament. If that fails, they want an extension through year end, presumable for time for May to resign and Conservatives to find a new leader; or to hold a general election.

The better tone helped cable rebound to 1.3109, a bounce of more than 100 pips from the lows.

Upcoming Friday data include: Canadian CPI and retail sales. Both will be closely watch and could push the BOC towards cutting rates. The Canadian 10-year note is trading at 1.67%, that's 7 basis points below the BOC's overnight rate in a troubling sign of inversion.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (m/m) | |||

| 0.6% | 0.1% | Mar 22 12:30 | |

تعلم من صفقاتك الناجحة والخاطئة

ماذا يمكنك أن تتعلم من صفقاتك الناجحة والخاطئة؟ انضم لندوتي الالكترونية يوم الثلاثاء 26 مارس، 10 مساءً بتوقيت مكة المكرمة. للمشاركة من جميع الدول ما عدا السعودية للمشاركة من السعودية فقط

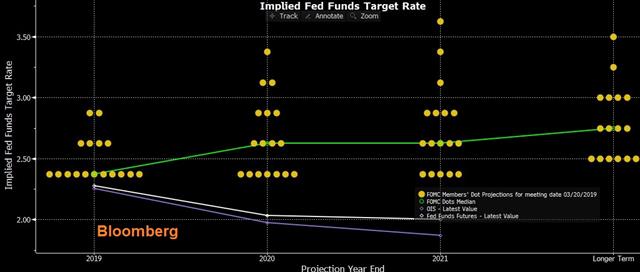

Fed Confirms No Hikes

The message confirmed from the FOMC there will not be any rate hike rates this year ... unless there is a shocking surprise in growth. The other key development is the Fed announcement to halt the process of uwinding its balance sheet by end of September. The US dollar slumped after the Fed statement, taking out some important levels, especially as the 10-year yield posted its biggest daily decline since May 2018. Aussie is up further on an unexpected decline in the jobless rate. The Premium EURUSD short was closed for 220 pip gain, while 8 of the remaining 9 trades are in the green.

The Federal Reserve delivered a dovish surprise that sent the US dollar sharply lower. The chatter before the announcement was that the Fed would keep a rate hike this year on the table but the dot plot median scratched both 2019 hikes while leaving only one in 2020.

That sparked a first leg of USD selling. The second wave of USD selling emerged in the press conference. A dovish shift based on soft growth abroad, especially in China and Europe, along with tariff risks wouldn't have been a huge surprise. Powell certainly highlighted that, but he also spoke about US-centric risks including a slowdown in business investment and consumer spending. That was a more morose outlook than anticipated and sent the dollar to the lows of the day.

As the US dollar sank it broke some notable levels. EUR/USD rose above the late-Feb top to the highest level since Feb 3. The kiwi also broke the late-Feb high and is now flirting with the best levels of the year. USD/JPY fell to a three-week low.

Perhaps the most-notable was WTI crude oil as it rallied above $60 and the 50% retracement of the Q4 breakdown. Crude was also lifted by a surprise drawdown in US weekly inventories. The Premium long in US oil at 54 remains open.

In Asia-Pacific trading, the kiwi gave back some of its gains on a report showing Q4 y/y growth at 2.3% compared to 2.5% expected. Calls for an RBNZ rate hike continue to grow louder.

In Australia talk of an RBA rate cut softened after the Feb jobless rate fell unexpectedly to 4.9% from 5.0%, while employment rose to 4.6K vs exp 15K and previous 38K.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Employment Change | |||

| 4.6K | 14.8K | 38.3K | Mar 21 0:30 |

إستغلال الفشل المناسب في مؤشر الداكس

سيكون أهم جزء يصدره مجلس الاحتياطي الفيدرالي هذا المساء هو ما إذا كان سيحدد متى سيتوقف عن بيع احتياطيات السندات التي اشتراها بين عامي 2008 و 2015 لتخفيف الأزمة المالية. و في نفس الوقت أركز على مؤشرات الأسهم ، مثل توقع المزيد من الانخفاض في مؤشرالداكس الألماني. التحليل الكامل

May Plots Delay, Fed Plots Lower Dots

Indices are finally coming off their lofty highs. Pivotal trade deals between the US & China along with the UK & EU are approaching the end game, we look at what's priced in. CHF is the strongest currency of the day (our USDCHF short remains intact), while GBP is the worst performer of the day after PM May formally sent a request for a short Brexit delay to EU's Donald Tusk. The Fed statement & dot plot forecast are at 14:00 New York, 18:00 London, 22:00 Dubai, and Powell's press conference follows 30 mins later. Last night, a new Premium trade was issued (currently 40 pts in the green), accompanied by 3 charts and 8 supporting arguments. An additional trade will be issued ahead of the London close.

Politics have been a more dominant force in G10 FX in the past two years than any time in memory and they are especially critical at the moment. A report on Tuesday said China was walking back some of its trade offers in a sign that talks had hit a snag. Markets reeled and the S&P 500 gave up its gains. At the same time, Lighthizer and Mnuchin revealed plans to travel China next week with Chinese officials set to go to Washington the week after.

Enforcement remains a key hurdle and there's no doubt that the final stretch of talks will be the toughest. That's why it's worrisome that markets are pricing in a +90% chance of a deal. That number might be right but the near-term risk is much more skewed toward negative headlines.

The story is flipped around Brexit with the market continuing to assign a low probability to May's deal passing. That's understandable given the endless backstabbing in UK politics. The latest example is a report saying Conservative Euroskeptic MPs had been lobbying EU members to block an Article 50 extension. That's something we've repeatedly warned about and it will come to a head on Thursday at an EU summit where leaders will evaluate May's pending extension request.

Cable remains non-committal but it will undoubtedly make a large move once the momentum begins to sway. At the moment, neither the ERG nor the DUP wants to be the first to commit to supporting May's deal.

In the day ahead, USD risks rise with the Federal Reserve decision. It includes new forecasts, a dot plot and a press conference and is also likely to outline a plan to halt the balance sheet runoff this year. Look for a slight downgrade to growth in the statement from 'strong' to 'moderate' or 'solid' but the main headlines may be the dot plot. The market buzz is for the Fed to move down to a only one more hike (either this year or next) and a lower terminal rate. If anything, the FOMC is likely to disappoint with a more-hawkish path as a continuation of the Fed's trend to overestimate in the dots. If so, the dollar could nudge higher, albeit the stakes are lower than most Fed meetings.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC Press Conference | |||

| Mar 20 18:30 | |||

GBP Falls on Speaker Objection Pre 3rd Vote

GBP is the biggest loser of the day as UK parliament will vote once against on Tuesday or ...Wednesday on whether to approve May's Brexit deal. Sterling's losses ensued after speaker of the House of Commons, John Bercow, said on Monday the government could not put the deal to the Commons again if it is “the same in substance”. Will he force the govt to rethink the vote?

تفاصيل اليورو و المؤشر المفضل (فيديو للمشتركين فقط)

Bercow, who is a remainer, suggested that a revised legal opinion on the deal may not be enough. UK Conservatives continue in high stakes negotiations with the DUP aimed at securing their 10 votes in the hope they will set off a domino effect that gets a Brexit deal done. However it may take a fourth vote to get it across the finish line.

In the third vote it will be critical for May to make significant progress. The PM needs to flip 75 votes from the last iteration to pass it. The DUP and ERG may deliver on 50 or more of those and that might be enough to keep the market believing it's possible. If she loses by 10 votes or less, it would be enough to convince the market a deal is probable and that could put a large bid into cable.

At the same time, last week's volatility may have only been a taste of the scale of moves to come on every headline and vote this week. It's a razors edge that could end in victory for May or a crushing defeat and political disarray.

The more-important trade story is that a Trump-Xi summit could be delayed until June. The sides are hung up on enforcement. The US wants the ability to unilaterally impose tariffs if it determines that IP is being stolen while China does not want to sacrifice its sovereignty. The US side has pushed for Trump and Xi to smooth it out at the highest levels but the Chinese side doesn't want Xi to be put in a position where he's forced to walk away from a bad deal due to last-minute changes; something that would cause him to lose prestige at home.

USD watchers are also focusing on Wednesday's FOMC announcement/press conference and dot plot forecasts. The Fed stmt and Powell's press conference are anticipated to shed more light on when it's likely to stop the process of selling resereves in its $4 trillion balance sheet later this year.