Yen up as Yields Break Down

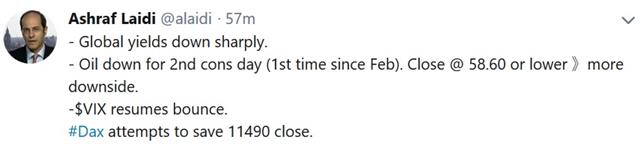

Bonds rally across the boards as yields tumble on renewed conerns about global growth. The latest catalyst is German manufacturing deepening into recession. All currencies down vs USD except for JPY. Germany's 10 year bund yield retest zero% and their US counterpart break the Jan low to hit 2.48%--lowest since Jan 2018. UK gilt yields are at their lowest since Sep 2017. Ashraf tweeted that falling yields combined with the 2nd consecutive drop in oil leaves no choice but for renewed selling in equity indices, thus helping the existing Premium trades.

The US dollar erased its post-FOMC declines against the euro, pound and commodity currencies on Thursday. One of the catalysts was investors returning to US equities in the hopes that low rates will spur growth and profits. The S&P 500 opened lower then found support at the old quadruple top of 2816 and then ripped higher, finishing up 31 points to a new 2019 high.

The biggest dollar move was against the pound but that was mostly a story of Brexit worries. The low of the day came ahead of May's meeting with EU leaders and request for an extension. There were murmurs about France rejecting a deal and the low was 1.3004. Once the meeting got underway the leaks displayed a more-constructive tone with several options for conditional and unconditional Article 50 extensions. The situation will change as the meeting wraps up but the EU's aim is either a very short extension – as little as two weeks – in order to get the deal through parliament. If that fails, they want an extension through year end, presumable for time for May to resign and Conservatives to find a new leader; or to hold a general election.

The better tone helped cable rebound to 1.3109, a bounce of more than 100 pips from the lows.

Upcoming Friday data include: Canadian CPI and retail sales. Both will be closely watch and could push the BOC towards cutting rates. The Canadian 10-year note is trading at 1.67%, that's 7 basis points below the BOC's overnight rate in a troubling sign of inversion.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (m/m) | |||

| 0.6% | 0.1% | Mar 22 12:30 | |

Latest IMTs

-

USDJPY Jumps on Dovish Picks

by Ashraf Laidi | Feb 25, 2026 11:40

-

Gold $5000?

by Ashraf Laidi | Feb 24, 2026 14:21

-

DXY Net Longs

by Ashraf Laidi | Feb 23, 2026 14:20

-

Iran Polymarket & Fed Odds

by Ashraf Laidi | Feb 20, 2026 11:27

-

Gold, Iran & Oil

by Ashraf Laidi | Feb 19, 2026 16:40