Intraday Market Thoughts Archives

Displaying results for week of Dec 18, 2016Gold & USDJPY Eye 76.4%

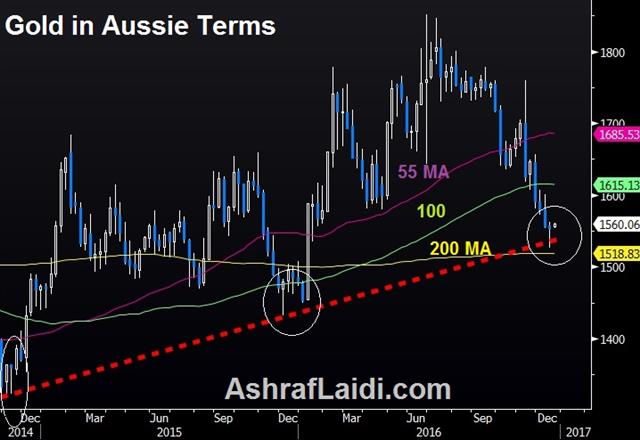

As gold and USD/JPY near their 76.4% retracement, questions about their similarity and differences resurface. Gold's 76.4% retracement of the rise from the December 2015 lows to the July 2016 highs stands near $1128, while USDJPY's retracement from the June 2015 high to the June 2016 low) is near 119.50.

Historic 76%

Over the last 15 years, never has gold retraced more than 76.4% of a major rally or decline of 25% or more. Similarly, USD/JPY has never retraced more than 76.4% of a major rally or decline of 25% or more. The definition of “major” means that the move begins from a multi-year low or high. Does this mean that gold is near the low and USDJPY is approaching its peak?A new note on gold and USDJPY has been issued to susbcribers alongside this week's video.

Data Indigestion

The US economy got some good news to close out the year as third quarter GDP was revised higher to a +3.5% annualized pace from +3.3%. That was coupled with a durable goods orders report that was stronger than it appeared. The headline measure fell 4.6% but the key metric of capital goods orders non-defense ex-air rose 0.9% compared to 0.3% expected.

The US dollar largely failed to respond to the data but that isn't a big surprise as ranges narrow into year end and flows dominate. Over time, however, those numbers will help build a floor under the dollar and help carry the positive momentum into 2017.

One damper, however, was the PCE report with spending a shade soft at +0.2% versus +0.3% expected and income flat compared to the +0.3% consensus. The long-awaited inflation/wage inflation paradigm that the Fed (and the market) is betting on for 2017 remains a serious question mark.

Neighbouring Canada also got some holiday cheer in the October retail sales report as it rose 1.1% compared to 0.3% expected. Ex-autos were also very strong at +1.4% compared to +0.7% expected.

The enthusiasm was offset by a soft November CPI report as prices rose 1.2% y/y versus 1.4% expected. The release also marked the first time Statistics Canada reported on three new CPI measures prescribed by the BOC. The CPI trim is likely to be the one Poloz monitors most closely and it sagged to +1.6% y/y from +1.8%. The Canadian dollar struggled and has now fallen in 7 of the past 8 days and sits at the worst levels of December.

We expect quiet markets through year end but will remain on guard for geopolitical shocks.| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (m/m) | |||

| 0.1% | 0.3% | Dec 23 13:30 | |

| CPI (m/m) | |||

| -0.4% | -0.1% | 0.2% | Dec 22 13:30 |

The Border of Tax Insanity

The latest idea floated by the incoming US administration is a complete re-think on taxation with a centre-piece of a system that hits companies harder who import and rewards exporters. On Wednesday, the euro was the top performer while the Canadian dollar lagged. Early in Asia-Pacific trading, New Zealand GDP beat expectations.

أين أخطأنا في اليورو و الدولار و ماذا بعد؟ (فيديو للمشتركين فقط)

The idea of a 'border tax' as part of corporate tax reform is grabbing headlines and the consensus view is that it would be good for the US dollar as it incentivizes companies to move production to where the goods are sold and US exporters would be rewarded with cheaper tax rates.

It's still at the idea stage but it could be a messy system. Imports would be 20% more expensive and it would be packaged as part of a comprehensive tax reform.

Where the real trouble starts is in retaliation. The proposed system would be a de facto tariff and it wouldn't fool other countries. It's likely to violate trade deals and the chance of other countries accepting it without hitting back is nil.

At this point, the market isn't near reacting to ideas that have been floated. For us, what this does show is the beginning of the transition from the market focusing on vague Republican ideas like lower taxation and less regulation to a focus on the details and consequences. In other words, a transition from hope to reality that will unfold in H1 2017. We don't expect a smooth ride.

In the short-term, CAD lagged alongside oil as US inventories grew more than forecast. The lone US data point was existing home sales and they were strong at 5.61m compared to 5.50m expected. There is good potential in US housing in 2017 as the scars from the crisis fade and lenders get freed up from regulations.

One spot where housing prices remain sky high is New Zealand. At the moment, the weak NZD is giving foreign buyers a discount. NZD/USD has fallen for seven consecutive days and even GDP at +1.1% compared to +0.8% expected in Q3 hardly moved up the currency. That's partly because Q2 was downgraded to +0.7% from +0.9%. There is minimal nearby technical support on the NZD/USD chart.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (q/q) | |||

| 1.1% | 0.8% | 0.7% | Dec 21 21:45 |

| HPI (m/m) | |||

| 0.4% | 0.6% | Dec 22 14:00 | |

Into the Ebb and Flow

The US dollar slacked off on Tuesday after touching the best levels since 2002. The Canadian dollar was the top performer on the day while the Japanese yen lagged in the aftermath of the BOJ. Australian vacancies and Japanese industry data are due later. The latest Premium Video focuses on what went wrong with EURUSD and Gold, and what is the next course of action.

The US dollar index is generally a poor representation of the broad US dollar because it's not trade weighted but it's still the most popular measure of the USD. On Tuesday it touched a resh 14-year high.

Later, the dollar edged back 30 pip across the board. That's a drop in the bucket compared to the recent moves but it underscores how the market will bob and chop for the next two weeks.

Economic data was limited to Canadian wholesale sales for October. They rose 1.1% compared to 0.5% and – along with a small rise in oil prices – that helped to boost the Canadian dollar.

The rule of thumb for quiet periods is that the market tends to drift in the direction it was headed previously. In general, that means US dollar strength, higher stock markets and weakening bonds. But that's interspersed by periods of headline risk and flows.

Considering the time of year, the overall ranges in FX were impressive on Tuesday with many exceeding 60 pips. Expect that to narrow in the days ahead.

Minor economic indicators can also cause outsized moves. On the calendar in the hours ahead is the Australian November skilled vacancies report for November. The prior reading was -0.4% m/m. Other data includes the October Japanese all-industry activity index. The consensus is for a 0.1% m/m rise.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Wholesale Sales (m/m) | |||

| 1.1% | 0.3% | -1.5% | Dec 20 13:30 |

| All Industries Activity (m/m) | |||

| 0.1% | 0.2% | Dec 21 4:30 | |

When Jawboning Works Best

Jawboning doesn't always work; but a central banker is most-likely to move the market with vague threats when momentum is on his side and the market is off-guard. That's the case today ahead of the BOJ meeting today. The yen was the top performer Monday while the pound lagged. A new NZD short has been filled and in progress and is already in the green. Our Aussie short is more than 100 pips in profit, but will be maintained ahead of the latest twists and turns in PBOC's balancing of yields and currency value.

BOJ leader Kuroda is in a comfortable position ahead of today's meeting. The yen has dramatically weakened since the US election and that will pump fresh life into Abenomics and revive hopes of inflation. Signs of a better economy in Japan have also led to speculation that Kuroda could take a less dovish approach today. That thinking led to an 85-pip slip in USD/JPY on Monday.

We warn that Kuroda could use the market momentum and the less-dovish speculation in his favour. Liquidity is also lower than normal.

The combination makes this a great time to stick to ultra-dovish rhetoric and attempt to talk down the yen. What's the risk for Kuroda in that approach? If he's seen as too-dovish it would only fuel inflation and it's impossible to believe that runaway inflation is on the horizon in Japan. If anything, a commitment to loose policy despite better recent data may help to destroy the deflationary mindset.

The decision usually lands around 0300-0400 GMT. There is no set time.

Changing gears, we are saddened to once again have to underscore the message in yesterday's IMT: Geopolitical risks are high and liquidity risk is low. That makes for dangerous, headline-driven markets. The assassination of the Russian ambassador in Turkey and the truck attack highlight the risks.

In other news on Monday, Fed Chair Yellen gave the US dollar a small lift when she underscored improvements in wages. That's a key metric for the Fed at the moment and her confidence suggests another hike in March already be in the process of being penciled in. The Fed fund futures market, however, is giving it just at 29.8% probability.

هل تعود مخاوف الصين؟

هل تعود مخاوف الصين؟ ما هو سبب وراء الهبوط المفاجئ لعملة الصين؟ ما هي العلاقة بين احتياطيات العملة وأسعار الفائدة؟

Liquid(ity) Engineering

The Chinese capture of a US drone rattled markets on Friday but the story going forward isn't about the geopolitics, it's about the outsized reaction. The yen is the early leader while the Australian dollar lags. CFTC positioning data shows the market piling into yen shorts. A new trade in NZD has been issued moments ago, while Friday's clsose of the NZDCAD trade at a profit.

The US dollar fell on Friday and risk assets reversed lower after China captured a US underwater drone in international waters. The move sparked tensions and tweets from the President-elect but it stopped there as China, on the weekend, agreed to return the vessel .

A reversal of some of that tension is the likely path for markets early in the week but the lesson is that the year is winding down and markets are less liquid. The market reaction to the drone seizure was outsized and that's no surprise as the headlines hit on a Friday afternoon with the year winding down.

The lesson for the week ahead is to keep a close eye out for news and to buy headlines. It's also a warning to remain cautious, even with the euro breaking down and the yen breaking out. Markets tend to drift at this time of year, not to race.

Aussie Downgrade?

The reason for some minor Australian dollar weakness to start the week was a hint from the Finance Minister that the budget is deteriorating. The update is due out in the hours ahead and the risk is that a ballooning deficit could be closely followed by a downgrade in Australia's AAA-rating. One AussieCommitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -88K vs -115K prior JPY -63K vs -34K prior GBP -72K vs -77K prior CHF -25K vs -25K prior AUD +14K vs +21K prior CAD -22K vs -18K prior NZD -4K vs -2K prior

The weekly positioning data showed a rush out of euro shorts and into yen shorts. It's the first post-ECB look at positioning. It's also the second week in a row of aggressive yen selling. Despite the fast move from flat to -63K, history shows there are likely still plenty of yen shots on the sidelines.